AstraZeneca Results Presentation Deck

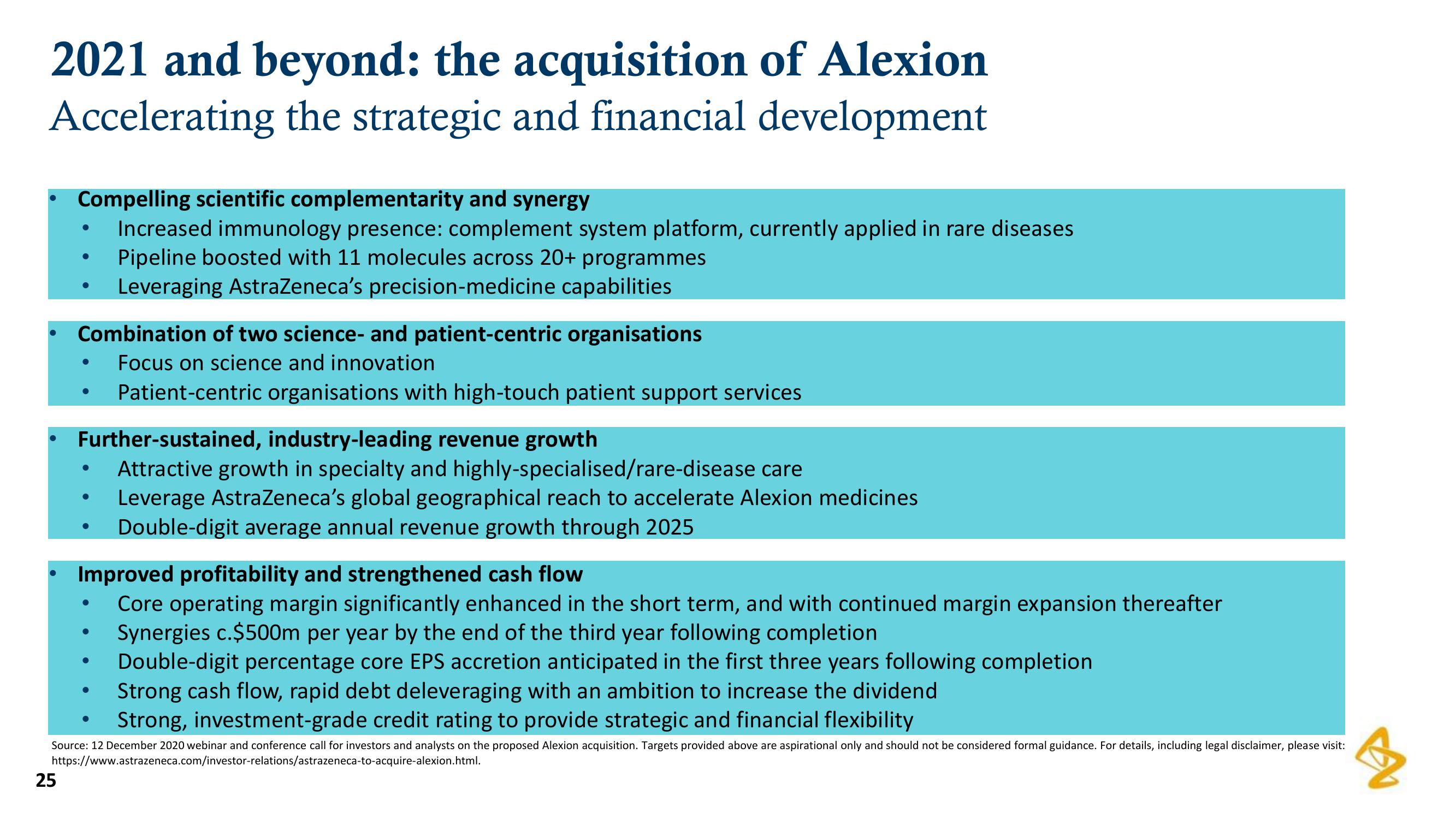

2021 and beyond: the acquisition of Alexion

Accelerating the strategic and financial development

Compelling scientific complementarity and synergy

Increased immunology presence: complement system platform, currently applied in rare diseases

Pipeline boosted with 11 molecules across 20+ programmes

Leveraging AstraZeneca's precision-medicine capabilities

25

●

●

Combination of two science- and patient-centric organisations

Focus on science and innovation

Patient-centric organisations with high-touch patient support services

●

●

Further-sustained, industry-leading revenue growth

Attractive growth in specialty and highly-specialised/rare-disease care

Leverage AstraZeneca's global geographical reach to accelerate Alexion medicines

Double-digit average annual revenue growth through 2025

●

Improved profitability and strengthened cash flow

Core operating margin significantly enhanced in the short term, and with continued margin expansion thereafter

Synergies c.$500m per year by the end of the third year following completion

Double-digit percentage core EPS accretion anticipated in the first three years following completion

Strong cash flow, rapid debt deleveraging with an ambition to increase the dividend

Strong, investment-grade credit rating to provide strategic and financial flexibility

Source: 12 December 2020 webinar and conference call for investors and analysts on the proposed Alexion acquisition. Targets provided above are aspirational only and should not be considered formal guidance. For details, including legal disclaimer, please visit:

https://www.astrazeneca.com/investor-relations/astrazeneca-to-acquire-alexion.html.

B

●

●

●View entire presentation