Evercore Investment Banking Pitch Book

McMoRan Situation Analysis

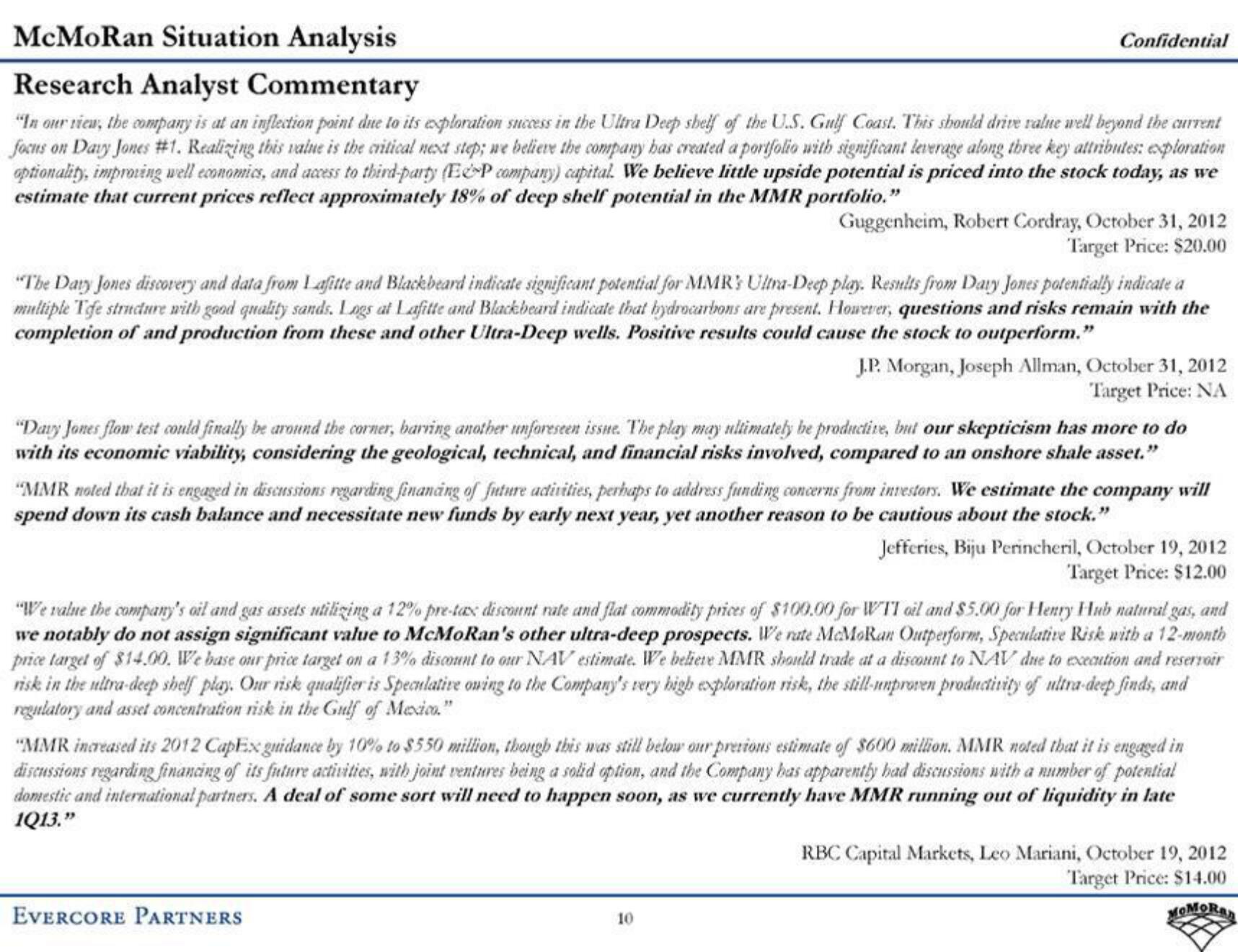

Research Analyst Commentary

"In our view, the company is at an inflection point due to its exploration success in the Ultra Deep shelf of the U.S. Gulf Coast. This should drive value well beyond the current

focus on Davy Jones #1. Realizing this value is the critical next step; we believe the company has created a portfolio with significant leverage along three key attributes: exploration

optionality, improving well economics, and access to third-party (EP company) capital. We believe little upside potential is priced into the stock today, as we

estimate that current prices reflect approximately 18% of deep shelf potential in the MMR portfolio."

Confidential

"The Davy Jones discovery and data from Lafitte and Blackbeard indicate significant potential for MMR's Ultra-Deep play. Results from Davy Jones potentially indicate a

multiple Tefe structure with good quality sands. Logs at Lafitte and Blackbeard indicate that hydrocarbons are present. However, questions and risks remain with the

completion of and production from these and other Ultra-Deep wells. Positive results could cause the stock to outperform."

Guggenheim, Robert Cordray, October 31, 2012

Target Price: $20.00

"Davy Jones flow test could finally be around the corner, barring another unforeseen issue. The play may ultimately be productive, but our skepticism has more to do

with its economic viability, considering the geological, technical, and financial risks involved, compared to an onshore shale asset."

"MMR noted that it is engaged in discussions regarding financing of future activities, perhaps to address funding concerns from investors. We estimate the company will

spend down its cash balance and necessitate new funds by early next year, yet another reason to be cautious about the stock."

EVERCORE PARTNERS

J.P. Morgan, Joseph Allman, October 31, 2012

Target Price: NA

10

"We value the company's oil and gas assets utilizing a 12% pre-tax discount rate and flat commodity prices of $100.00 for WTI oil and $5.00 for Henry Hub natural gas, and

we notably do not assign significant value to McMoRan's other ultra-deep prospects. We rate McMoRan Outperform, Speculative Risk with a 12-month

price target of $14.00. We hase our price target on a 13% discount to our NAV estimate. We believe MMR should trade at a discount to NAV dne to execution and reservoir

risk in the ultra-deep shelf play. Our risk qualifier is Speculative owing to the Company's very high exploration risk, the still unproven productivity of ultra-deep finds, and

regulatory and asset concentration risk in the Gulf of Mexico."

Jefferies, Biju Perincheril, October 19, 2012

Target Price: $12.00

"MMR increased its 2012 CapEx guidance by 10% to $550 million, though this was still below our previous estimate of $600 million. MMR noted that it is engaged in

discussions regarding financing of its future activities, with joint ventures being a solid option, and the Company has apparently had discussions with a number of potential

domestic and international partners. A deal of some sort will need to happen soon, as we currently have MMR running out of liquidity in late

1Q13."

RBC Capital Markets, Leo Mariani, October 19, 2012

Target Price: $14.00

MOMORANView entire presentation