Bridge Investment Group Results Presentation Deck

Appendix

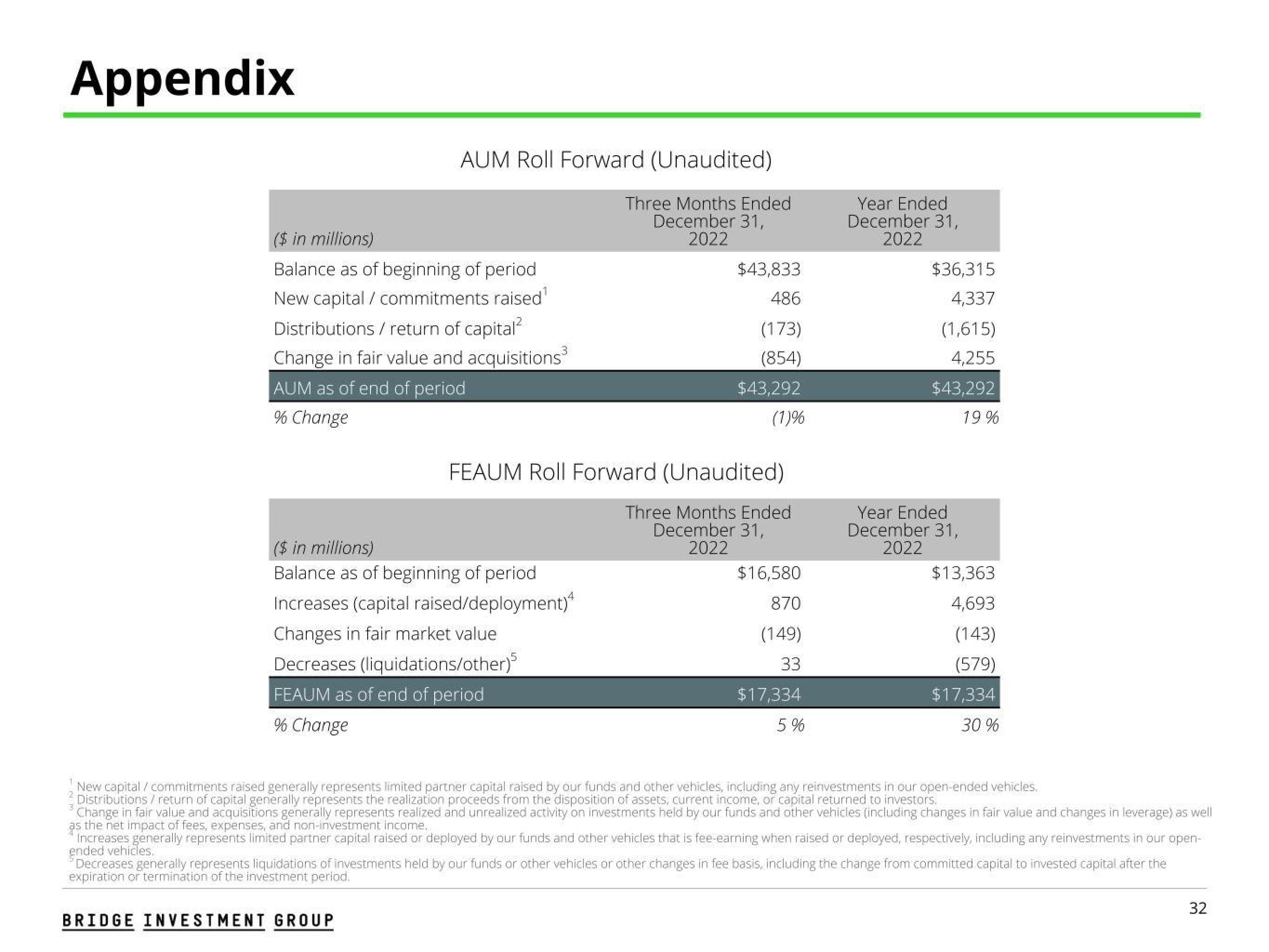

AUM Roll Forward (Unaudited)

Three Months Ended

December 31,

2022

($ in millions)

Balance as of beginning of period

New capital / commitments raised¹

Distributions / return of capital²

Change in fair value and acquisitions³

AUM as of end of period

% Change

($ in millions)

Balance as of beginning of period

FEAUM Roll Forward (Unaudited)

Three Months Ended

December 31,

2022

Increases (capital raised/deployment)

Changes in fair market value

Decreases (liquidations/other)

FEAUM as of end of period

% Change

$43,833

486

(173)

(854)

$43,292

(1)%

BRIDGE INVESTMENT GROUP

$16,580

870

(149)

33

$17,334

5%

Year Ended

December 31,

2022

$36,315

4,337

(1,615)

4,255

$43,292

19%

Year Ended

December 31,

2022

$13,363

4,693

(143)

(579)

$17,334

30 %

New capital / commitments raised generally represents limited partner capital raised by our funds and other vehicles, including any reinvestments in our open-ended vehicles.

Distributions / return of capital generally represents the realization proceeds from the disposition of assets, current income, or capital returned to investors.

Change in fair value and acquisitions generally represents realized and unrealized activity on investments held by our funds and other vehicles (including changes in fair value and changes in leverage) as well

as the net impact of fees, expenses, and non-investment income.

Increases generally represents limited partner capital raised or deployed by our funds and other vehicles that is fee-earning when raised or deployed, respectively, including any reinvestments in our open-

ended vehicles.

Decreases generally represents liquidations of investments held by our funds or other vehicles or other changes in fee basis, including the change from committed capital to invested capital after the

expiration or termination of the investment period.

32View entire presentation