WeWork Investor Presentation Deck

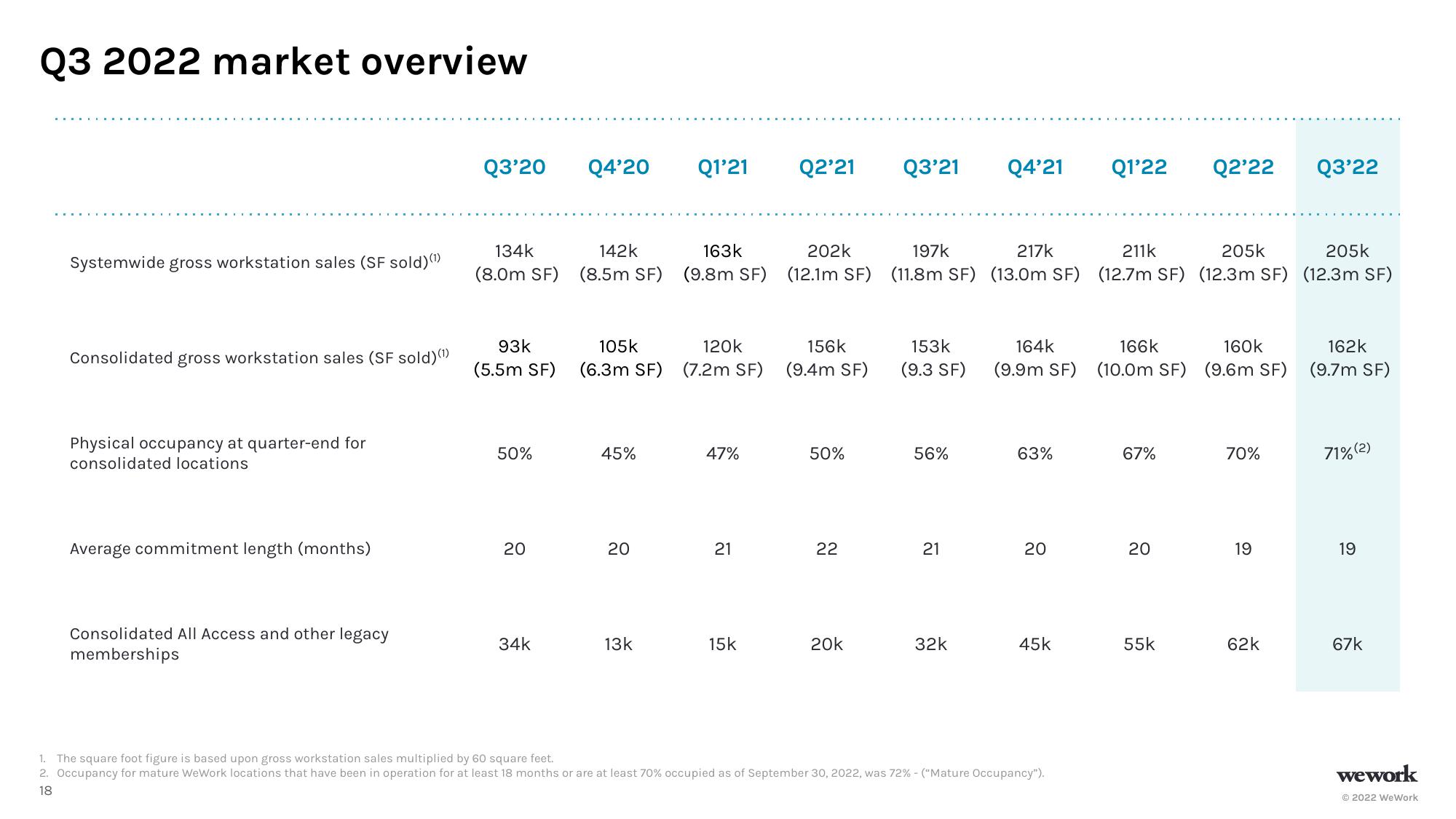

Q3 2022 market overview

Systemwide gross workstation sales (SF sold) (¹)

Consolidated gross workstation sales (SF sold)(¹)

Physical occupancy at quarter-end for

consolidated locations

Average commitment length (months)

Consolidated All Access and other legacy

memberships

Q3'20

134k

(8.0m SF)

93k

(5.5m SF)

50%

20

34k

Q4'20

142k

(8.5m SF)

105k

(6.3m SF)

45%

20

13k

Q1'21

163k

(9.8m SF)

120k

(7.2m SF)

47%

21

15k

Q2'21 Q3'21

202k

(12.1m SF)

156k

(9.4m SF)

50%

22

20k

197k

217k

(11.8m SF) (13.0m SF)

153k

(9.3 SF)

56%

21

Q4'21

32k

164k

(9.9m SF)

63%

20

45k

1. The square foot figure is based upon gross workstation sales multiplied by 60 square feet.

2. Occupancy for mature WeWork locations that have been in operation for at least 18 months or are at least 70% occupied as of September 30, 2022, was 72% - ("Mature Occupancy").

18

Q1'22

205k

211k

205k

(12.7m SF) (12.3m SF) (12.3m SF)

166k

(10.0m SF)

67%

20

Q2'22 Q3'22

55k

160k

(9.6m SF)

70%

19

62k

162k

(9.7m SF)

71% (2)

19

67k

wework

Ⓒ2022 WeWorkView entire presentation