Deutsche Bank Fixed Income Presentation Deck

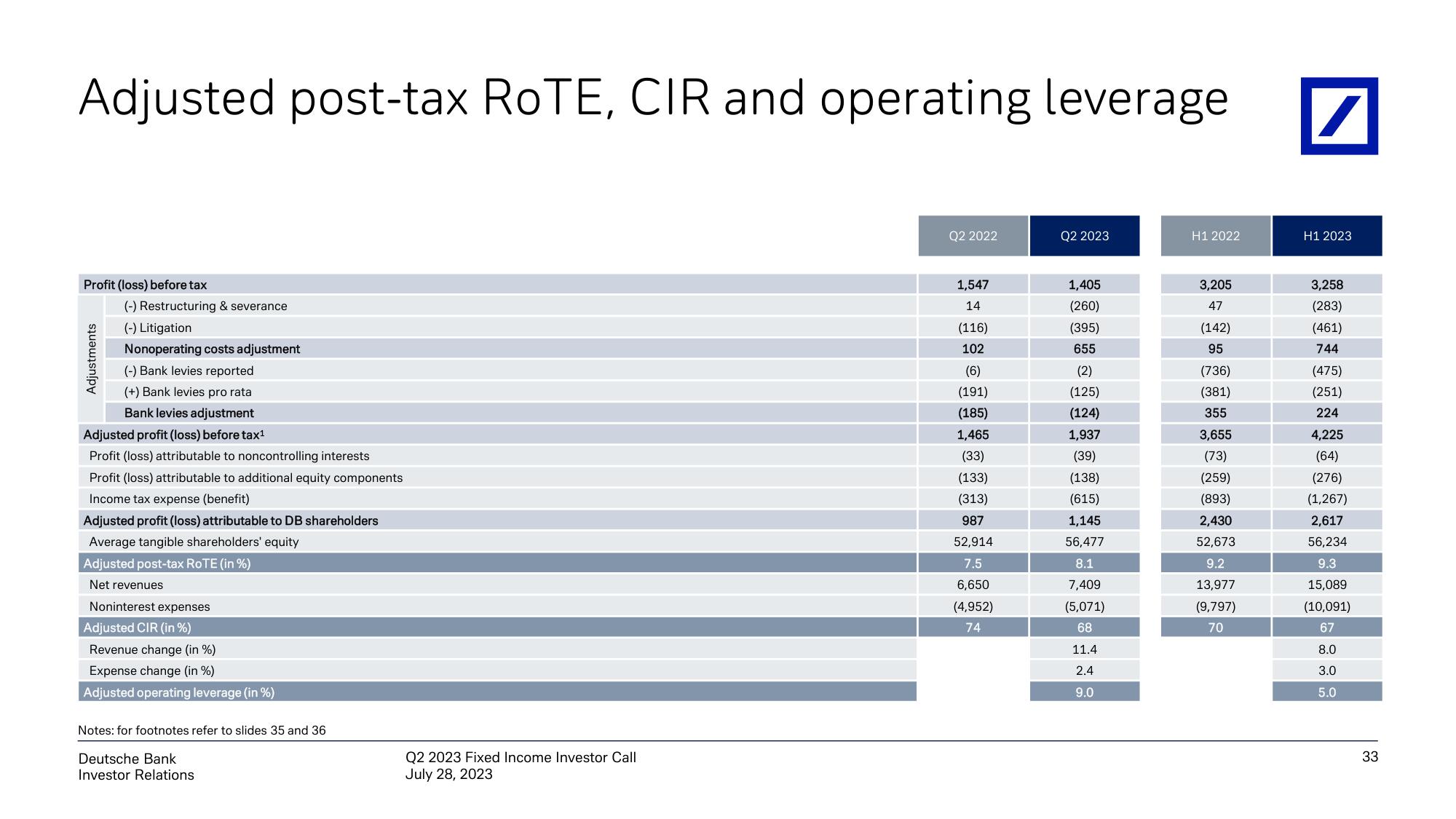

Adjusted post-tax ROTE, CIR and operating leverage

Profit (loss) before tax

(-) Restructuring & severance

(-) Litigation

Nonoperating costs adjustment

(-) Bank levies reported

(+) Bank levies pro rata

Bank levies adjustment

Adjusted profit (loss) before tax¹

Profit (loss) attributable to noncontrolling interests

Profit (loss) attributable to additional equity components

Income tax expense (benefit)

Adjusted profit (loss) attributable to DB shareholders

Average tangible shareholders' equity

Adjusted post-tax ROTE (in %)

Net revenues

Adjustments

Noninterest expenses

Adjusted CIR (in %)

Revenue change (in %)

Expense change (in %)

Adjusted operating leverage (in %)

Notes: for footnotes refer to slides 35 and 36

Deutsche Bank

Investor Relations

Q2 2023 Fixed Income Investor Call

July 28, 2023

Q2 2022

1,547

14

(116)

102

(6)

(191)

(185)

1,465

(33)

(133)

(313)

987

52,914

7.5

6,650

(4,952)

74

Q2 2023

1,405

(260)

(395)

655

(2)

(125)

(124)

1,937

(39)

(138)

(615)

1,145

56,477

8.1

7,409

(5,071)

68

11.4

2.4

9.0

H1 2022

3,205

47

(142)

95

(736)

(381)

355

3,655

(73)

(259)

(893)

2,430

52,673

9.2

13,977

(9,797)

70

/

H1 2023

3,258

(283)

(461)

744

(475)

(251)

224

4,225

(64)

(276)

(1,267)

2,617

56,234

9.3

15,089

(10,091)

67

8.0

3.0

5.0

33View entire presentation