FiscalNote Investor Presentation Deck

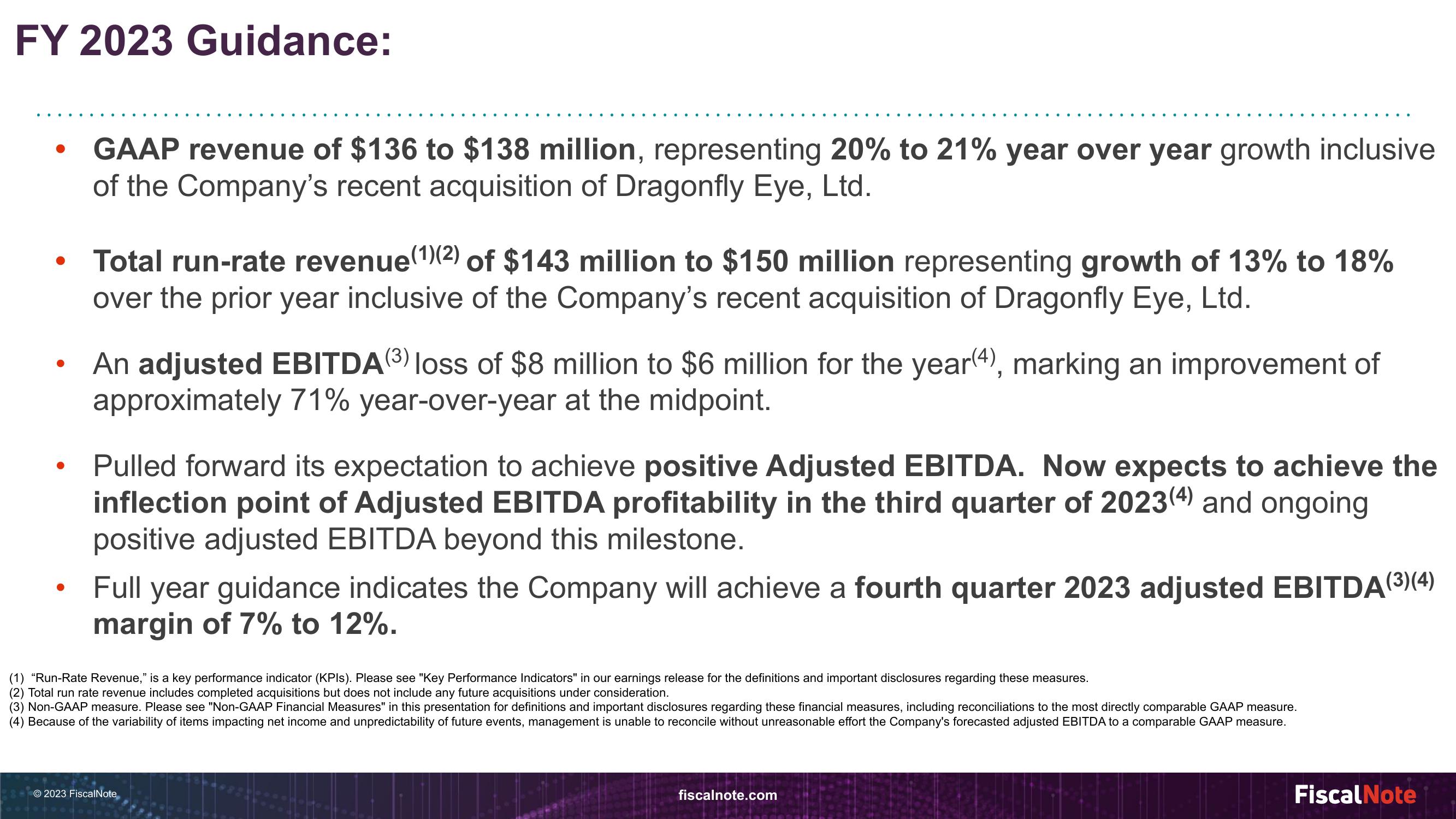

FY 2023 Guidance:

●

●

●

●

GAAP revenue of $136 to $138 million, representing 20% to 21% year over year growth inclusive

of the Company's recent acquisition of Dragonfly Eye, Ltd.

Total run-rate revenue(1)(2) of $143 million to $150 million representing growth of 13% to 18%

over the prior year inclusive of the Company's recent acquisition of Dragonfly Eye, Ltd.

An adjusted EBITDA (3) loss of $8 million to $6 million for the year(4), marking an improvement of

approximately 71% year-over-year at the midpoint.

Pulled forward its expectation to achieve positive Adjusted EBITDA. Now expects to achieve the

inflection point of Adjusted EBITDA profitability in the third quarter of 2023(4) and ongoing

positive adjusted EBITDA beyond this milestone.

Full year guidance indicates the Company will achieve a fourth quarter 2023 adjusted EBITDA (3) (4)

margin of 7% to 12%.

(1) "Run-Rate Revenue," is a key performance indicator (KPIs). Please see "Key Performance Indicators" in our earnings release for the definitions and important disclosures regarding these measures.

(2) Total run rate revenue includes completed acquisitions but does not include any future acquisitions under consideration.

(3) Non-GAAP measure. Please see "Non-GAAP Financial Measures" in this presentation for definitions and important disclosures regarding these financial measures, including reconciliations to the most directly comparable GAAP measure.

(4) Because of the variability of items impacting net income and unpredictability of future events, management is unable to reconcile without unreasonable effort the Company's forecasted adjusted EBITDA to a comparable GAAP measure.

© 2023 FiscalNote

fiscalnote.com

Fiscal NoteView entire presentation