Cameco IPO Presentation Deck

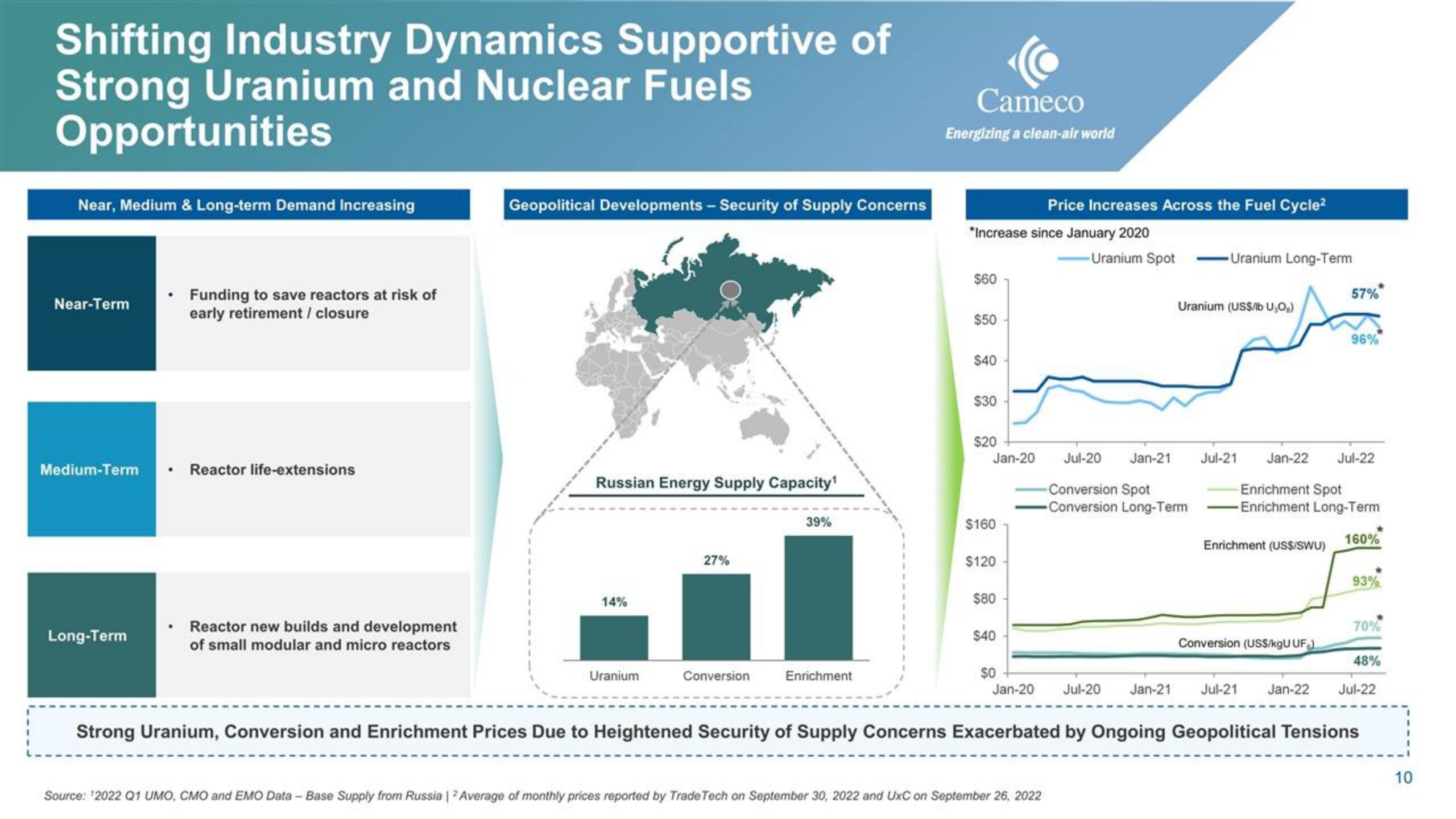

Shifting Industry Dynamics Supportive of

Strong Uranium and Nuclear Fuels

Opportunities

Near, Medium & Long-term Demand Increasing

Near-Term

• Funding to save reactors at risk of

early retirement / closure

Medium-Term • Reactor life-extensions

Long-Term

Reactor new builds and development

of small modular and micro reactors

Geopolitical Developments - Security of Supply Concerns

Russian Energy Supply Capacity¹

14%

Uranium

27%

Conversion

39%

Enrichment

Cameco

Energizing a clean-air world

*Increase since January 2020

$60

$50

$40

$30

$20

Jan-20

$160

$120

$80

$40

$0

Jan-20

Price Increases Across the Fuel Cycle²

Source: ¹2022 Q1 UMO, CMO and EMO Data - Base Supply from Russia | 2 Average of monthly prices reported by TradeTech on September 30, 2022 and UxC on September 26, 2022

- Uranium Spot

-Uranium Long-Term

Uranium (US$/b U₂0,)

Jul-20 Jan-21

-Conversion Spot

-Conversion Long-Term

Jul-21

Jan-22

Enrichment (US$/SWU)

57%

Conversion (US$/kgU UF)

96%

Enrichment Spot

Enrichment Long-Term

Jul-22

160%

93%

70%

48%

Jul-20 Jan-21 Jul-21 Jan-22 Jul-22

Strong Uranium, Conversion and Enrichment Prices Due to Heightened Security of Supply Concerns Exacerbated by Ongoing Geopolitical Tensions

10View entire presentation