Credit Suisse Results Presentation Deck

Wealth Management

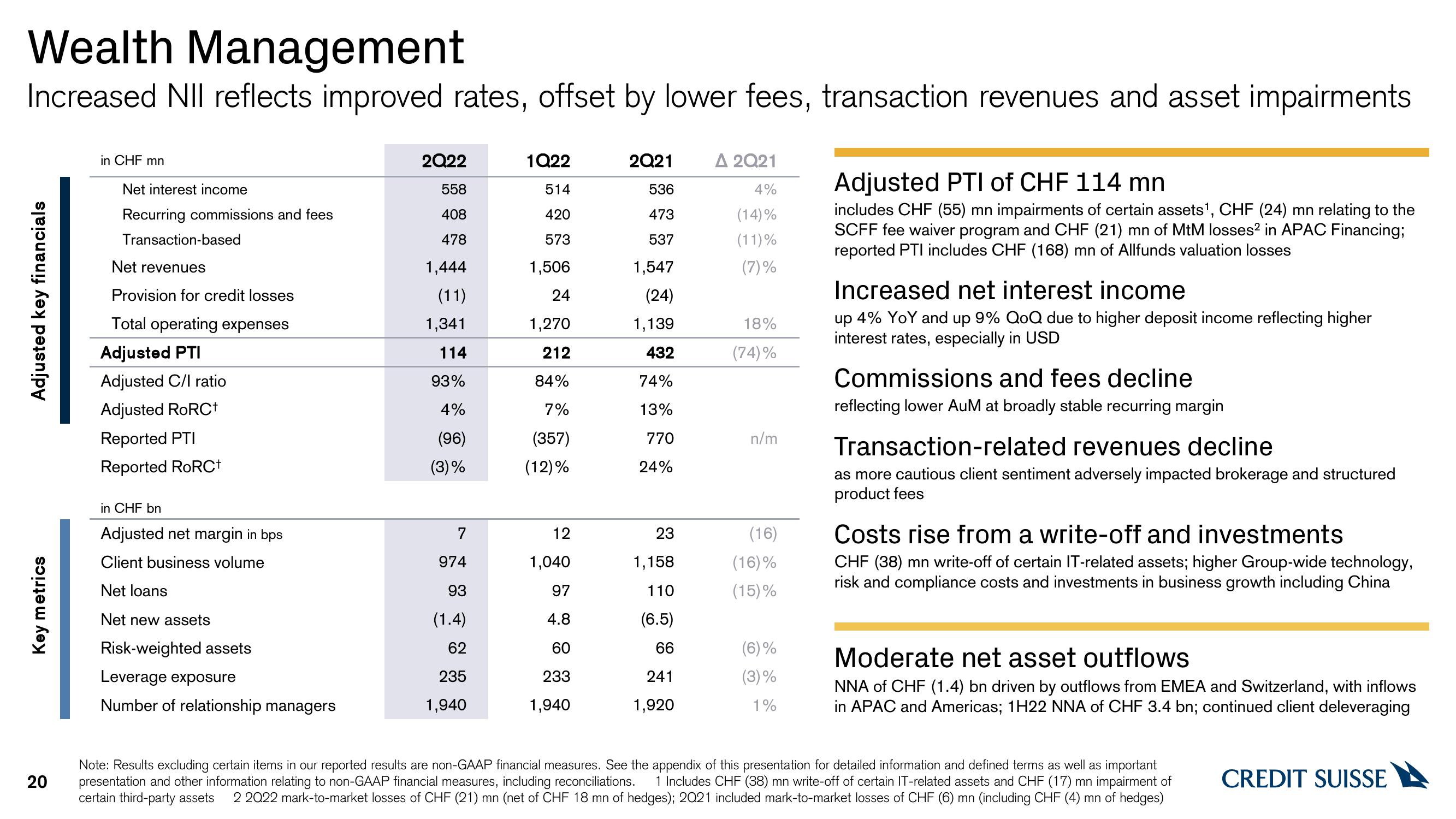

Increased NII reflects improved rates, offset by lower fees, transaction revenues and asset impairments

Adjusted key financials

Key metrics

20

in CHF mn

Net interest income

Recurring commissions and fees

Transaction-based

Net revenues

Provision for credit losses

Total operating expenses

Adjusted PTI

Adjusted C/I ratio

Adjusted RoRC+

Reported PTI

Reported RoRCt

in CHF bn

Adjusted net margin in bps

Client business volume

Net loans

Net new assets

Risk-weighted assets

Leverage exposure

Number of relationship managers

2Q22

558

408

478

1,444

(11)

1,341

114

93%

4%

(96)

(3)%

7

974

93

(1.4)

62

235

1,940

1Q22

514

420

573

1,506

24

1,270

212

84%

7%

(357)

(12)%

12

1,040

97

4.8

60

233

1,940

2Q21 Δ 2021

536

4%

473

(14)%

537

(11)%

(7)%

1,547

(24)

1,139

432

74%

13%

770

24%

23

1,158

110

(6.5)

66

241

1,920

18%

(74)%

n/m

(16)

(16)%

(15)%

(6)%

(3)%

1%

Adjusted PTI of CHF 114 mn

includes CHF (55) mn impairments of certain assets¹, CHF (24) mn relating to the

SCFF fee waiver program and CHF (21) mn of MtM losses² in APAC Financing;

reported PTI includes CHF (168) mn of Allfunds valuation losses

Increased net interest income

up 4% YoY and up 9% QoQ due to higher deposit income reflecting higher

interest rates, especially in USD

Commissions and fees decline

reflecting lower AuM at broadly stable recurring margin

Transaction-related revenues decline

as more cautious client sentiment adversely impacted brokerage and structured

product fees

Costs rise from a write-off and investments

CHF (38) mn write-off of certain IT-related assets; higher Group-wide technology,

risk and compliance costs and investments in business growth including China

Moderate net asset outflows

NNA of CHF (1.4) bn driven by outflows from EMEA and Switzerland, with inflows

in APAC and Americas; 1H22 NNA of CHF 3.4 bn; continued client deleveraging

Note: Results excluding certain items in our reported results are non-GAAP financial measures. See the appendix of this presentation for detailed information and defined terms as well as important

presentation and other information relating to non-GAAP financial measures, including reconciliations. 1 Includes CHF (38) mn write-off of certain IT-related assets and CHF (17) mn impairment of

certain third-party assets 2 2022 mark-to-market losses of CHF (21) mn (net of CHF 18 mn of hedges); 2021 included mark-to-market losses of CHF (6) mn (including CHF (4) mn of hedges)

CREDIT SUISSEView entire presentation