HSBC Investor Day Presentation Deck

1.

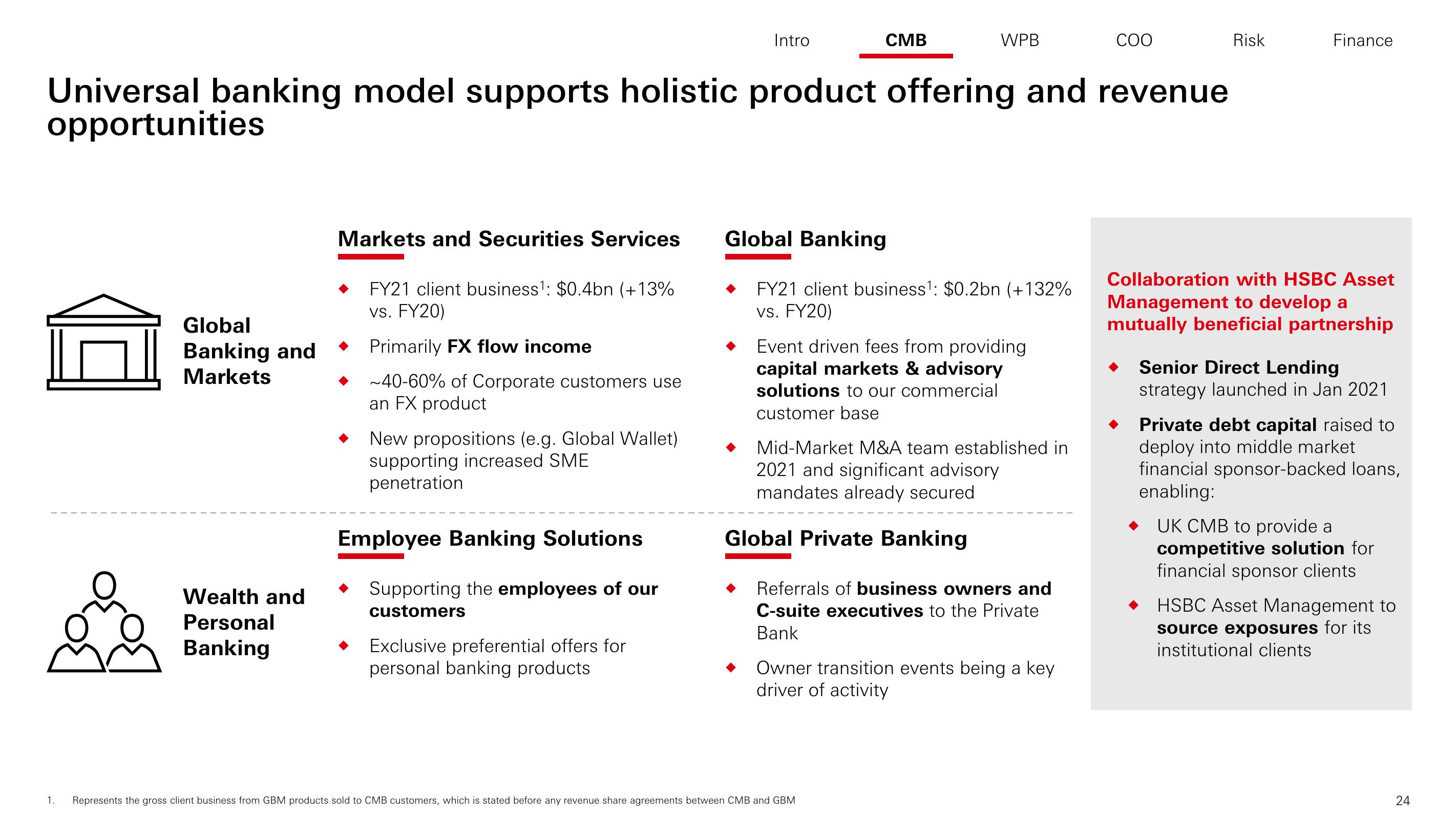

Global

Banking and

Markets

Wealth and

Personal

Banking

Universal banking model supports holistic product offering and revenue

opportunities

Markets and Securities Services

FY21 client business¹: $0.4bn (+13%

vs. FY20)

Primarily FX flow income

~40-60% of Corporate customers use

an FX product

New propositions (e.g. Global Wallet)

supporting increased SME

penetration

Employee Banking Solutions

Supporting the employees of our

customers

Intro

Exclusive preferential offers for

personal banking products

CMB

WPB

Global Banking

FY21 client business¹: $0.2bn (+132%

vs. FY20)

Event driven fees from providing

capital markets & advisory

solutions to our commercial

customer base

Mid-Market M team established in

2021 and significant advisory

mandates already secured

Global Private Banking

Referrals of business owners and

C-suite executives to the Private

Bank

Represents the gross client business from GBM products sold to CMB customers, which is stated before any revenue share agreements between CMB and GBM

Owner transition events being a key

driver of activity

COO

Risk

Finance

Collaboration with HSBC Asset

Management to develop a

mutually beneficial partnership

Senior Direct Lending

strategy launched in Jan 2021

Private debt capital raised to

deploy into middle market

financial sponsor-backed loans,

enabling:

UK CMB to provide a

competitive solution for

financial sponsor clients

HSBC Asset Management to

source exposures for its

institutional clients

24View entire presentation