Klaviyo IPO Presentation Deck

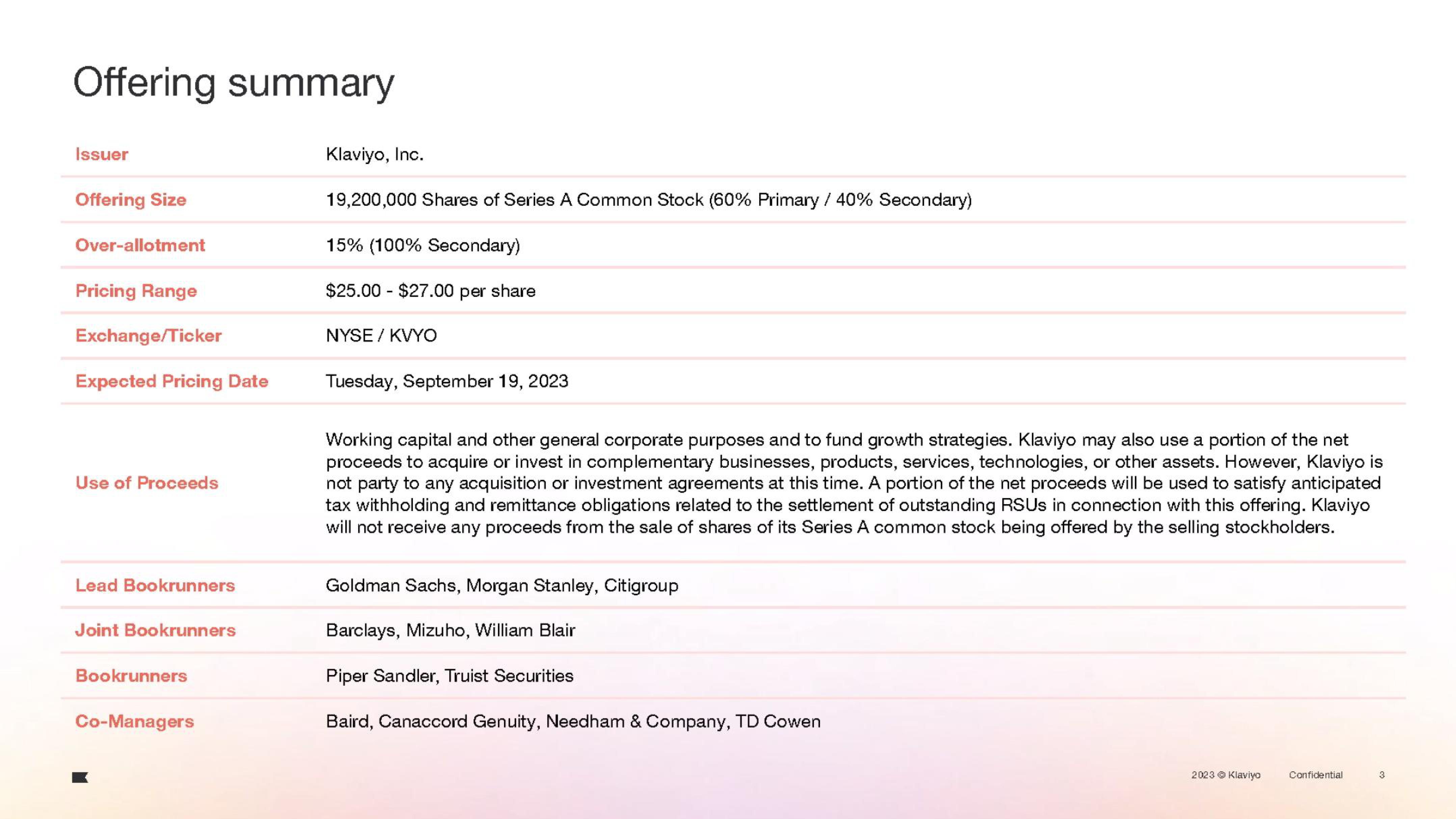

Offering summary

Issuer

Offering Size

Over-allotment

Pricing Range

Exchange/Ticker

Expected Pricing Date

Use of Proceeds

Lead Bookrunners

Joint Bookrunners

Bookrunners

Co-Managers

Klaviyo, Inc.

19,200,000 Shares of Series A Common Stock (60% Primary / 40% Secondary)

15% (100% Secondary)

$25.00 $27.00 per share

NYSE/KVYO

Tuesday, September 19, 2023

Working capital and other general corporate purposes and to fund growth strategies. Klaviyo may also use a portion of the net

proceeds to acquire or invest in complementary businesses, products, services, technologies, or other assets. However, Klaviyo is

not party to any acquisition or investment agreements at this time. A portion of the net proceeds will be used to satisfy anticipated

tax withholding and remittance obligations related to the settlement of outstanding RSUS in connection with this offering. Klaviyo

will not receive any proceeds from the sale of shares of its Series A common stock being offered by the selling stockholders.

Goldman Sachs, Morgan Stanley, Citigroup

Barclays, Mizuho, William Blair

Piper Sandler, Truist Securities

Baird, Canaccord Genuity, Needham & Company, TD Cowen

2023 Ⓒ Klaviyo

Confidential

3View entire presentation