ValueAct Capital Activist Presentation Deck

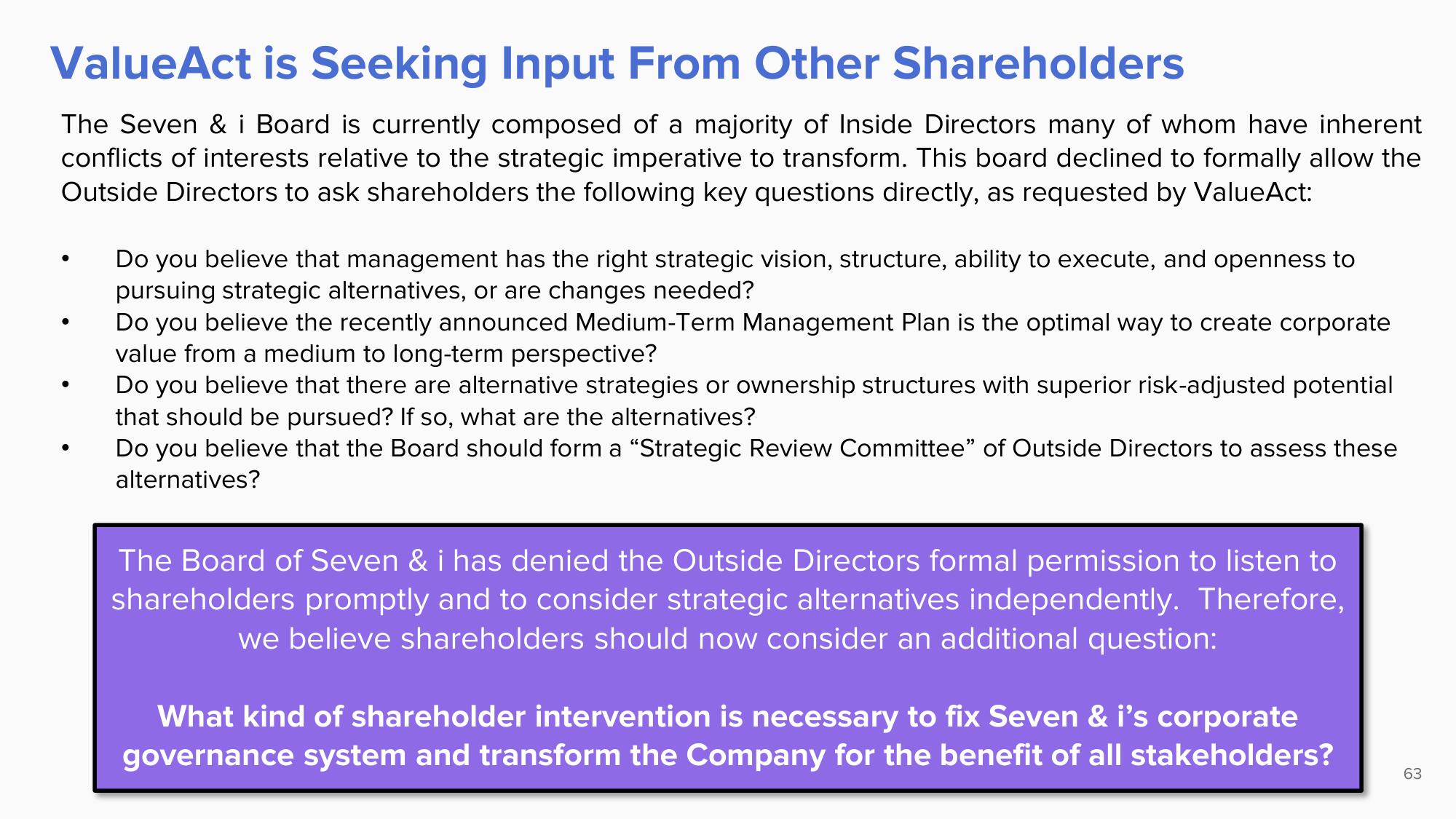

ValueAct is Seeking Input From Other Shareholders

The Seven & i Board is currently composed of a majority of Inside Directors many of whom have inherent

conflicts of interests relative to the strategic imperative to transform. This board declined to formally allow the

Outside Directors to ask shareholders the following key questions directly, as requested by ValueAct:

●

●

Do you believe that management has the right strategic vision, structure, ability to execute, and openness to

pursuing strategic alternatives, or are changes needed?

Do you believe the recently announced Medium-Term Management Plan is the optimal way to create corporate

value from a medium to long-term perspective?

Do you believe that there are alternative strategies or ownership structures with superior risk-adjusted potential

that should be pursued? If so, what are the alternatives?

Do you believe that the Board should form a "Strategic Review Committee" of Outside Directors to assess these

alternatives?

The Board of Seven & i has denied the Outside Directors formal permission to listen to

shareholders promptly and to consider strategic alternatives independently. Therefore,

we believe shareholders should now consider an additional question:

What kind of shareholder intervention is necessary to fix Seven & i's corporate

governance system and transform the Company for the benefit of all stakeholders?

63View entire presentation