PJT Partners Investment Banking Pitch Book

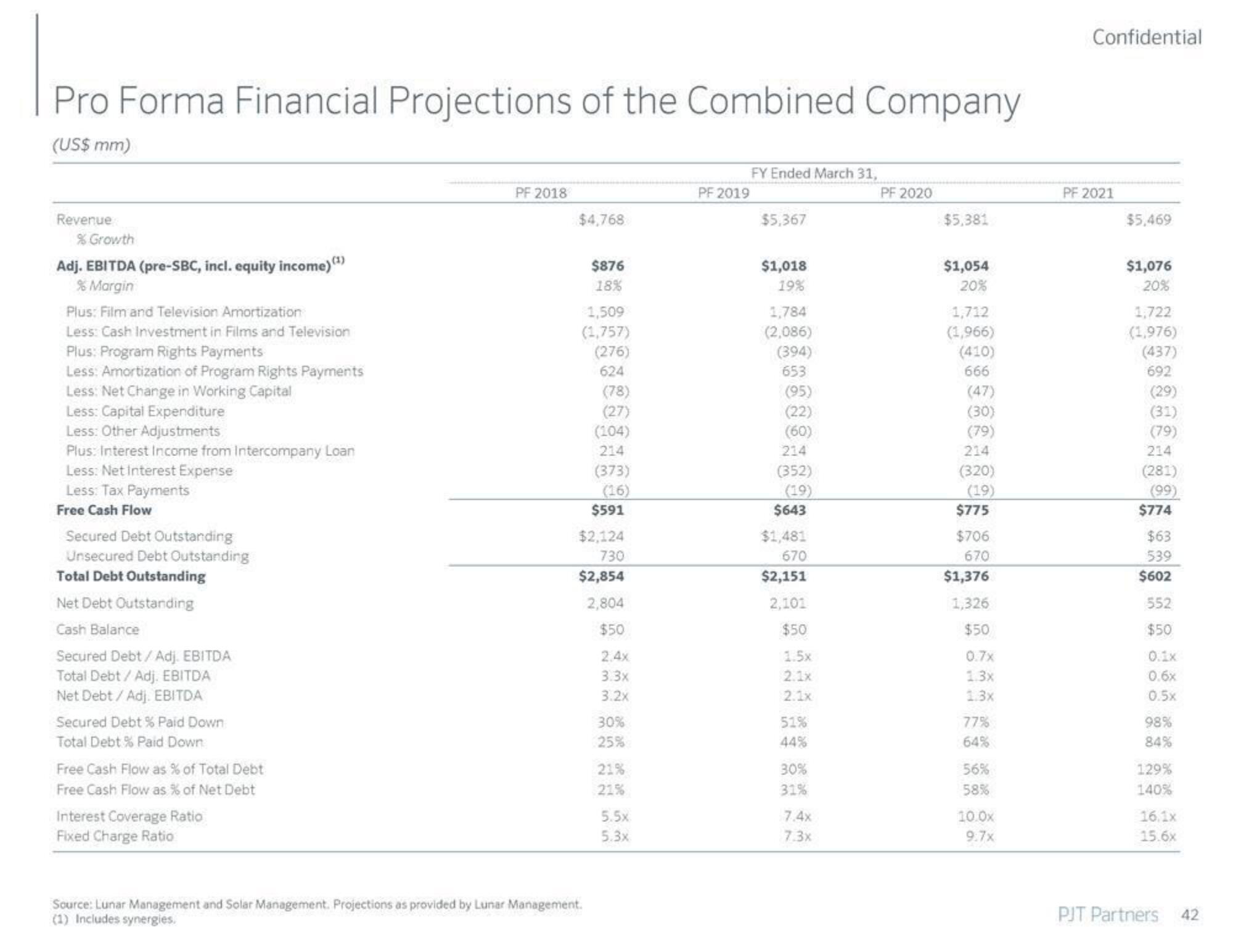

Pro Forma Financial Projections of the Combined Company

(US$ mm)

Revenue

% Growth

Adj. EBITDA (pre-SBC, incl. equity income) (¹)

% Margin

Plus: Film and Television Amortization

Less: Cash Investment in Films and Television

Plus: Program Rights Payments

Less: Amortization of Program Rights Payments

Less: Net Change in Working Capital

Less: Capital Expenditure

Less: Other Adjustments

Plus: Interest Income from Intercompany Loan

Less: Net Interest Expense

Less: Tax Payments

Free Cash Flow

Secured Debt Outstanding

Unsecured Debt Outstanding

Total Debt Outstanding

Net Debt Outstanding

Cash Balance

Secured Debt / Adj. EBITDA

Total Debt / Adj. EBITDA

Net Debt / Adj. EBITDA

Secured Debt % Paid Down

Total Debt % Paid Down

Free Cash Flow as % of Total Debt

Free Cash Flow as % of Net Debt

Interest Coverage Ratio

Fixed Charge Ratio

PF 2018

$4,768

$876

18%

1,509

(1,757)

(276)

624

Source: Lunar Management and Solar Management. Projections as provided by Lunar Management.

(1) Includes synergies.

(78)

(27)

(104)

214

(373)

(16)

$591

$2,124

730

$2,854

2,804

$50

2.4x

3.3x

3.2x

30%

25%

21%

21%

5.5x

5.3x

PF 2019

FY Ended March 31,

$5,367

$1,018

19%

1,784

(2,086)

(394)

653

(95)

(22)

(60)

214

(352)

(19)

$643

$1,481

670

$2,151

2,101

$50

1.5x

2.1x

2.1x

51%

44%

30%

31%

7.4x

7.3x

PF 2020

$5,381

$1,054

20%

1,712

(1,966)

(410)

666

(47)

(30)

(79)

214

(320)

(19)

$775

$706

670

$1,376

1,326

$50

0.7x

1.3x

1.3x

77%

64%

56%

58%

10.0x

9.7x

Confidential

PF 2021

$5,469

$1,076

20%

1,722

(1,976)

(437)

692

(29)

(31)

(79)

214

(281)

(99)

$774

$63

539

$602

552

$50

0.6x

0.5x

98%

84%

129%

140%

16.1x

15.6x

PJT Partners

42View entire presentation