Aston Martin Lagonda Results Presentation Deck

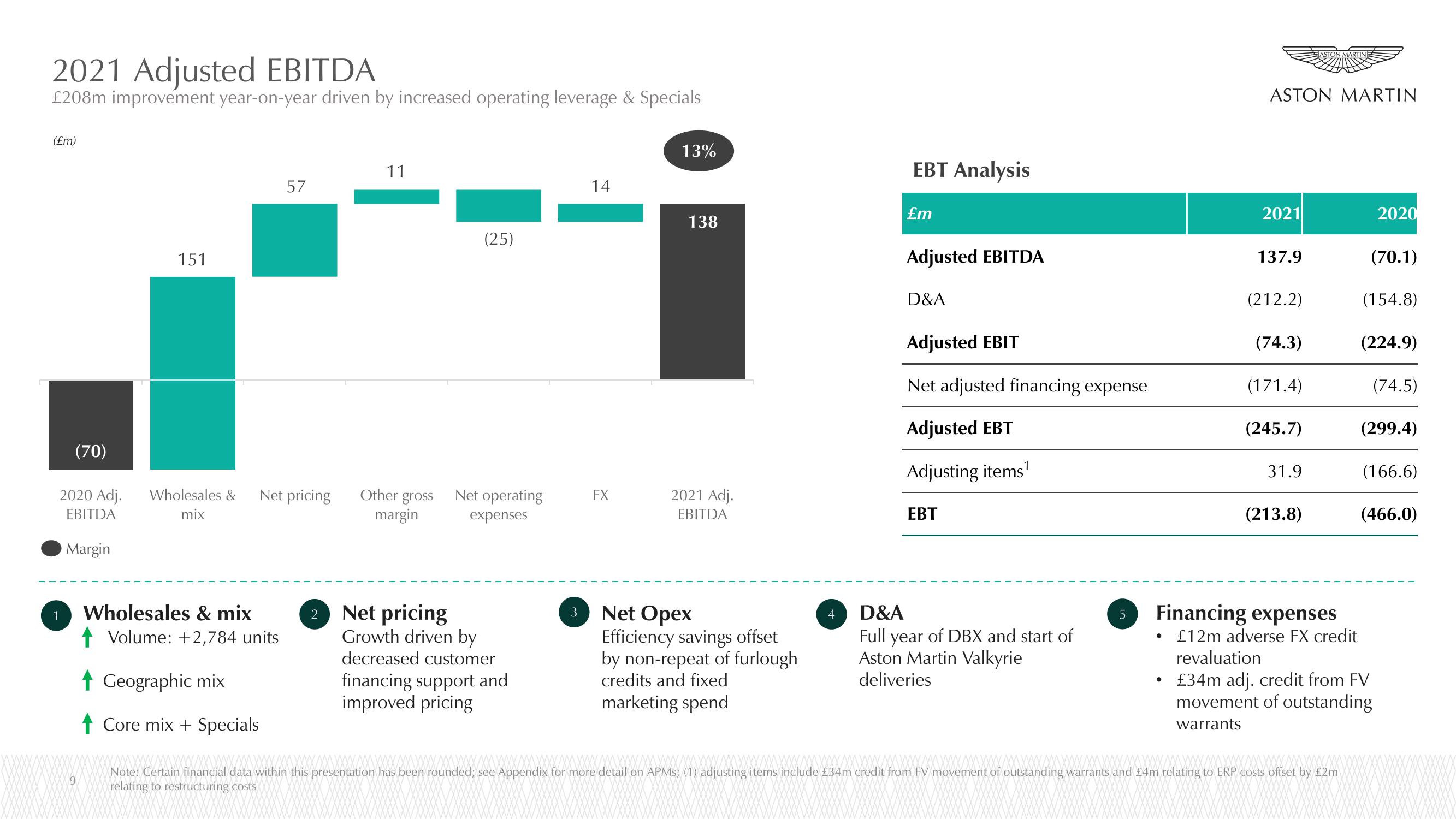

2021 Adjusted EBITDA

£208m improvement year-on-year driven by increased operating leverage & Specials

(£m)

(70)

2020 Adj.

EBITDA

Margin

1

9

151

Wholesales &

mix

Wholesales & mix

Volume: +2,784 units

↑ Geographic mix

Core mix+ Specials

57

Net pricing

11

(25)

Other gross Net operating

margin

expenses

2 Net pricing

Growth driven by

decreased customer

financing support and

improved pricing

14

FX

13%

138

2021 Adj.

EBITDA

3 Net Opex

Efficiency savings offset

by non-repeat of furlough

credits and fixed

marketing spend

4

EBT Analysis

£m

Adjusted EBITDA

D&A

Adjusted EBIT

Net adjusted financing expense

Adjusted EBT

Adjusting items¹

EBT

D&A

Full year of DBX and start of

Aston Martin Valkyrie

deliveries

5

ASTON MARTIN

2021

●

137.9

(212.2)

(74.3)

(171.4)

(245.7)

31.9

ASTON MARTIN

(213.8)

Financing expenses

Note: Certain financial data within this presentation has been rounded; see Appendix for more detail on APMs; (1) adjusting items include £34m credit from FV movement of outstanding warrants and £4m relating to ERP costs offset by £2m

relating to restructuring costs

2020

(70.1)

(154.8)

(224.9)

(74.5)

£12m adverse FX credit

revaluation

●

• £34m adj. credit from FV

movement of outstanding

warrants

(299.4)

(166.6)

(466.0)View entire presentation