Citi Investment Banking Pitch Book

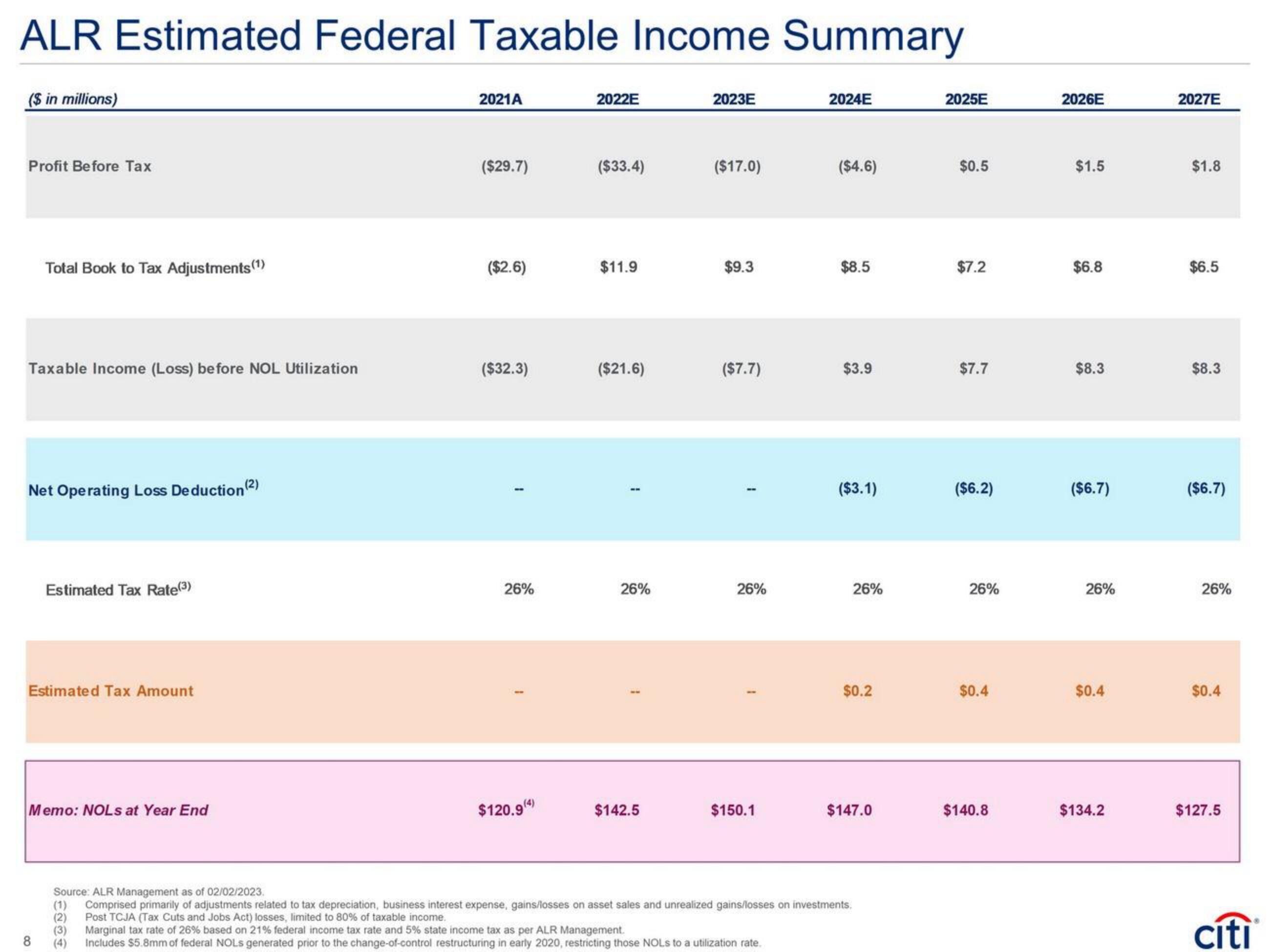

ALR Estimated Federal Taxable Income Summary

($ in millions)

Profit Before Tax

Total Book to Tax Adjustments (1)

Taxable Income (Loss) before NOL Utilization

Net Operating Loss Deduction (2)

Estimated Tax Rate (3)

Estimated Tax Amount

8

Memo: NOLs at Year End

2021A

($29.7)

($2.6)

($32.3)

26%

$120.9(4)

2022E

($33.4)

$11.9

($21.6)

26%

$142.5

2023E

($17.0)

$9.3

($7.7)

26%

$150.1

2024E

Marginal tax rate of 26% based on 21% federal income tax rate and 5% state income tax as per ALR Management.

Includes $5.8mm of federal NOLS generated prior to the change-of-control restructuring in early 2020, restricting those NOLS to a utilization rate.

($4.6)

$8.5

$3.9

($3.1)

26%

$0.2

$147.0

Source: ALR Management as of 02/02/2023.

Comprised primarily of adjustments related to tax depreciation, business interest expense, gains/losses on asset sales and unrealized gains/losses on investments.

(2) Post TCJA (Tax Cuts and Jobs Act) losses, limited to 80% of taxable income.

(3)

2025E

$0.5

$7.2

$7.7

($6.2)

26%

$0.4

$140.8

2026E

$1.5

$6.8

$8.3

($6.7)

26%

$0.4

$134.2

2027E

$1.8

$6.5

$8.3

($6.7)

26%

$0.4

$127.5

citiView entire presentation