Investor Presentation

Financials

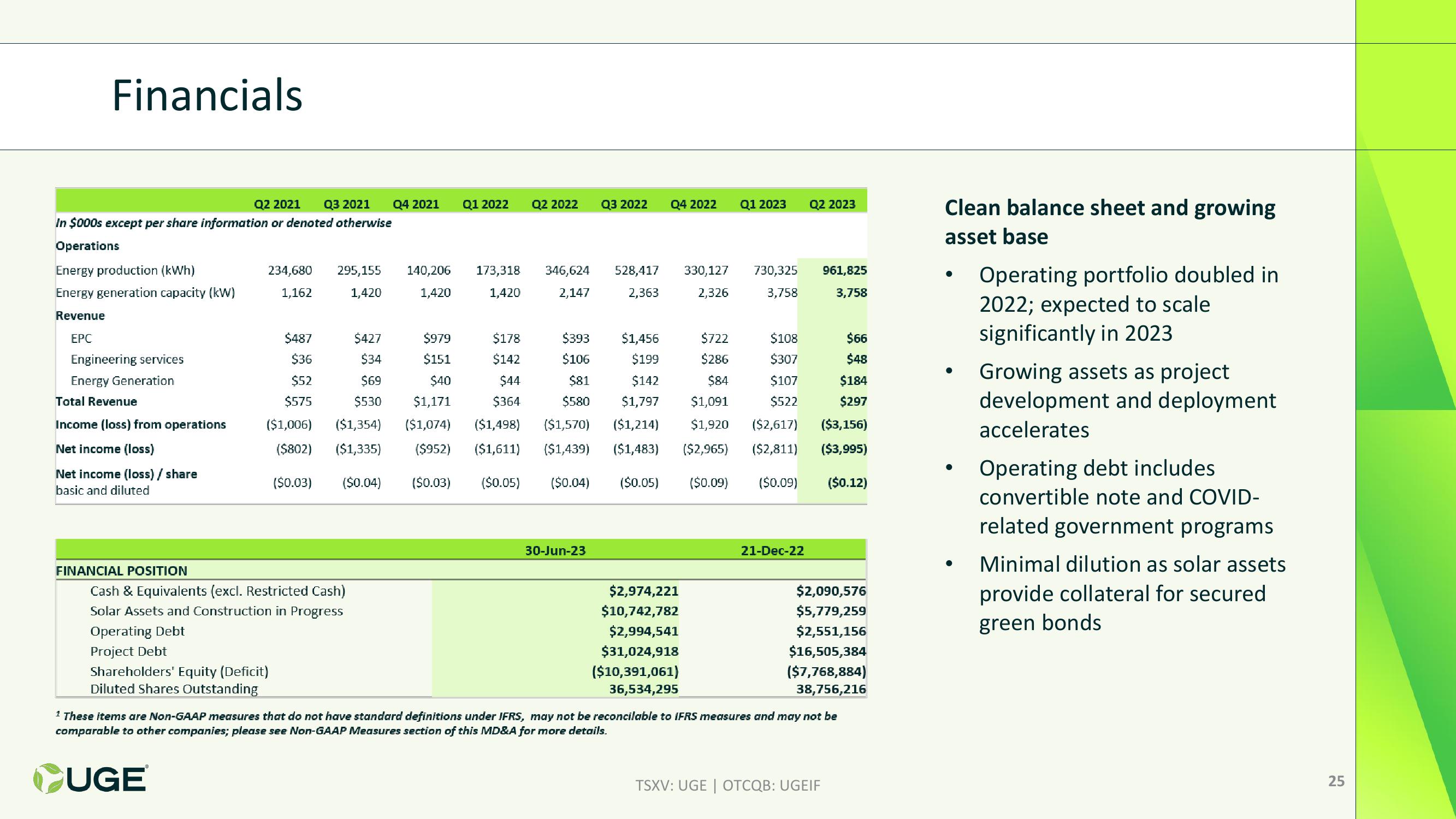

Q2 2021 Q3 2021 Q4 2021

Q1 2022

Q2 2022

Q3 2022

Q4 2022

Q1 2023

Q2 2023

In $000s except per share information or denoted otherwise

Operations

Energy production (kWh)

234,680

295,155 140,206

173,318

346,624

528,417

Energy generation capacity (kW)

1,162

1,420

1,420

1,420

2,147

2,363

330,127

2,326

730,325

3,758

961,825

3,758

Revenue

EPC

$487

$427

$979

$178

$393

$1,456

$722

$108

$66

Engineering services

$36

$34

$151

$142

$106

$199

$286

$307

$48

Energy Generation

$52

$69

$40

$44

$81

$142

$84

$107

$184

Total Revenue

$530

Income (loss) from operations

Net income (loss)

Net income (loss)/share

basic and diluted

$575

($1,006) ($1,354) ($1,074) ($1,498)

($802) ($1,335) ($952) ($1,611)

($0.03) ($0.04)

$1,171

$364

$580

$1,797

$1,091

$522

$297

($1,570)

($1,439)

($1,214)

($1,483)

$1,920 ($2,617)

($2,965)

($3,156)

($2,811) ($3,995)

($0.03) ($0.05) ($0.04)

($0.05)

($0.09) ($0.09)

($0.12)

30-Jun-23

21-Dec-22

Clean balance sheet and growing

asset base

Operating portfolio doubled in

2022; expected to scale

significantly in 2023

Growing assets as project

development and deployment

accelerates

Operating debt includes

convertible note and COVID-

related government programs

Minimal dilution as solar assets

provide collateral for secured

FINANCIAL POSITION

Cash & Equivalents (excl. Restricted Cash)

Solar Assets and Construction in Progress

Operating Debt

Project Debt

Diluted Shares Outstanding

Shareholders' Equity (Deficit)

$2,974,221

$10,742,782

$2,994,541

$31,024,918

($10,391,061)

36,534,295

$2,090,576

$5,779,259

$2,551,156

green bonds

$16,505,384

($7,768,884)

38,756,216

1 These items are Non-GAAP measures that do not have standard definitions under IFRS, may not be reconcilable to IFRS measures and may not be

comparable to other companies; please see Non-GAAP Measures section of this MD&A for more details.

UGE

TSXV: UGE | OTCQB: UGEIF

25

25View entire presentation