Fort Capital Investment Banking Pitch Book

NAVPS Sensitivity Analysis

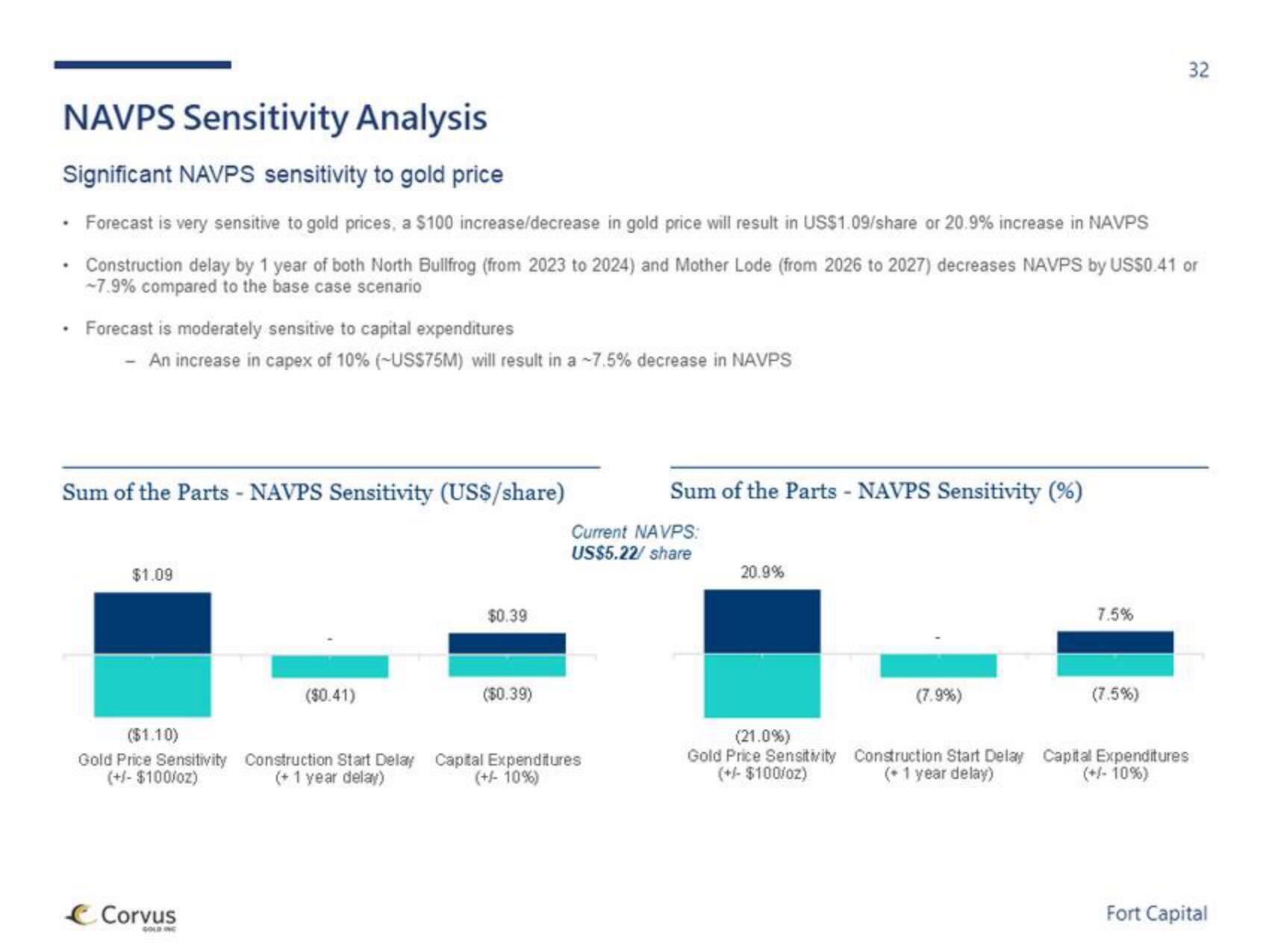

Significant NAVPS sensitivity to gold price

• Forecast is very sensitive to gold prices, a $100 increase/decrease in gold price will result in US$1.09/share or 20.9% increase in NAVPS

• Construction delay by 1 year of both North Bullfrog (from 2023 to 2024) and Mother Lode (from 2026 to 2027) decreases NAVPS by US$0.41 or

-7.9% compared to the base case scenario

Forecast is moderately sensitive to capital expenditures

- An increase in capex of 10% (-US$75M) will result in a -7.5% decrease in NAVPS

Sum of the Parts - NAVPS Sensitivity (US$/share)

$1.09

($1.10)

Gold Price Sensitivity

(+/- $100/oz)

Corvus

($0.41)

Construction Start Delay

(+ 1 year delay)

$0.39

($0.39)

Sum of the Parts - NAVPS Sensitivity (%)

Current NAVPS:

US$5.22/ share

Capital Expenditures

(+/- 10%)

20.9%

(21.0%)

Gold Price Sensitivity

(+/- $100/oz)

(7.9%)

Construction Start Delay

(+ 1 year delay)

7.5%

32

(7.5%)

Capital Expenditures

(+/- 10%)

Fort CapitalView entire presentation