Ready Capital Investor Presentation Deck

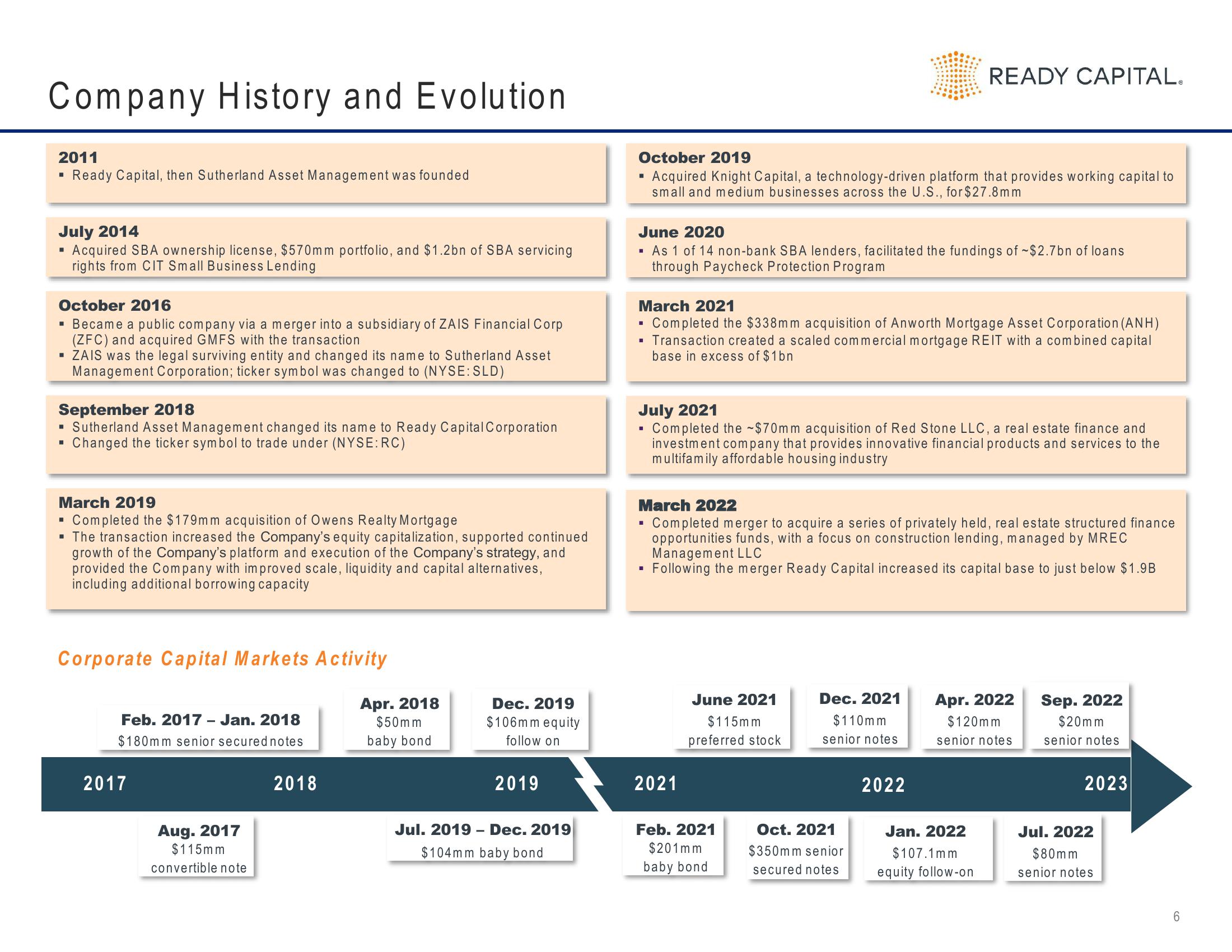

Company History and Evolution

2011

Ready Capital, then Sutherland Asset Management was founded

■

July 2014

Acquired SBA ownership license, $570mm portfolio, and $1.2bn of SBA servicing

rights from CIT Small Business Lending

■

October 2016

Became a public company via a merger into a subsidiary of ZAIS Financial Corp

(ZFC) and acquired GMFS with the transaction

■

▪ ZAIS was the legal surviving entity and changed its name to Sutherland Asset

Management Corporation; ticker symbol was changed to (NYSE: SLD)

September 2018

▪ Sutherland Asset Management changed its name to Ready Capital Corporation

Changed the ticker symbol to trade under (NYSE: RC)

■

March 2019

Completed the $179mm acquisition of Owens Realty Mortgage

▪ The transaction increased the Company's equity capitalization, supported continued

growth of the Company's platform and execution of the Company's strategy, and

provided the Company with improved scale, liquidity and capital alternatives,

including additional borrowing capacity

■

Corporate Capital Markets Activity

Feb. 2017 - Jan. 2018

$180mm senior secured notes

2017

Aug. 2017

$115mm

convertible note

2018

Apr. 2018

$50mm

baby bond

Dec. 2019

$106mm equity

follow on

2019

Jul. 2019 Dec. 2019

$104mm baby bond

October 2019

Acquired Knight Capital, a technology-driven platform that provides working capital to

small and medium businesses across the U.S., for $27.8mm

June 2020

As 1 of 14 non-bank SBA lenders, facilitated the fundings of ~$2.7bn of loans

through Paycheck Protection Program

March 2021

Completed the $338mm acquisition of Anworth Mortgage Asset Corporation (ANH)

▪ Transaction created a scaled commercial mortgage REIT with a combined capital

base in excess of $1bn

July 2021

Completed the $70mm acquisition of Red Stone LLC, a real estate finance and

investment company that provides innovative financial products and services to the

multifamily affordable housing industry

March 2022

Completed merger to acquire a series of privately held, real estate structured finance

opportunities funds, with a focus on construction lending, managed by MREC

Management LLC

Following the merger Ready Capital increased its capital base to just below $1.9B

2021

June 2021

$115mm

preferred stock

READY CAPITAL.

Feb. 2021

$201mm

baby bond

Dec. 2021

110mm

senior notes

Oct. 2021

$350mm senior

secured notes

2022

Apr. 2022

$120mm

senior notes

Jan. 2022

$107.1mm

equity follow-on

Sep. 2022

$20mm

senior notes

2023

Jul. 2022

$80mm

senior notes

6.View entire presentation