Vale Investor Conference Presentation Deck

2022 BofA Securities Global Metals, Mining & Steel Conference

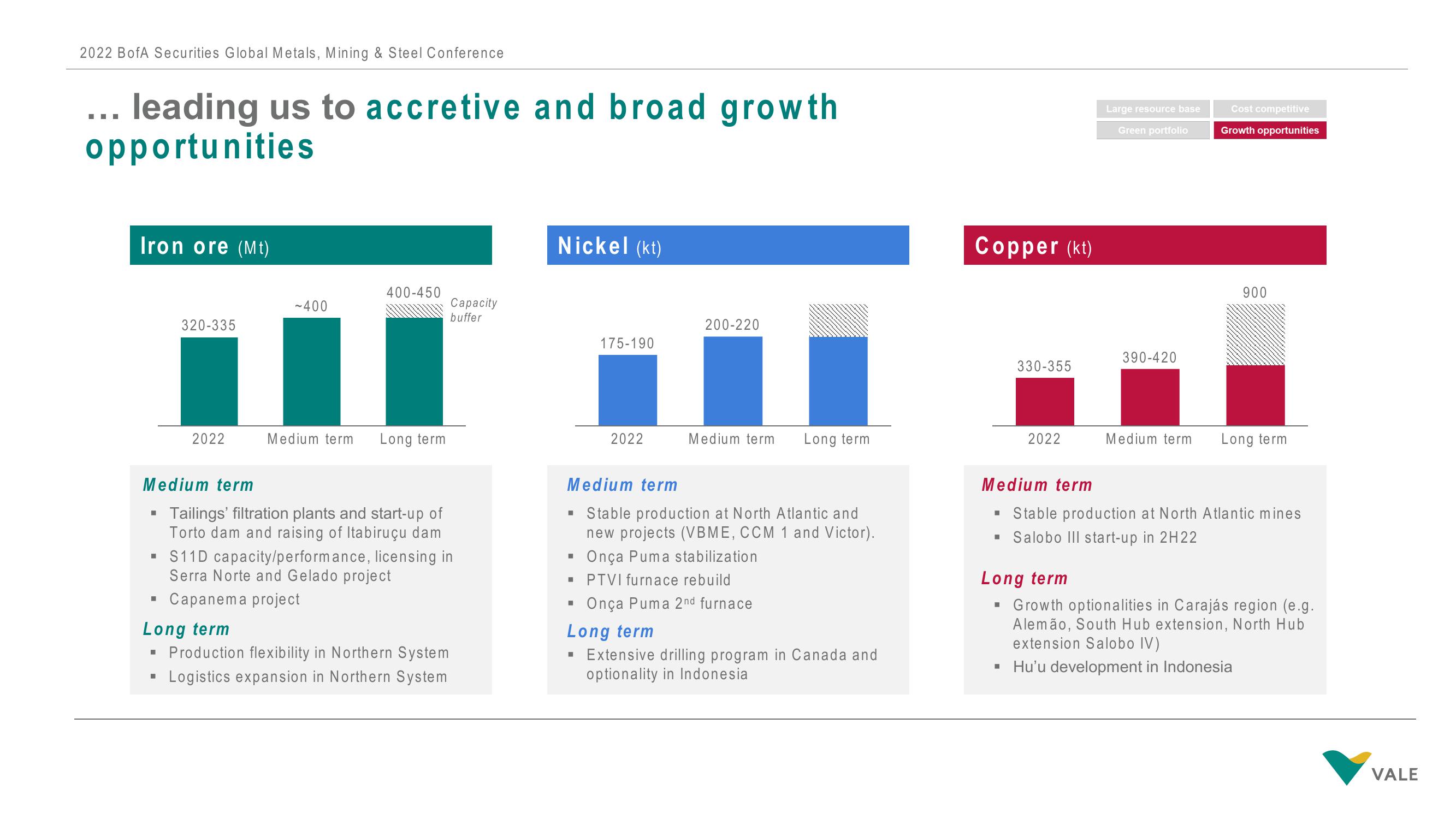

... leading us to accretive and broad growth

opportunities

Iron ore (Mt)

320-335

2022

-400

■

400-450

Medium term Long term

Medium term

Tailings' filtration plants and start-up of

Torto dam and raising of Itabiruçu dam

▪ S11D capacity/performance, licensing in

Serra Norte and Gelado project

Capanema project

Long term

▪ Production flexibility in Northern System

Logistics expansion in Northern System

Capacity

buffer

Nickel (kt)

175-190

M

2022

200-220

Medium term Long term

Medium term

▪ Stable production at North Atlantic and

new projects (VBME, CCM 1 and Victor).

Onça Puma stabilization

▪ PTVI furnace rebuild

Onça Puma 2nd furnace

Long term

▪ Extensive drilling program in Canada and

optionality in Indonesia

Copper (kt)

330-355

2022

■

Large resource base

Green portfolio

390-420

Medium term

Cost competitive

Growth opportunities

900

Long term

Medium term

▪ Stable production at North Atlantic mines

▪ Salobo III start-up in 2H22

Long term

▪ Growth optionalities in Carajás region (e.g.

Alemão, South Hub extension, North Hub

extension Salobo IV)

Hu'u development in Indonesia

VALEView entire presentation