Kore SPAC Presentation Deck

Operational Benchmarking

●

●

Commentary

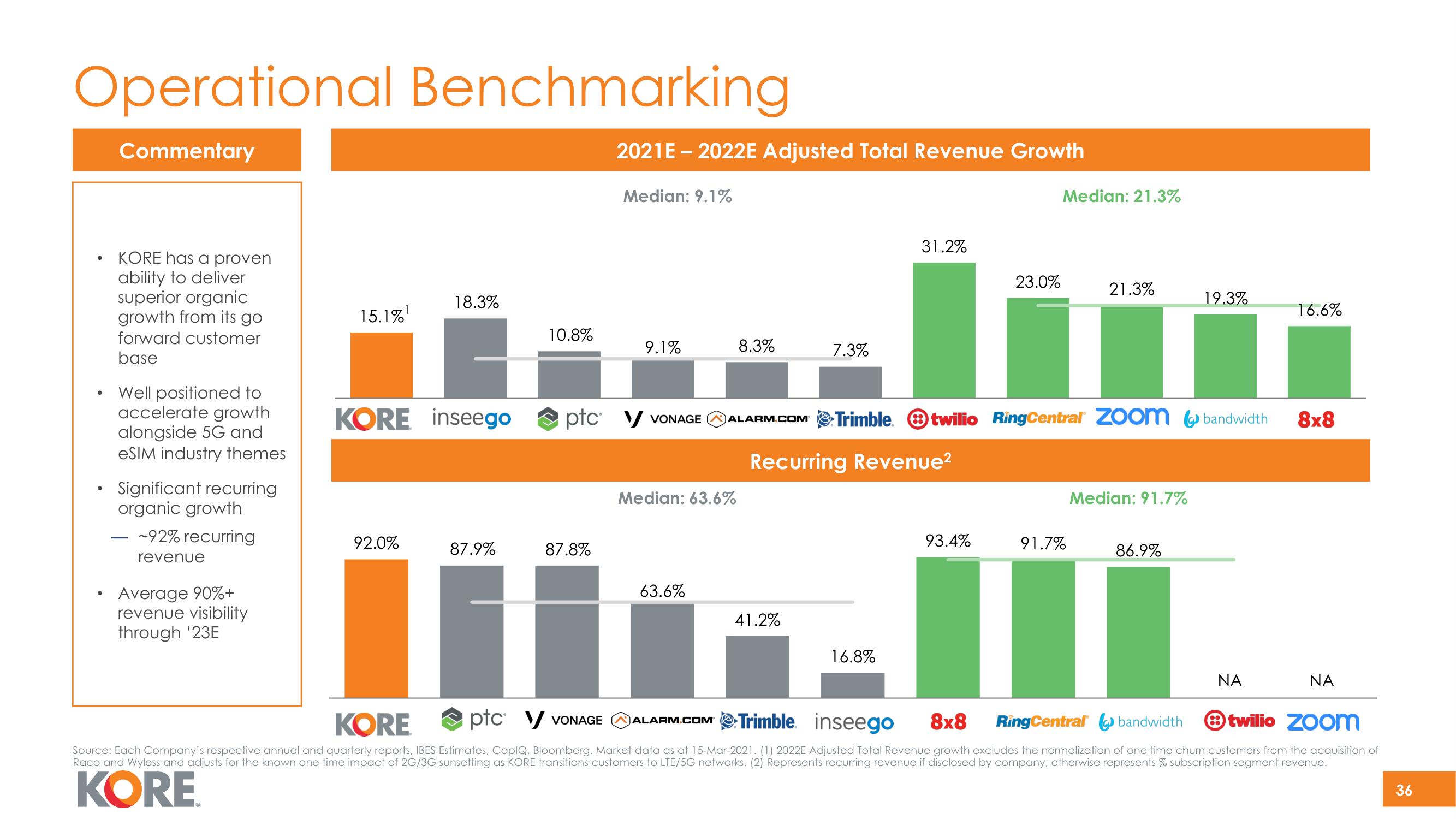

KORE has a proven

ability to deliver

superior organic

growth from its go

forward customer

base

Well positioned to

accelerate growth

alongside 5G and

eSIM industry themes

Significant recurring

organic growth

~92% recurring

revenue

Average 90%+

revenue visibility

through ¹23E

15.1%

1

92.0%

18.3%

KORE inseego

87.9%

10.8%

2021E - 2022E Adjusted Total Revenue Growth

87.8%

Median: 9.1%

9.1%

ptc V VONAGE

Median: 63.6%

63.6%

8.3%

ALARM.COM®

7.3%

41.2%

31.2%

Recurring Revenue²

16.8%

23.0%

93.4%

Median: 21.3%

21.3%

Trimble twilio RingCentral Zoom bandwidth 8x8

Median: 91.7%

91.7%

MI

RingCentral bandwidth

19.3%

86.9%

16.6%

ΝΑ

ΝΑ

KORE

ptc V VONAGE ALARM.COM Trimble inseego 8x8

twilio Zoom

Source: Each Company's respective annual and quarterly reports, IBES Estimates, CapIQ, Bloomberg. Market data as at 15-Mar-2021. (1) 2022E Adjusted Total Revenue growth excludes the normalization of one time churn customers from the acquisition of

Raco and Wyless and adjusts for the known one time impact of 2G/3G sunsetting as KORE transitions customers to LTE/5G networks. (2) Represents recurring revenue if disclosed by company, otherwise represents % subscription segment revenue.

KORE

36View entire presentation