Trian Partners Activist Presentation Deck

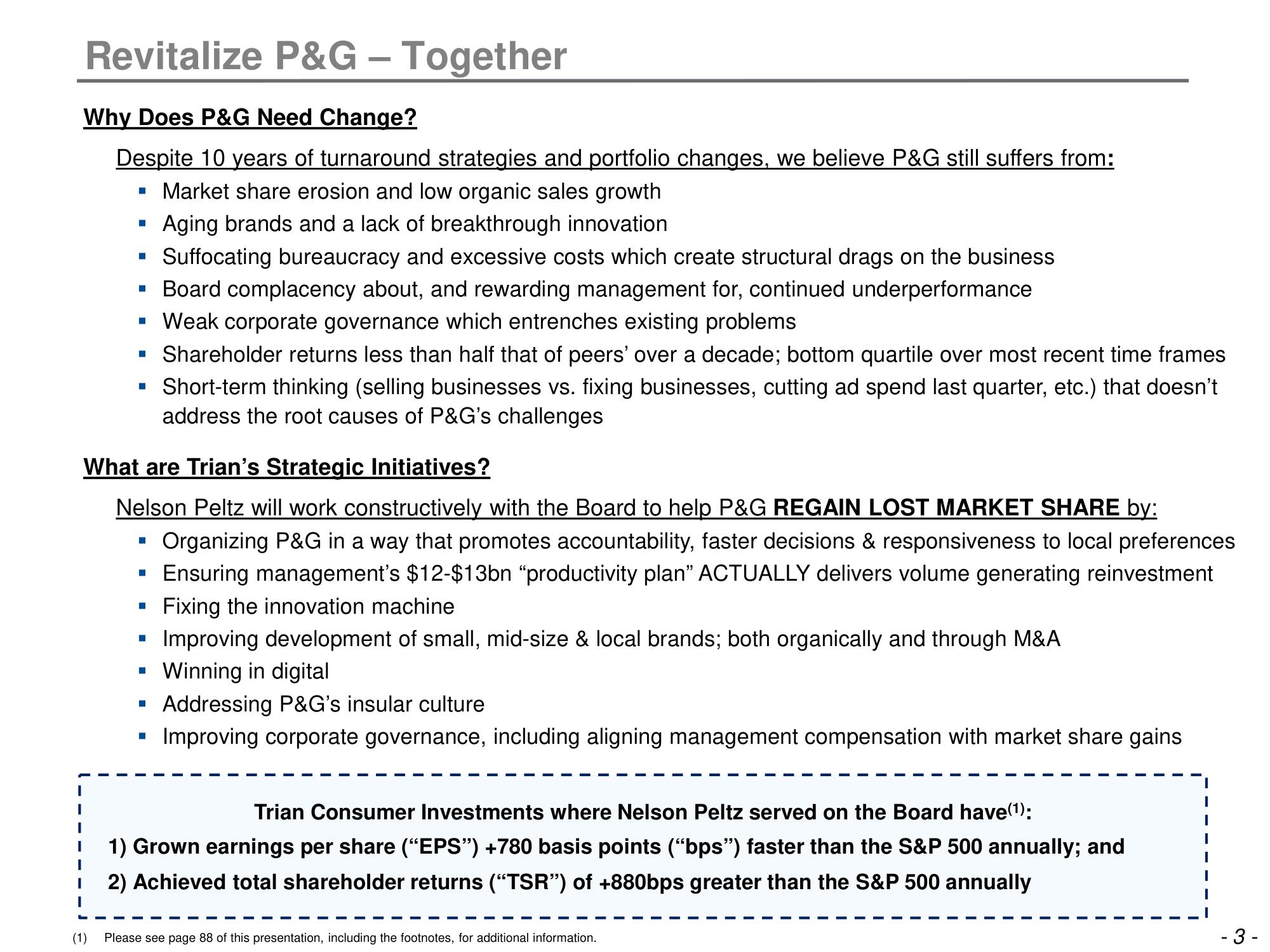

Revitalize P&G - Together

Why Does P&G Need Change?

Despite 10 years of turnaround strategies and portfolio changes, we believe P&G still suffers from:

▪ Market share erosion and low organic sales growth

Aging brands and a lack of breakthrough innovation

Suffocating bureaucracy and excessive costs which create structural drags on the business

▪ Board complacency about, and rewarding management for, continued underperformance

▪ Weak corporate governance which entrenches existing problems

▪ Shareholder returns less than half that of peers' over a decade; bottom quartile over most recent time frames

Short-term thinking (selling businesses vs. fixing businesses, cutting ad spend last quarter, etc.) that doesn't

address the root causes of P&G's challenges

I

(1)

■

What are Trian's Strategic Initiatives?

Nelson Peltz will work constructively with the Board to help P&G REGAIN LOST MARKET SHARE by:

Organizing P&G in a way that promotes accountability, faster decisions & responsiveness to local preferences

Ensuring management's $12-$13bn "productivity plan" ACTUALLY delivers volume generating reinvestment

Fixing the innovation machine

■

I

■

Improving development of small, mid-size & local brands; both organically and through M&A

Winning in digital

Addressing P&G's insular culture

Improving corporate governance, including aligning management compensation with market share gains

Trian Consumer Investments where Nelson Peltz served on the Board have(¹):

1) Grown earnings per share (“EPS”) +780 basis points ("bps") faster than the S&P 500 annually; and

2) Achieved total shareholder returns ("TSR") of +880bps greater than the S&P 500 annually

Please see page 88 of this presentation, including the footnotes, for additional information.

- 3-View entire presentation