AngloAmerican Investor Update

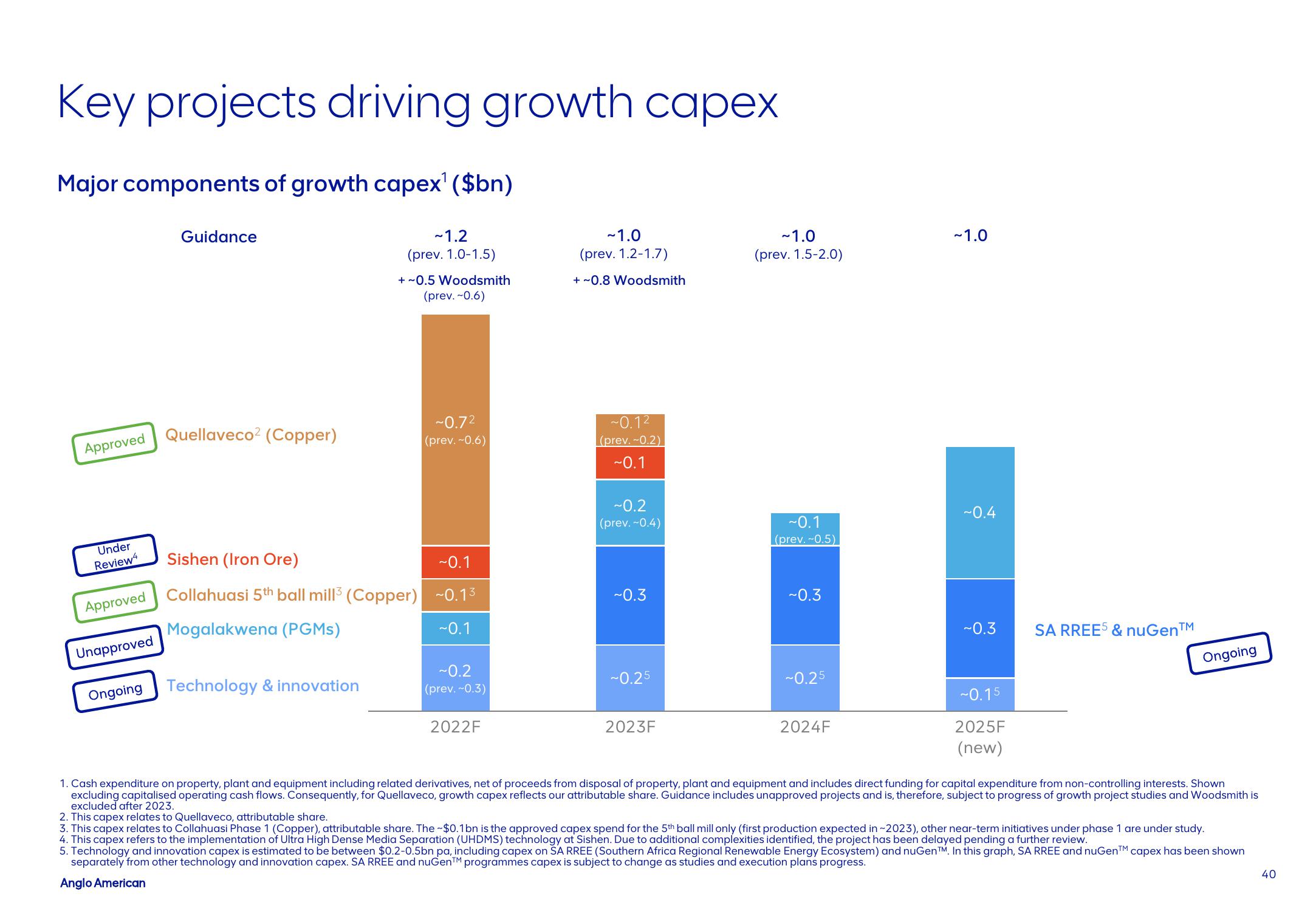

Key projects driving growth capex

Major components of growth capex¹ ($bn)

~1.2

(prev. 1.0-1.5)

+ ~0.5 Woodsmith

(prev. -0.6)

Approved Quellaveco² (Copper)

Under

Review4

Guidance

Unapproved

Sishen (Iron Ore)

Approved Collahuasi 5th ball mill³ (Copper) -0.13

Ongoing

Mogalakwena (PGMs)

~0.72

(prev.-0.6)

Technology & innovation

~0.1

~0.1

~0.2

(prev. ~0.3)

2022F

~1.0

(prev. 1.2-1.7)

+ ~0.8 Woodsmith

~0.12

(prev.-0.2)

~0.1

~0.2

(prev.-0.4)

~0.3

~0.25

2023F

~1.0

(prev. 1.5-2.0)

~0.1

(prev.-0.5)

~0.3

~0.25

2024F

~1.0

~0.4

~0.3

~0.15

2025F

(new)

SA RREE5 & nuGen™

Ongoing

1. Cash expenditure on property, plant and equipment including related derivatives, net of proceeds from disposal of property, plant and equipment and includes direct funding for capital expenditure from non-controlling interests. Shown

excluding capitalised operating cash flows. Consequently, for Quellaveco, growth capex reflects our attributable share. Guidance includes unapproved projects and is, therefore, subject to progress of growth project studies and Woodsmith is

excluded after 2023.

2. This capex relates to Quellaveco, attributable share.

3. This capex relates to Collahuasi Phase 1 (Copper), attributable share. The ~$0.1bn is the approved capex spend for the 5th ball mill only (first production expected in ~2023), other near-term initiatives under phase 1 are under study.

4. This capex refers to the implementation of Ultra High Dense Media Separation (UHDMS) technology at Sishen. Due to additional complexities identified, the project has been delayed pending a further review.

5. Technology and innovation capex is estimated to be between $0.2-0.5bn pa, including capex on SA RREE (Southern Africa Regional Renewable Energy Ecosystem) and nuGenTM. In this graph, SA RREE and nuGenTM capex has been shown

separately from other technology and innovation capex. SA RREE and nuGenTM programmes capex is subject to change as studies and execution plans progress.

Anglo American

40View entire presentation