MoneyLion Results Presentation Deck

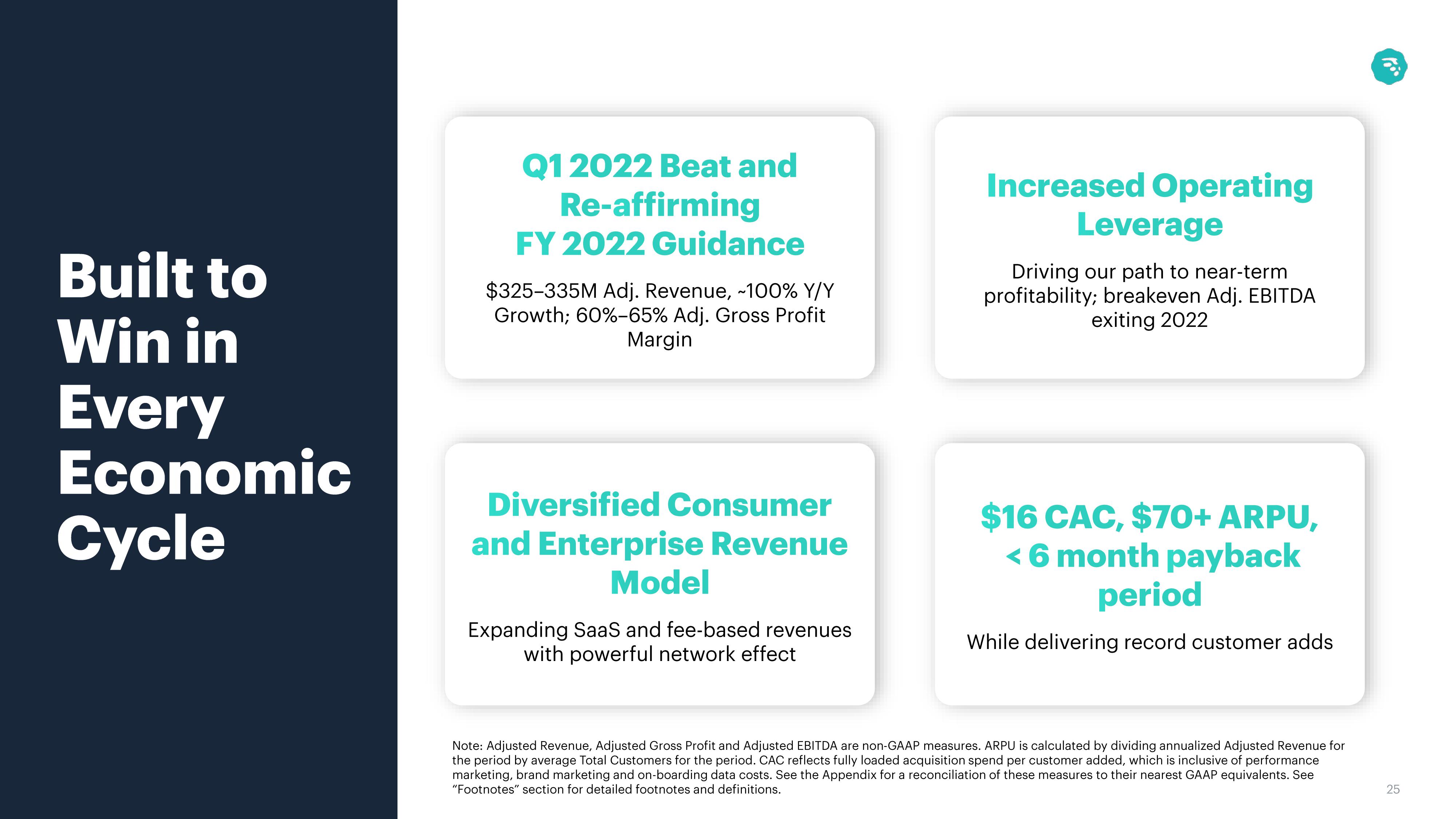

Built to

Win in

Every

Economic

Cycle

Q1 2022 Beat and

Re-affirming

FY 2022 Guidance

$325-335M Adj. Revenue, ~100% Y/Y

Growth; 60%-65% Adj. Gross Profit

Margin

Diversified Consumer

and Enterprise Revenue

Model

Expanding SaaS and fee-based revenues

with powerful network effect

Increased Operating

Leverage

Driving our path to near-term

profitability; breakeven Adj. EBITDA

exiting 2022

$16 CAC, $70+ ARPU,

< 6 month payback

period

While delivering record customer adds

Note: Adjusted Revenue, Adjusted Gross Profit and Adjusted EBITDA are non-GAAP measures. ARPU is calculated by dividing annualized Adjusted Revenue for

the period by average Total Customers for the period. CAC reflects fully loaded acquisition spend per customer added, which is inclusive performance

marketing, brand marketing and on-boarding data costs. See the Appendix for a reconciliation of these measures to their nearest GAAP equivalents. See

"Footnotes" section for detailed footnotes and definitions.

50⁰

25View entire presentation