Deutsche Bank Results Presentation Deck

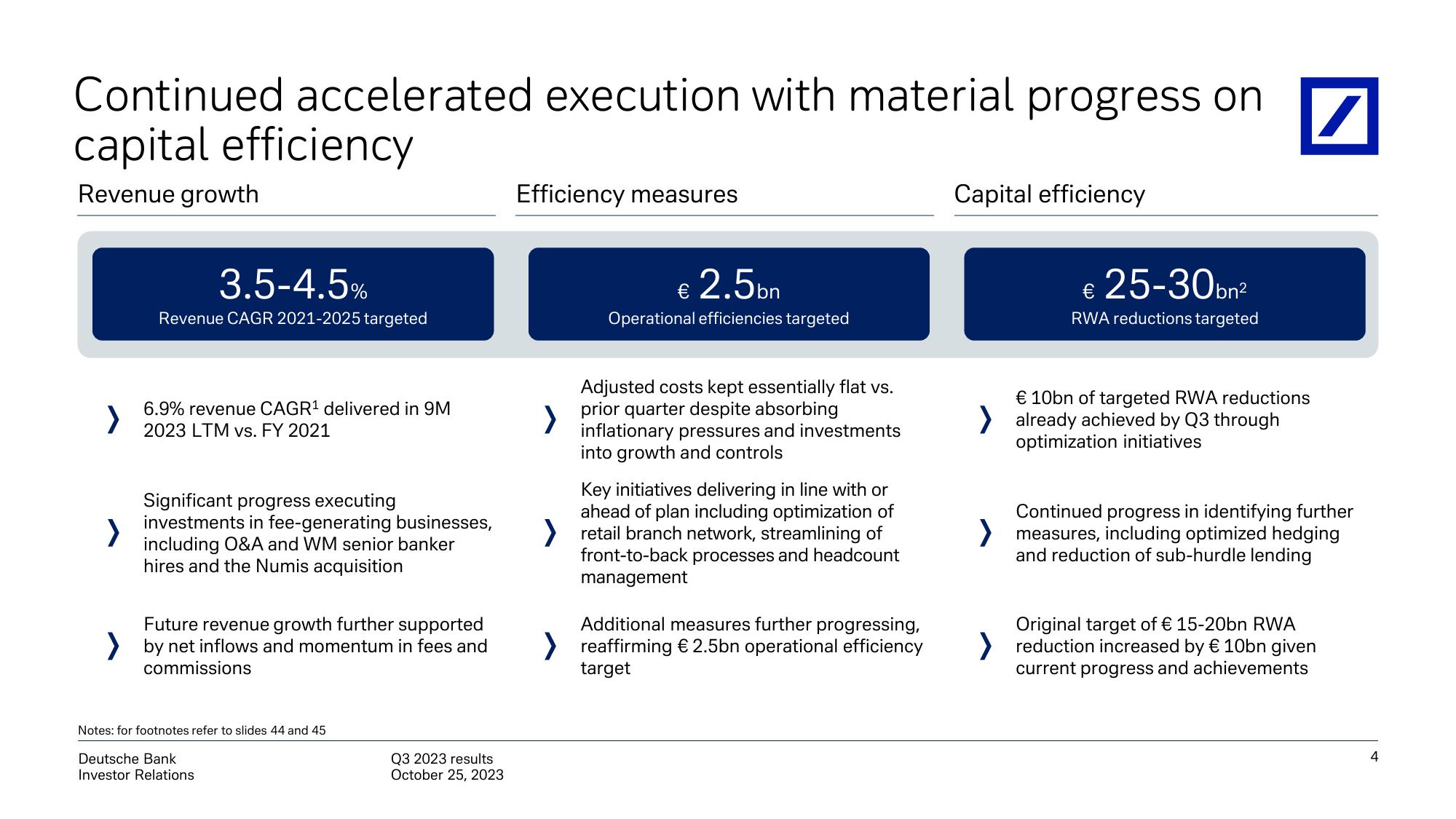

Continued accelerated execution with material progress on

capital efficiency

Revenue growth

>

>

3.5-4.5%

Revenue CAGR 2021-2025 targeted

6.9% revenue CAGR¹ delivered in 9M

2023 LTM vs. FY 2021

Significant progress executing

investments in fee-generating businesses,

including O&A and WM senior banker

hires and the Numis acquisition

Future revenue growth further supported

by net inflows and momentum in fees and

commissions

Notes: for footnotes refer to slides 44 and 45

Deutsche Bank

Investor Relations

Q3 2023 results

October 25, 2023

Efficiency measures

>

€ 2.5bn

Operational efficiencies targeted

Adjusted costs kept essentially flat vs.

prior quarter despite absorbing

inflationary pressures and investments

into growth and controls

Key initiatives delivering in line with or

ahead of plan including optimization of

retail branch network, streamlining of

front-to-back processes and headcount

management

Additional measures further progressing,

> reaffirming € 2.5bn operational efficiency

target

Capital efficiency

€ 25-30bn²

RWA reductions targeted

€ 10bn of targeted RWA reductions

> already achieved by Q3 through

optimization initiatives

Continued progress in identifying further

> measures, including optimized hedging

and reduction of sub-hurdle lending

Original target of € 15-20bn RWA

> reduction increased by € 10bn given

current progress and achievements

4View entire presentation