Bird Investor Presentation Deck

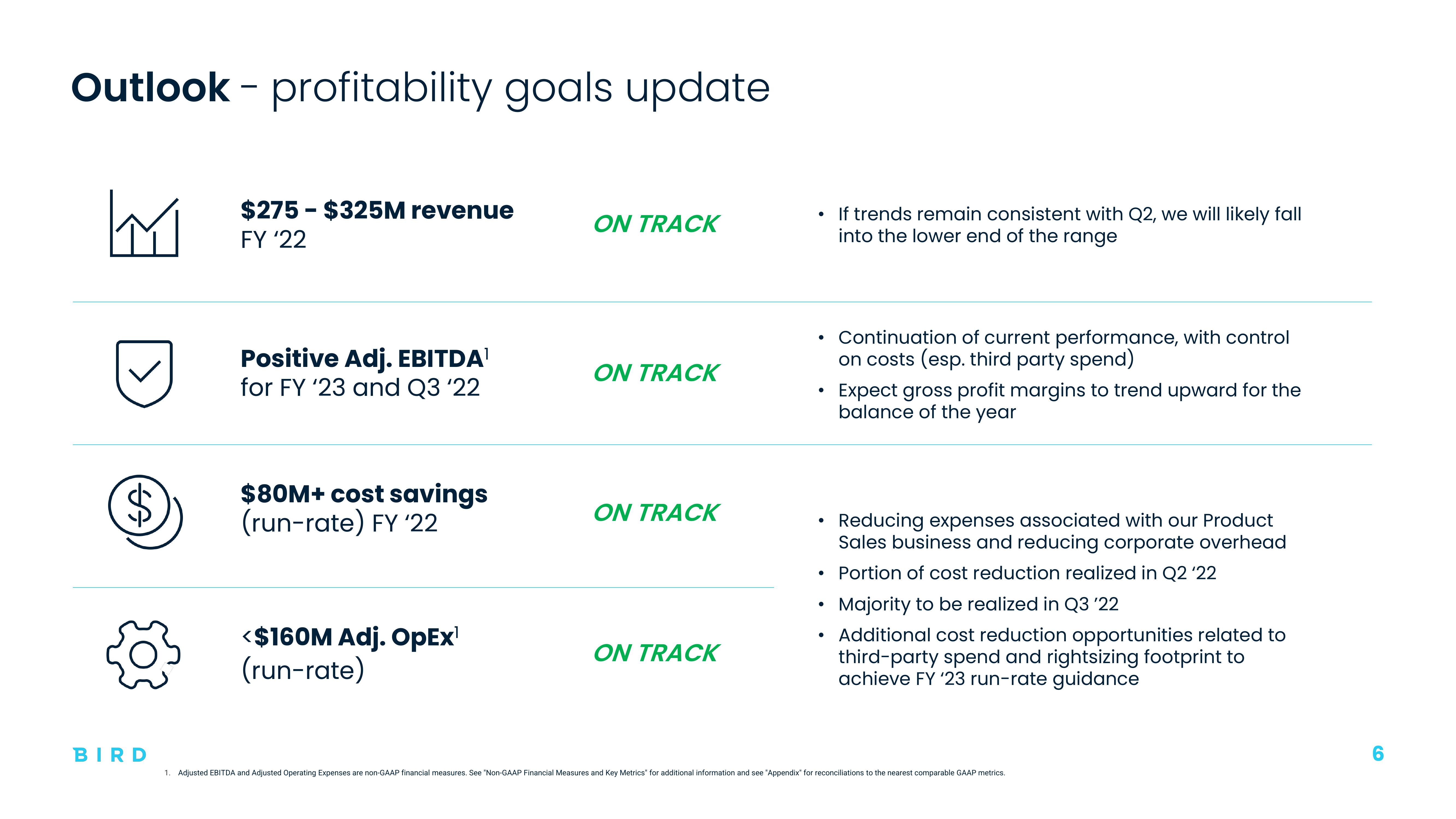

Outlook - profitability goals update

M

$

BIRD

$275- $325M revenue

FY '22

Positive Adj. EBITDA¹

for FY '23 and Q3 '22

$80M+ cost savings

(run-rate) FY '22

<$160M Adj. OpEx¹

(run-rate)

ON TRACK

ON TRACK

ON TRACK

ON TRACK

●

●

●

●

If trends remain consistent with Q2, we will likely fall

into the lower end of the range

inuation current performance, with control

on costs (esp. third party spend)

Expect gross profit margins to trend upward for the

balance of the year

Reducing expenses associated with our Product

Sales business and reducing corporate overhead

Portion of cost reduction realized in Q2 '22

Majority to be realized in Q3 '22

Additional cost reduction opportunities related to

third-party spend and rightsizing footprint to

achieve FY '23 run-rate guidance

1. Adjusted EBITDA and Adjusted Operating Expenses are non-GAAP financial measures. See "Non-GAAP Financial Measures and Key Metrics for additional information and see "Appendix" for reconciliations to the nearest comparable GAAP metrics.View entire presentation