Uber Mergers and Acquisitions Presentation Deck

Strategic Rationale 01

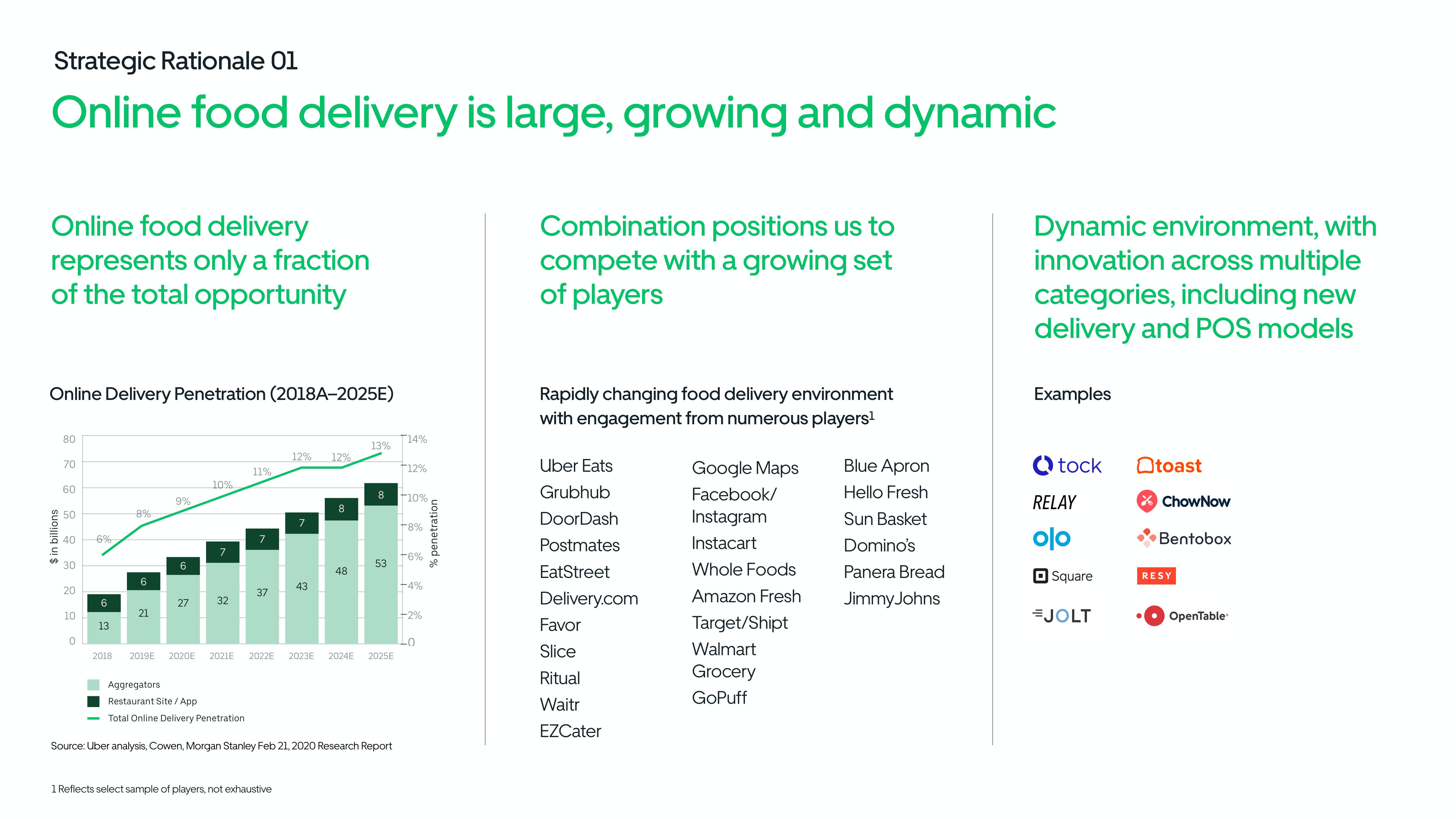

Online food delivery is large, growing and dynamic

Online food delivery

represents only a fraction

of the total opportunity

Online Delivery Penetration (2018A-2025E)

$ in billions

80

70

60

50

30

20

10

0

6%

6

13

8%

6

21

9%

6

27

10%

32

11%

Aggregators

Restaurant Site / App

Total Online Delivery Penetration

7

37

12% 12%

7

1 Reflects select sample of players, not exhaustive

43

8

48

13%

8

2018 2019E 2020E 2021E 2022E 2023E 2024E 2025E

53

Source: Uber analysis, Cowen, Morgan Stanley Feb 21, 2020 Research Report

T14%

+12%

+10%

-8%

-6%

-4%

+2%

10

% penetration

Combination positions us to

compete with a growing set

of players

Rapidly changing food delivery environment

with engagement from numerous players¹

Uber Eats

Grubhub

DoorDash

Postmates

EatStreet

Delivery.com

Favor

Slice

Ritual

Waitr

EZCater

Google Maps

Facebook/

Instagram

Instacart

Whole Foods

Amazon Fresh

Target/Shipt

Walmart

Grocery

GoPuff

Blue Apron

Hello Fresh

Sun Basket

Domino's

Panera Bread

Jimmy Johns

Dynamic environment, with

innovation across multiple

categories, including new

delivery and POS models

Examples

tock

RELAY

olo

Square

=JOLT

Otoast

ChowNow

Bentobox

RESY

• OpenTableView entire presentation