J.P.Morgan Shareholder Engagement Presentation Deck

B Executive Compensation

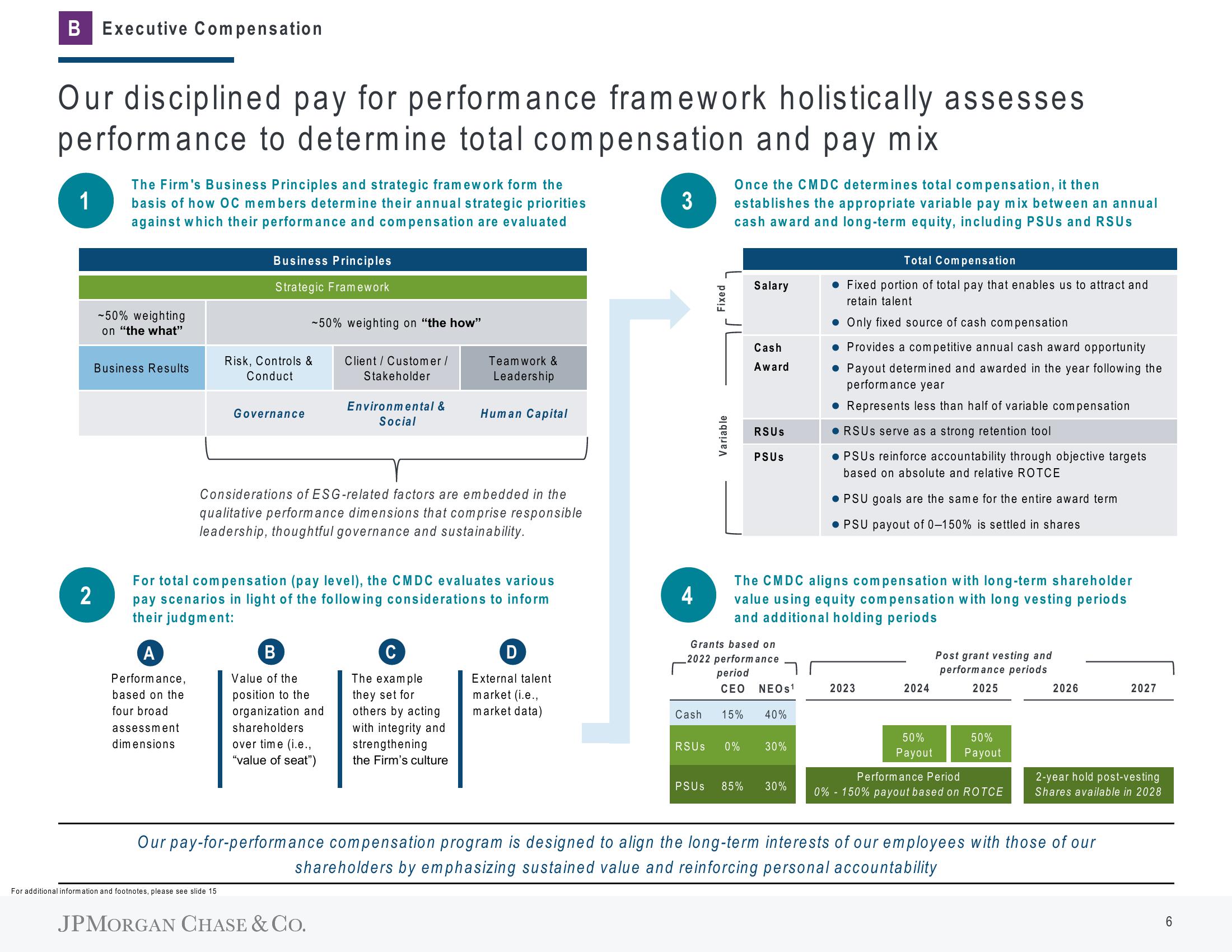

Our disciplined pay for performance framework holistically assesses

performance to determine total compensation and pay mix

1

2

The Firm's Business Principles and strategic framework form the

basis of how OC members determine their annual strategic priorities

against which their performance and compensation are evaluated

-50% weighting

on "the what"

Business Results

A

Performance,

based on the

four broad

assessment

dimensions

Business Principles

Strategic Framework

Risk, Controls &

Conduct

Governance

For additional information and footnotes, please see slide 15

-50% weighting on "the how"

Client Customer /

Stakeholder

B

Value of the

position to the

organization and

shareholders

over time (i.e.,

"value of seat")

Environmental &

Social

Considerations of ESG-related factors are embedded in the

qualitative performance dimensions that comprise responsible

leadership, thoughtful governance and sustainability.

For total compensation (pay level), the CMDC evaluates various

pay scenarios in light of the following considerations to inform

their judgment:

JPMORGAN CHASE & CO.

Teamwork &

Leadership

Human Capital

C

The example

they set for

others by acting

with integrity and

strengthening

the Firm's culture

D

External talent

market (i.e.,

market data)

3

4

Cash

Fixed

Variable

PSUS

Once the CMDC determines total compensation, it then

establishes the appropriate variable pay mix between an annual

cash award and long-term equity, including PSUs and RSUS

Salary

Cash

Award

period

CEO

RSUS

Grants based on

2022 performance

PSUS

The CMDC aligns compensation with long-term shareholder

value using equity compensation with long vesting periods

and additional holding periods

NEOS1

15% 40%

RSUS 0% 30%

Total Compensation

Fixed portion of total pay that enables us to attract and

retain talent

• Only fixed source of cash compensation

• Provides a competitive annual cash award opportunity

• Payout determined and awarded in the year following the

performance year

Represents less than half of variable compensation

85% 30%

• RSUS serve as a strong retention tool

● PSUs reinforce accountability through objective targets

based on absolute and relative ROTCE

● PSU goals are the same for the entire award term

PSU payout of 0-150% is settled in shares

2023

2024

Post grant vesting and

performance periods

2025

50%

50%

Payout Payout

Performance Period

0% - 150% payout based on ROTCE

2026

Our pay-for-performance compensation program is designed to align the long-term interests of our employees with those of our

shareholders by emphasizing sustained value and reinforcing personal accountability

2027

2-year hold post-vesting

Shares available in 2028

6View entire presentation