Evercore Investment Banking Pitch Book

Preliminary Situation Assessment

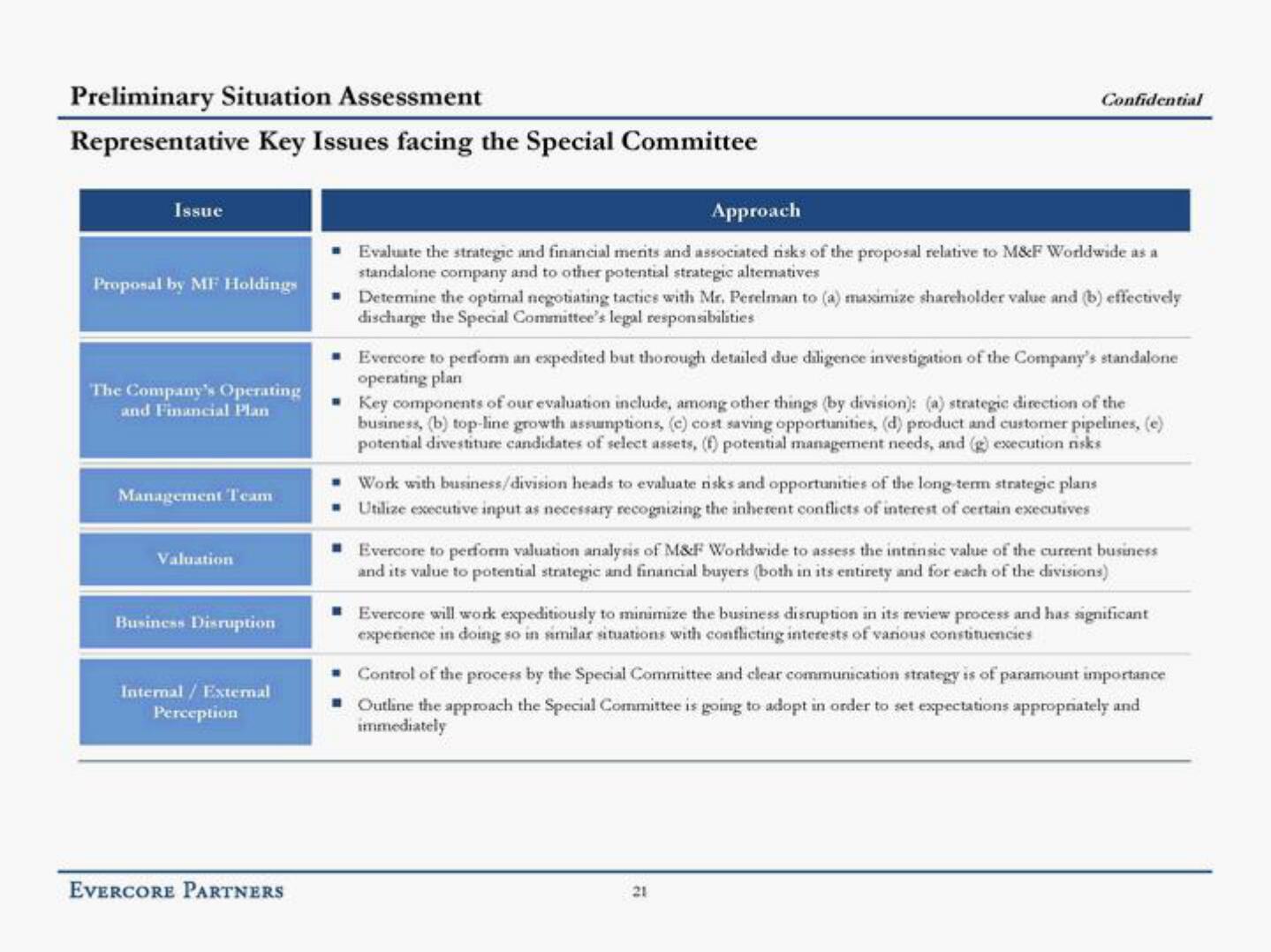

Representative Key Issues facing the Special Committee

Issue

Proposal by MF Holdings

The Company's Operating

and Financial Plan

Management Team

Valuation

Business Disruption

Internal / External

Perception

EVERCORE PARTNERS

▪

Approach

Evaluate the strategic and financial ments and associated risks of the proposal relative to M&F Worldwide as a

standalone company and to other potential strategic altematives

Confidential

Determine the optimal negotiating tactics with Mr. Perelman to (a) maximize shareholder value and (b) effectively

discharge the Special Committee's legal responsibilities

■

Evercore to perform an expedited but thorough detailed due diligence investigation of the Company's standalone

operating plan

Key components of our evaluation include, among other things (by division): (a) strategic direction of the

business, (b) top-line growth assumptions, (c) cost saving opportunities, (d) product and customer pipelines, (e)

potential divestiture candidates of select assets, (f) potential management needs, and (g) execution risks

■ Work with business/division heads to evaluate risks and opportunities of the long-term strategic plans

Utilize executive input as necessary recognizing the inherent conflicts of interest of certain executives

Evercore to perform valuation analysis of M&F Worldwide to assess the intrinsic value of the current business

and its value to potential strategic and financial buyers (both in its entirety and for each of the divisions)

Evercore will work expeditiously to minimize the business disruption in its review process and has significant

experience in doing so in similar situations with conflicting interests of various constituencies

Control of the process by the Special Committee and clear communication strategy is of paramount importance

Outline the approach the Special Committee is going to adopt in order to set expectations appropriately and

immediately

21View entire presentation