Liberty Global Results Presentation Deck

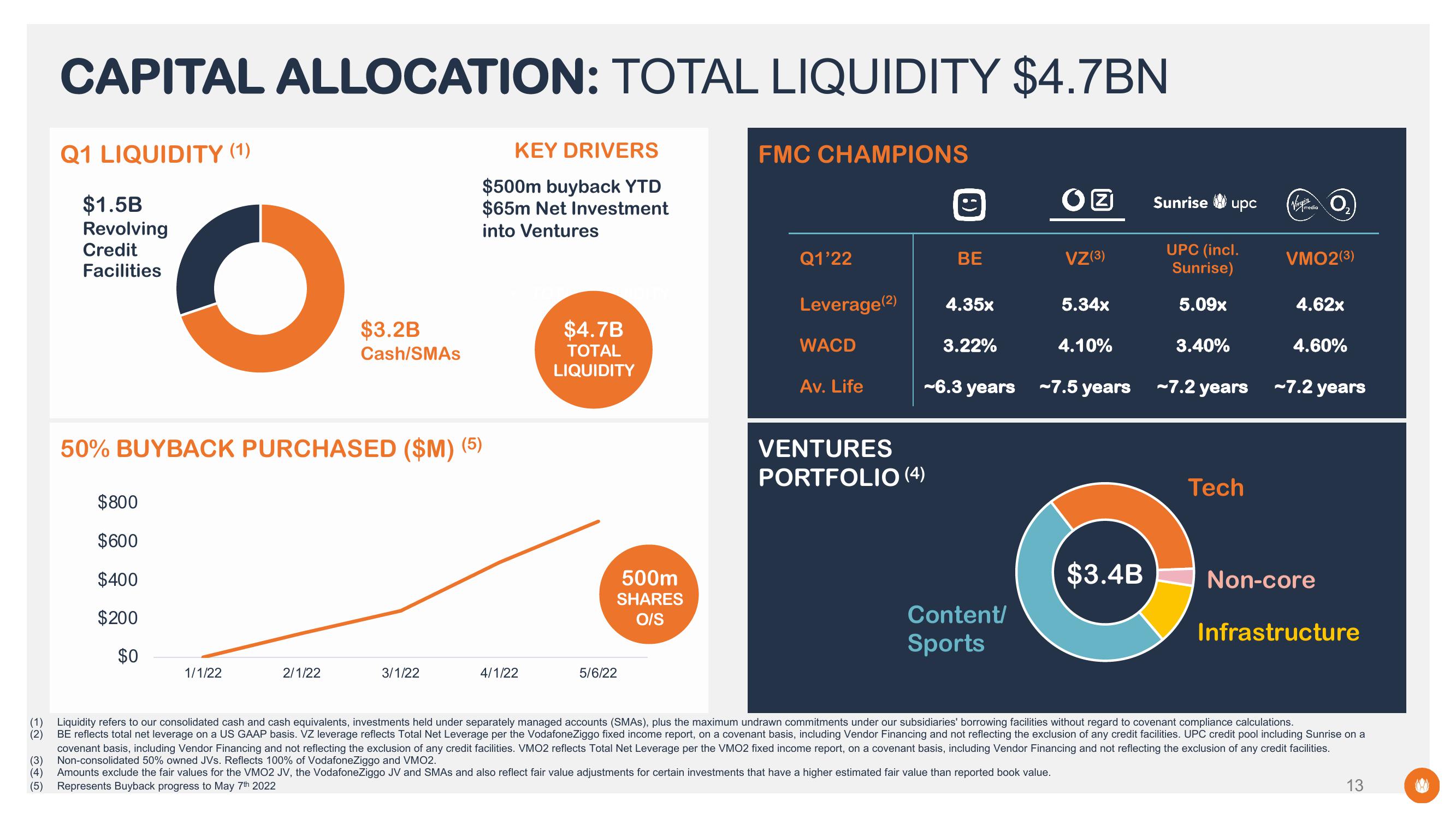

CAPITAL ALLOCATION: TOTAL LIQUIDITY $4.7BN

Q1 LIQUIDITY (1)

$1.5B

Revolving

Credit

Facilities

O

$800

$600

$400

$200

$0

50% BUYBACK PURCHASED ($M) (5)

1/1/22

$3.2B

Cash/SMAS

2/1/22

KEY DRIVERS

$500m buyback YTD

$65m Net Investment

into Ventures

3/1/22

4/1/22

$4.7B

TOTAL

LIQUIDITY

500m

SHARES

O/S

5/6/22

FMC CHAMPIONS

Q1'22

Leverage (2)

WACD

Av. Life

BE

VENTURES

PORTFOLIO (4)

4.35x

3.22%

-6.3 years

Content/

Sports

O

VZ(3)

5.34x

4.10%

-7.5 years

$3.4B

Sunrise

upc

UPC (incl.

Sunrise)

5.09x

3.40%

-7.2 years

Tech

(Verygtedi 0₂

media

VMO2(3)

4.62x

4.60%

-7.2 years

Non-core

Infrastructure

(1) Liquidity refers to our consolidated cash and cash equivalents, investments held under separately managed accounts (SMAs), plus the maximum undrawn commitments under our subsidiaries' borrowing facilities without regard to covenant compliance calculations.

(2) BE reflects total net leverage on a US GAAP basis. VZ leverage reflects Total Net Leverage per the VodafoneZiggo fixed income report, on a covenant basis, including Vendor Financing and not reflecting the exclusion of any credit facilities. UPC credit pool including Sunrise on a

covenant basis, including Vendor Financing and not reflecting the exclusion of any credit facilities. VMO2 reflects Total Net Leverage per the VMO2 fixed income report, on a covenant basis, including Vendor Financing and not reflecting the exclusion of any credit facilities.

(3) Non-consolidated 50% owned JVs. Reflects 100% of VodafoneZiggo and VMO2.

(4) Amounts exclude the fair values for the VMO2 JV, the VodafoneZiggo JV and SMAS and also reflect fair value adjustments for certain investments that have a higher estimated fair value than reported book value.

(5) Represents Buyback progress to May 7th 2022

13View entire presentation