Evercore Investment Banking Pitch Book

Confidential - Preliminary and Subject to Change

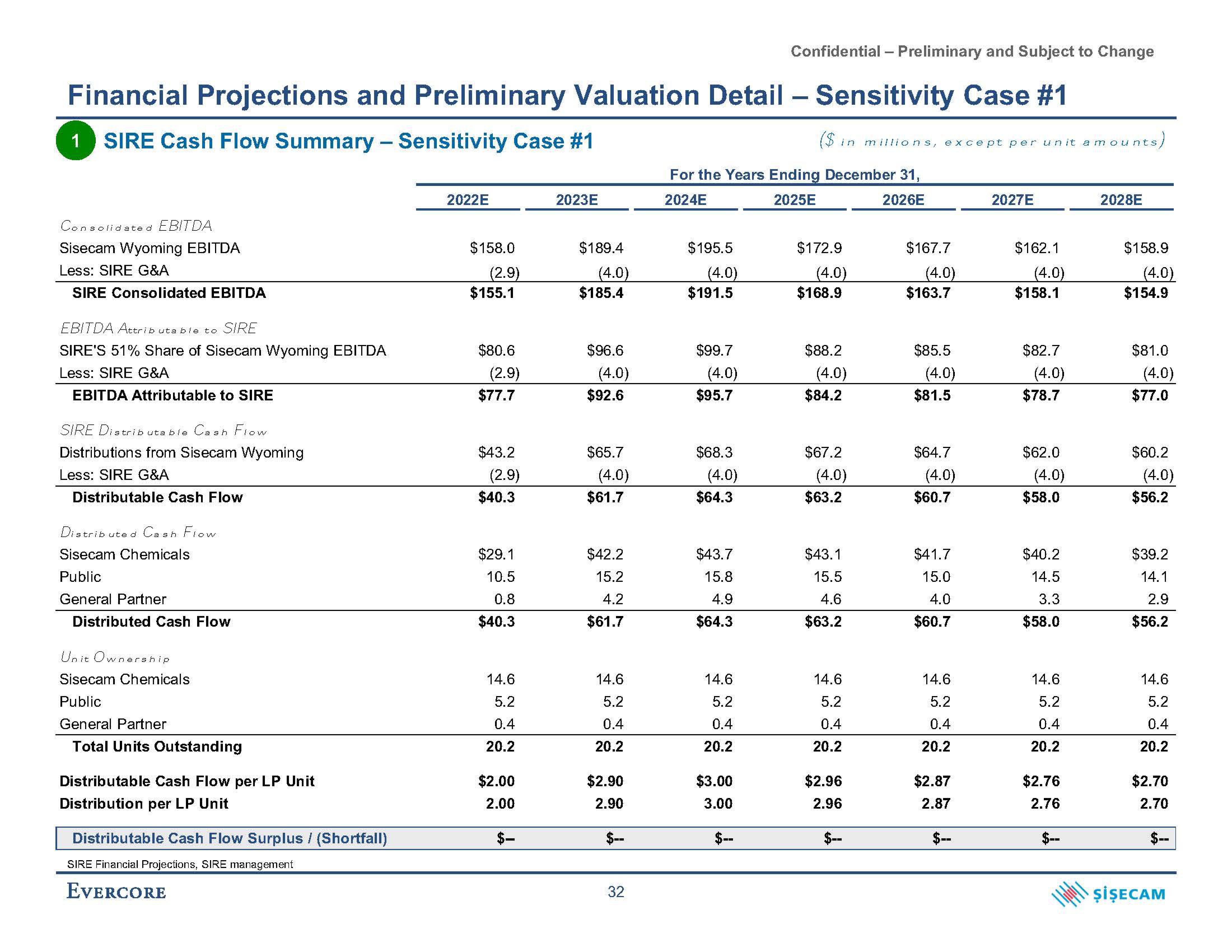

Financial Projections and Preliminary Valuation Detail - Sensitivity Case #1

1 SIRE Cash Flow Summary - Sensitivity Case #1

($ in millions, except per unit amounts,

Consolidated EBITDA

Sisecam Wyoming EBITDA

Less: SIRE G&A

SIRE Consolidated EBITDA

EBITDA Attributable to SIRE

SIRE'S 51% Share of Sisecam Wyoming EBITDA

Less: SIRE G&A

EBITDA Attributable to SIRE

SIRE Distributable Cash Flow

Distributions from Sisecam Wyoming

Less: SIRE G&A

Distributable Cash Flow

Distributed Cash Flow

Sisecam Chemicals

Public

General Partner

Distributed Cash Flow

Unit Ownership

Sisecam Chemicals

Public

General Partner

Total Units Outstanding

Distributable Cash Flow per LP Unit

Distribution per LP Unit

Distributable Cash Flow Surplus / (Shortfall)

SIRE Financial Projections, SIRE management

EVERCORE

2022E

$158.0

(2.9)

$155.1

$80.6

(2.9)

$77.7

$43.2

(2.9)

$40.3

$29.1

10.5

0.8

$40.3

14.6

5.2

0.4

20.2

$2.00

2.00

$-

2023E

$189.4

(4.0)

$185.4

$96.6

(4.0)

$92.6

$65.7

(4.0)

$61.7

$42.2

15.2

4.2

$61.7

14.6

5.2

0.4

20.2

$2.90

2.90

32

For the Years Ending December 31,

2024E

2025E

2026E

$195.5

(4.0)

$191.5

$99.7

(4.0)

$95.7

$68.3

(4.0)

$64.3

$43.7

15.8

4.9

$64.3

14.6

5.2

0.4

20.2

$3.00

3.00

$172.9

(4.0)

$168.9

$88.2

(4.0)

$84.2

$67.2

(4.0)

$63.2

$43.1

15.5

4.6

$63.2

14.6

5.2

0.4

20.2

$2.96

2.96

$--

$167.7

(4.0)

$163.7

$85.5

(4.0)

$81.5

$64.7

(4.0)

$60.7

$41.7

15.0

4.0

$60.7

14.6

5.2

0.4

20.2

$2.87

2.87

2027E

$162.1

(4.0)

$158.1

$82.7

(4.0)

$78.7

$62.0

(4.0)

$58.0

$40.2

14.5

3.3

$58.0

14.6

5.2

0.4

20.2

$2.76

2.76

2028E

$158.9

(4.0)

$154.9

$81.0

(4.0)

$77.0

$60.2

(4.0)

$56.2

$39.2

14.1

2.9

$56.2

14.6

5.2

0.4

20.2

$2.70

2.70

$--

ŞİŞECAMView entire presentation