UBS Results Presentation Deck

Investment Bank

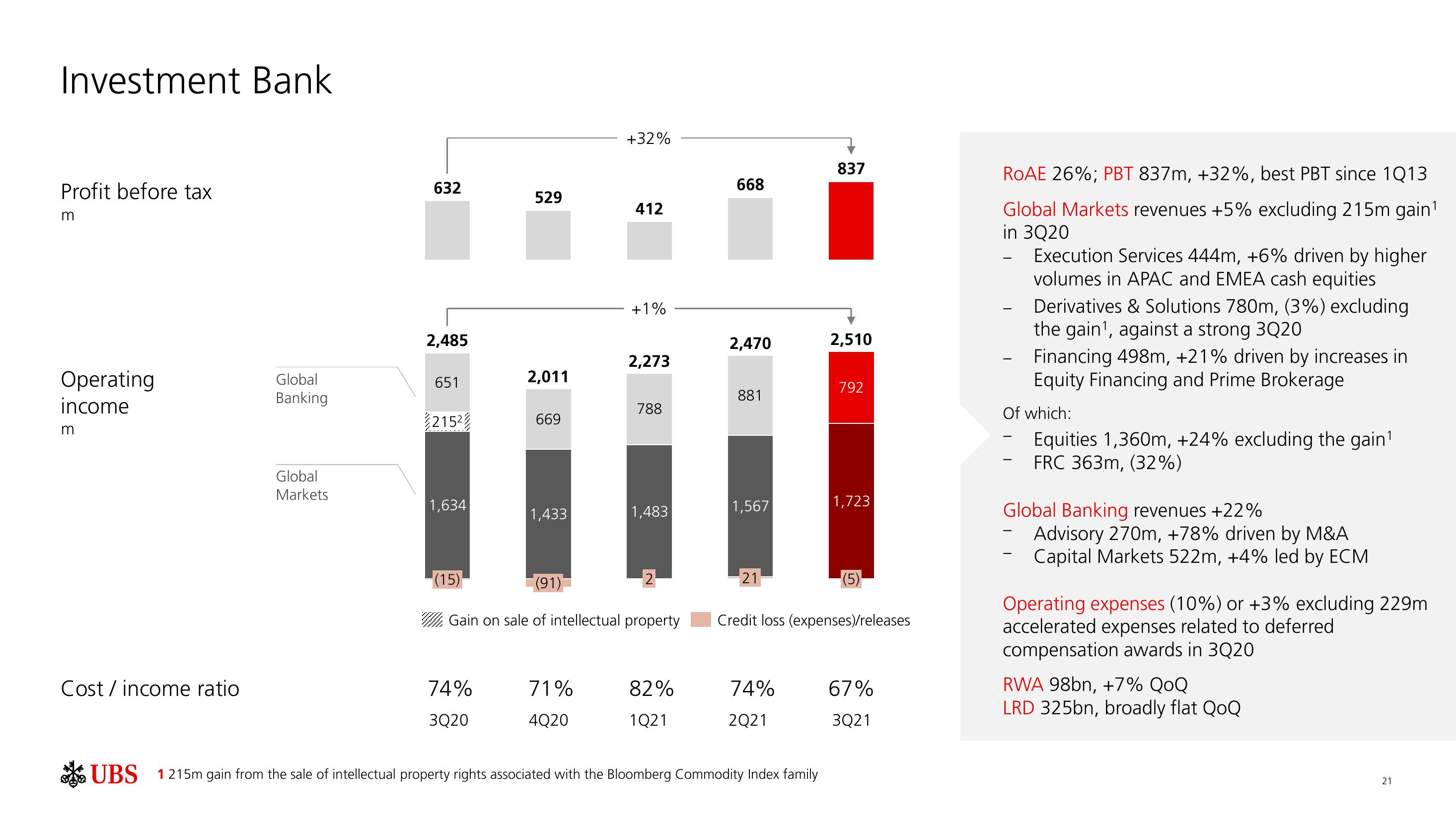

Profit before tax

m

Operating

income

m

Cost / income ratio

Global

Banking

Global

Markets

632

2,485

651

215²

1,634

(15)

529

74%

3Q20

2,011

669

1,433

+32%

71%

4Q20

412

+1%

2,273

788

1,483

(91)

Gain on sale of intellectual property

2

82%

1Q21

668

2,470

881

1,567

21

74%

2Q21

837

UBS 1215m gain from the sale of intellectual property rights associated with the Bloomberg Commodity Index family

2,510

792

1,723

Credit loss (expenses)/releases

(5)

67%

3Q21

ROAE 26%; PBT 837m, +32%, best PBT since 1Q13

Global Markets revenues +5% excluding 215m gain¹

in 3Q20

-

-

-

Execution Services 444m, +6% driven by higher

volumes in APAC and EMEA cash equities

Of which:

Equities 1,360m, +24% excluding the gain¹

FRC 363m, (32%)

-

Derivatives & Solutions 780m, (3%) excluding

the gain¹, against a strong 3Q20

-

Financing 498m, +21% driven by increases in

Equity Financing and Prime Brokerage

Global Banking revenues +22%

Advisory 270m, +78% driven by M&A

Capital Markets 522m, +4% led by ECM

Operating expenses (10%) or +3% excluding 229m

accelerated expenses related to deferred

compensation awards in 3Q20

RWA 98bn, +7% QOQ

LRD 325bn, broadly flat QoQ

21View entire presentation