Vista Equity Partners Fund VIII, L.P. Recommendation Report

Hamilton Lane

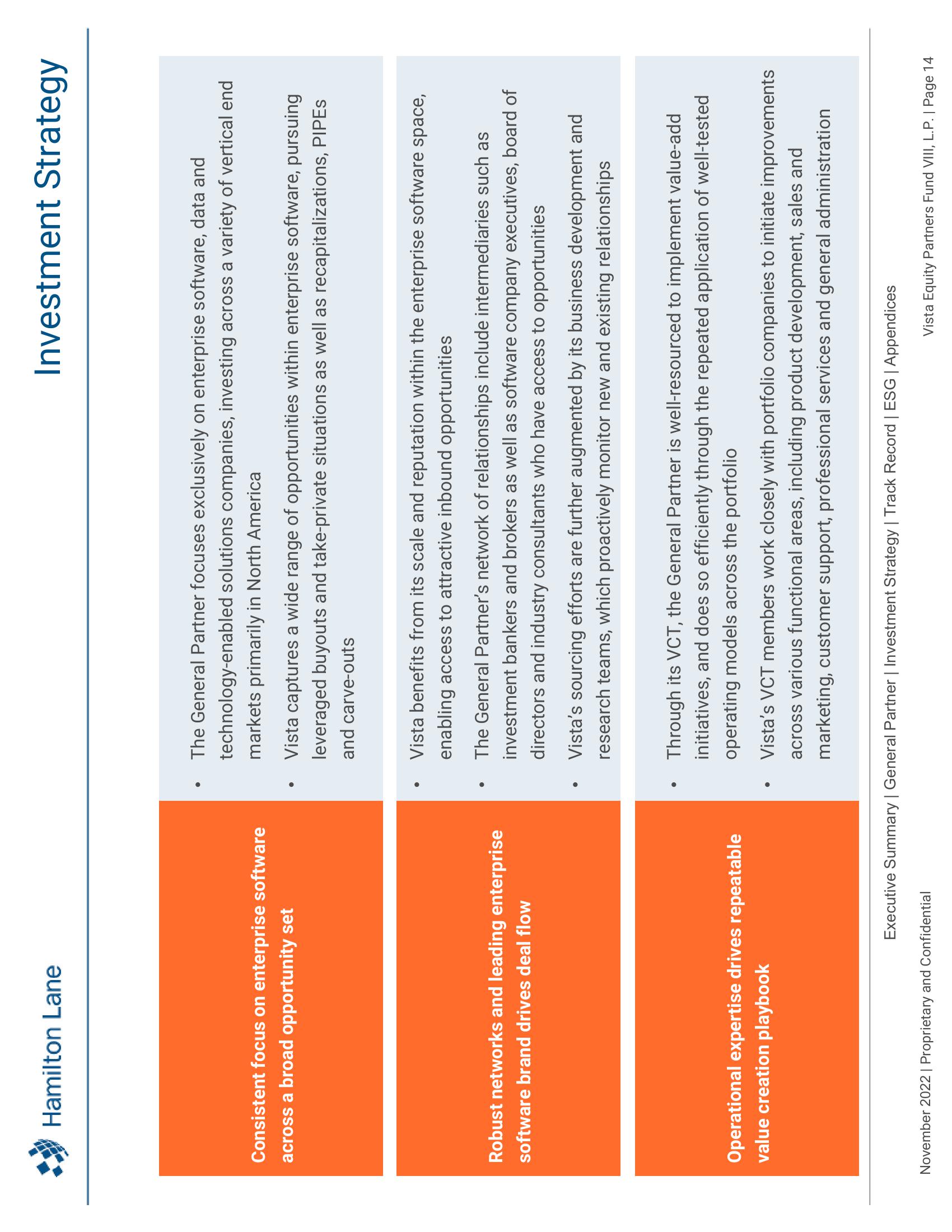

Consistent focus on enterprise software

across a broad opportunity set

Robust networks and leading enterprise

software brand drives deal flow

Operational expertise drives repeatable

value creation playbook

●

November 2022 | Proprietary and Confidential

●

Investment Strategy

The General Partner focuses exclusively on enterprise software, data and

technology-enabled solutions companies, investing across a variety of vertical end

markets primarily in North America

Vista captures a wide range of opportunities within enterprise software, pursuing

leveraged buyouts and take-private situations as well as recapitalizations, PIPES

and carve-outs

Vista benefits from its scale and reputation within the enterprise software space,

enabling access to attractive inbound opportunities

The General Partner's network of relationships include intermediaries such as

investment bankers and brokers as well as software company executives, board of

directors and industry consultants who have access to opportunities

Vista's sourcing efforts are further augmented by its business development and

research teams, which proactively monitor new and existing relationships

Through its VCT, the General Partner is well-resourced to implement value-add

initiatives, and does so efficiently through the repeated application of well-tested

operating models across the portfolio

Vista's VCT members work closely with portfolio companies to initiate improvements

across various functional areas, including product development, sales and

marketing, customer support, professional services and general administration

Executive Summary | General Partner | Investment Strategy | Track Record | ESG | Appendices

Vista Equity Partners Fund VIII, L.P. | Page 14View entire presentation