Uber Investor Presentation Deck

Adjusted EBITDA

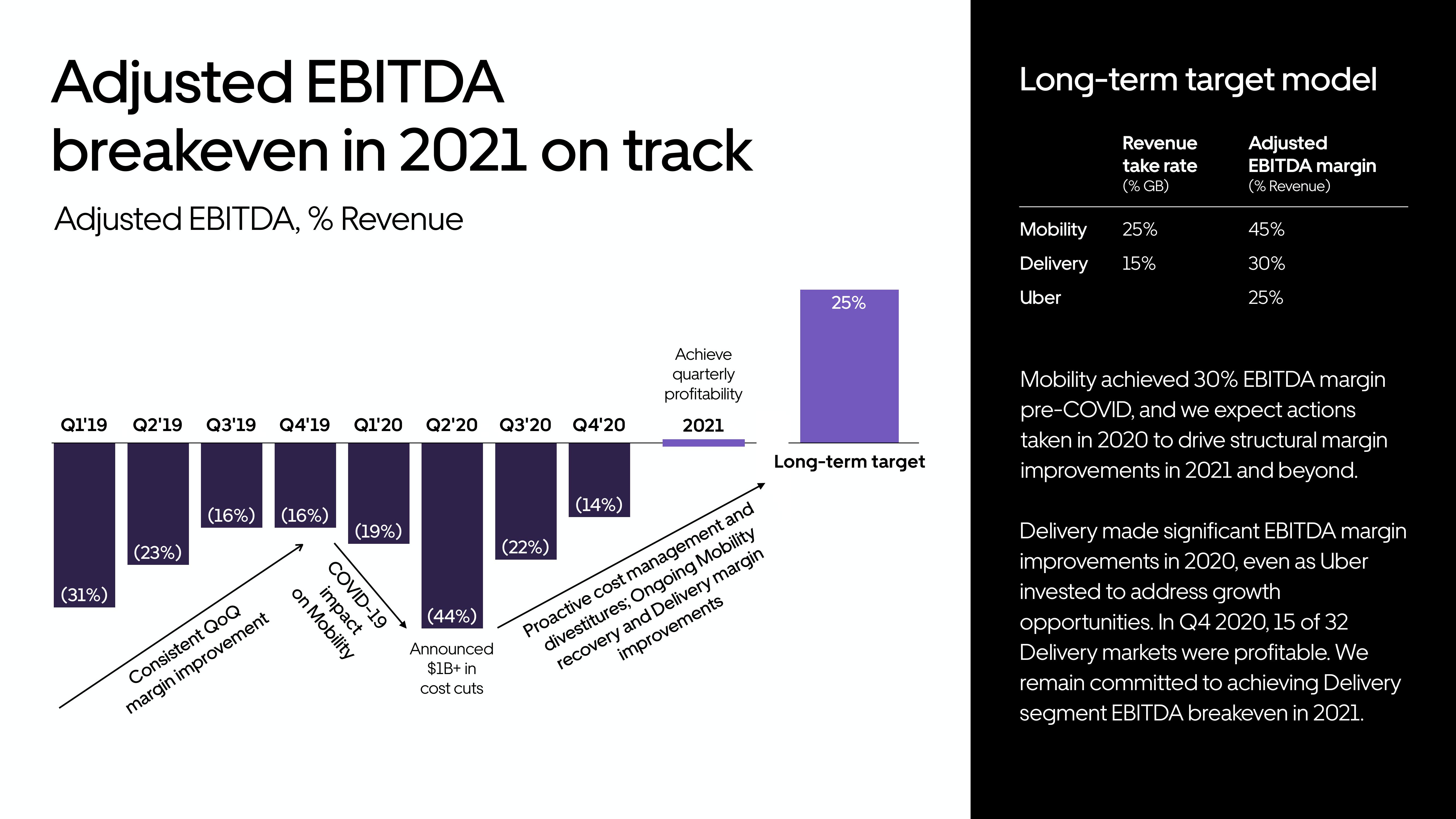

breakeven in 2021 on track

Adjusted EBITDA, % Revenue

Q1'19 Q2'19 Q3'19 Q4'19 Q1'20 Q2'20 Q3'20 Q4'20

(31%)

(23%)

(16%) (16%)

Consistent QoQ

margin improvement

on Mobility

impact

COVID-19

(19%)

(44%)

Announced

$1B+ in

cost cuts

(22%)

(14%)

Achieve

quarterly

profitability

2021

25%

Long-term target

Proactive cost management and

divestitures; Ongoing Mobility

improvements

recovery and Delivery margin

Long-term target model

Adjusted

EBITDA margin

(% Revenue)

Revenue

take rate

(% GB)

Mobility 25%

15%

Delivery

Uber

45%

30%

25%

Mobility achieved 30% EBITDA margin

pre-COVID, and we expect actions

taken in 2020 to drive structural margin

improvements in 2021 and beyond.

Delivery made significant EBITDA margin

improvements in 2020, even as Uber

invested to address growth

opportunities. In Q4 2020, 15 of 32

Delivery markets were profitable. We

remain committed to achieving Delivery

segment EBITDA breakeven in 2021.View entire presentation