Payoneer SPAC Presentation Deck

Pro forma share count

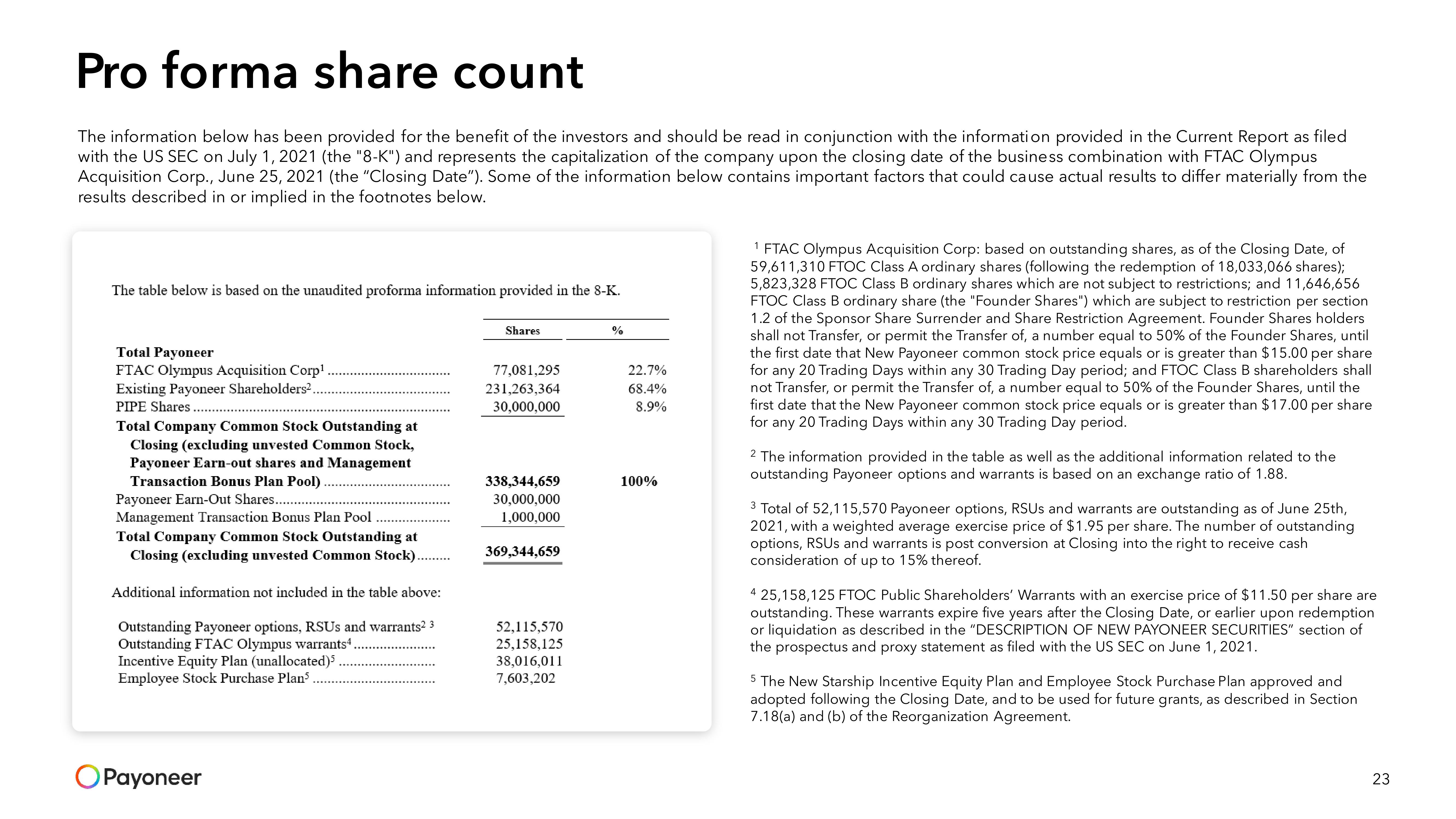

The information below has been provided for the benefit of the investors and should be read in conjunction with the information provided in the Current Report as filed

with the US SEC on July 1, 2021 (the "8-K") and represents the capitalization of the company upon the closing date of the business combination with FTAC Olympus

Acquisition Corp., June 25, 2021 (the "Closing Date"). Some of the information below contains important factors that could cause actual results to differ materially from the

results described in or implied in the footnotes below.

The table below is based on the unaudited proforma information provided in the 8-K.

Total Payoneer

FTAC Olympus Acquisition Corp¹.

Existing Payoneer Shareholders².

PIPE Shares

Total Company Common Stock Outstanding at

Closing (excluding unvested Common Stock,

Payoneer Earn-out shares and Management

Transaction Bonus Plan Pool)

Payoneer Earn-Out Shares.....

Management Transaction Bonus Plan Pool

Total Company Common Stock Outstanding at

Closing (excluding unvested Common Stock)..

Additional information not included in the table above:

Outstanding Payoneer options, RSUS and warrants² 3

Outstanding FTAC Olympus warrants..

Incentive Equity Plan (unallocated)³

Employee Stock Purchase Plan³

Payoneer

Shares

77,081,295

231,263,364

30,000,000

338,344,659

30,000,000

1,000,000

369,344,659

52,115,570

25,158,125

38,016,011

7,603,202

%

22.7%

68.4%

8.9%

100%

1 FTAC Olympus Acquisition Corp: based on outstanding shares, as of the Closing Date, of

59,611,310 FTOC Class A ordinary shares (following the redemption of 18,033,066 shares);

5,823,328 FTOC Class B ordinary shares which are not subject to restrictions; and 11,646,656

FTOC Class B ordinary share (the "Founder Shares") which are subject to restriction per section

1.2 of the Sponsor Share Surrender and Share Restriction Agreement. Founder Shares holders

shall not Transfer, or permit the Transfer of, a number equal to 50% of the Founder Shares, until

the first date that New Payoneer common stock price equals or is greater than $15.00 per share

for any 20 Trading Days within any 30 Trading Day period; and FTOC Class B shareholders shall

not Transfer, or permit the Transfer of, a number equal to 50% of the Founder Shares, until the

first date that the New Payoneer common stock price equals or is greater than $17.00 per share

for any 20 Trading Days within any 30 Trading Day period.

2 The information provided in the table as well as the additional information related to the

outstanding Payoneer options and warrants is based on an exchange ratio of 1.88.

3 Total of 52,115,570 Payoneer options, RSUS and warrants are outstanding as of June 25th,

2021, with a weighted average exercise price of $1.95 per share. The number of outstanding

options, RSUS and warrants is post conversion at Closing into the right to receive cash

consideration of up to 15% thereof.

4 25,158,125 FTOC Public Shareholders' Warrants with an exercise price of $11.50 per share are

outstanding. These warrants expire five years after the Closing Date, or earlier upon redemption

or liquidation as described in the "DESCRIPTION OF NEW PAYONEER SECURITIES" section of

the prospectus and proxy statement as filed with the US SEC on June 1, 2021.

5 The New Starship Incentive Equity Plan and Employee Stock Purchase Plan approved and

adopted following the Closing Date, and to be used for future grants, as described in Section

7.18(a) and (b) of the Reorganization Agreement.

23View entire presentation