OpenText Investor Presentation Deck

Reconciliation of Selected Non-GAAP Measures | Q1 F21

FOOTNOTES

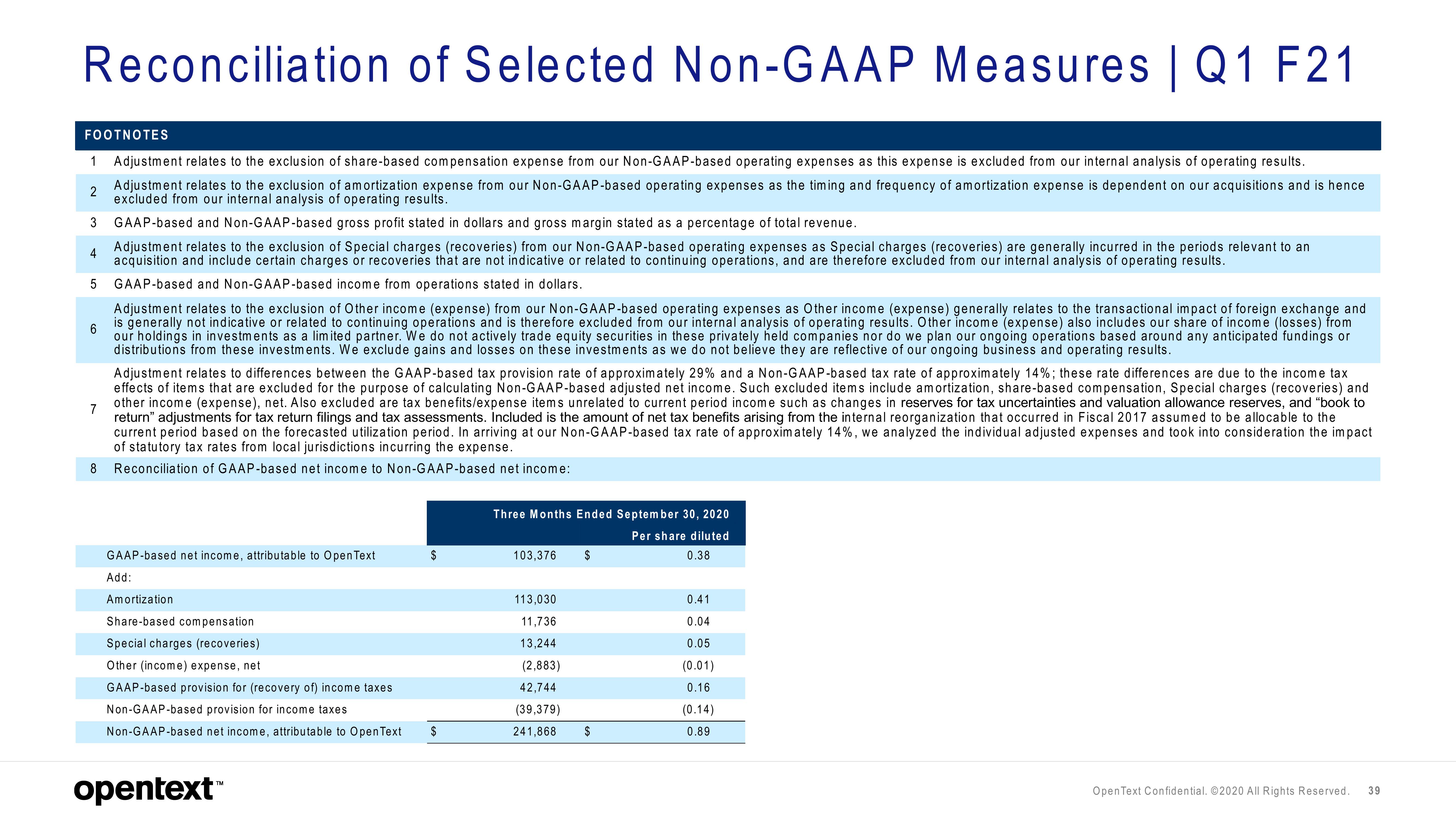

1 Adjustment relates to the exclusion of share-based compensation expense from our Non-GAAP-based operating expenses as this expense is excluded from our internal analysis of operating results.

Adjustment relates to the exclusion of amortization expense from our Non-GAAP-based operating expenses as the timing and frequency of amortization expense is dependent on our acquisitions and is hence

excluded from our internal analysis of operating results.

GAAP-based and Non-GAAP-based gross profit stated in dollars and gross margin stated as a percentage of total revenue.

Adjustment relates to the exclusion of Special charges (recoveries) from our Non-GAAP-based operating expenses as Special charges (recoveries) are generally incurred in the periods relevant to an

acquisition and include certain charges or recoveries that are not indicative or related to continuing operations, and are therefore excluded from our internal analysis of operating results.

GAAP-based and Non-GAAP-based income from operations stated in dollars.

2

3

4

5

6

Adjustment relates to the exclusion of Other income (expense) from our Non-GAAP-based operating expenses as Other income (expense) generally relates to the transactional impact of foreign exchange and

is generally not indicative or related continuing operations and is therefore excluded from our internal analysis of operating results. Other income (expense) also includes our share of income (losses) from

our holdings in investments limited partner. We do not actively trade equity securities in these privately held companies nor do we plan our ongoing operations based around any anticipated fundings

distributions from these investments. We exclude gains and losses on these investments as we do not believe they are reflective of our ongoing business and operating results.

7

8

Adjustment relates to differences between the GAAP-based tax provision rate of approximately 29% and a Non-GAAP-based tax rate of approximately 14%; these rate differences are due to the income tax

effects of items that are excluded for the purpose of calculating Non-GAAP-based adjusted net income. Such excluded items include amortization, share-based compensation, Special charges (recoveries) and

other income (expense), net. Also excluded are tax benefits/expense items unrelated to current period income such as changes in reserves for tax uncertainties and valuation allowance reserves, and "book to

return" adjustments for tax return filings and tax assessments. Included is the amount of net tax benefits arising from the internal reorganization that occurred in Fiscal 2017 assumed to be allocable to the

current period based on the forecasted utilization period. In arriving at our Non-GAAP-based tax rate of approximately 14%, we analyzed the individual adjusted expenses and took into consideration the impact

of statutory tax rates from local jurisdictions incurring the expense.

Reconciliation of GAAP-based net income to Non-GAAP-based net income:

GAAP-based net income, attributable to Open Text

Add:

$

Amortization

Share-based compensation

Special charges (recoveries)

Other (income) expense, net

GAAP-based provision for (recovery of) income taxes

Non-GAAP-based provision for income taxes

Non-GAAP-based net income, attributable to Open Text $

opentext™

Three Months Ended September 30, 2020

Per share diluted

0.38

103,376

113,030

11,736

13,244

(2,883)

42,744

(39,379)

241,868

$

$

0.41

0.04

0.05

(0.01)

0.16

(0.14)

0.89

Open Text Confidential. ©2020 All Rights Reserved. 39View entire presentation