KKR Real Estate Finance Trust Results Presentation Deck

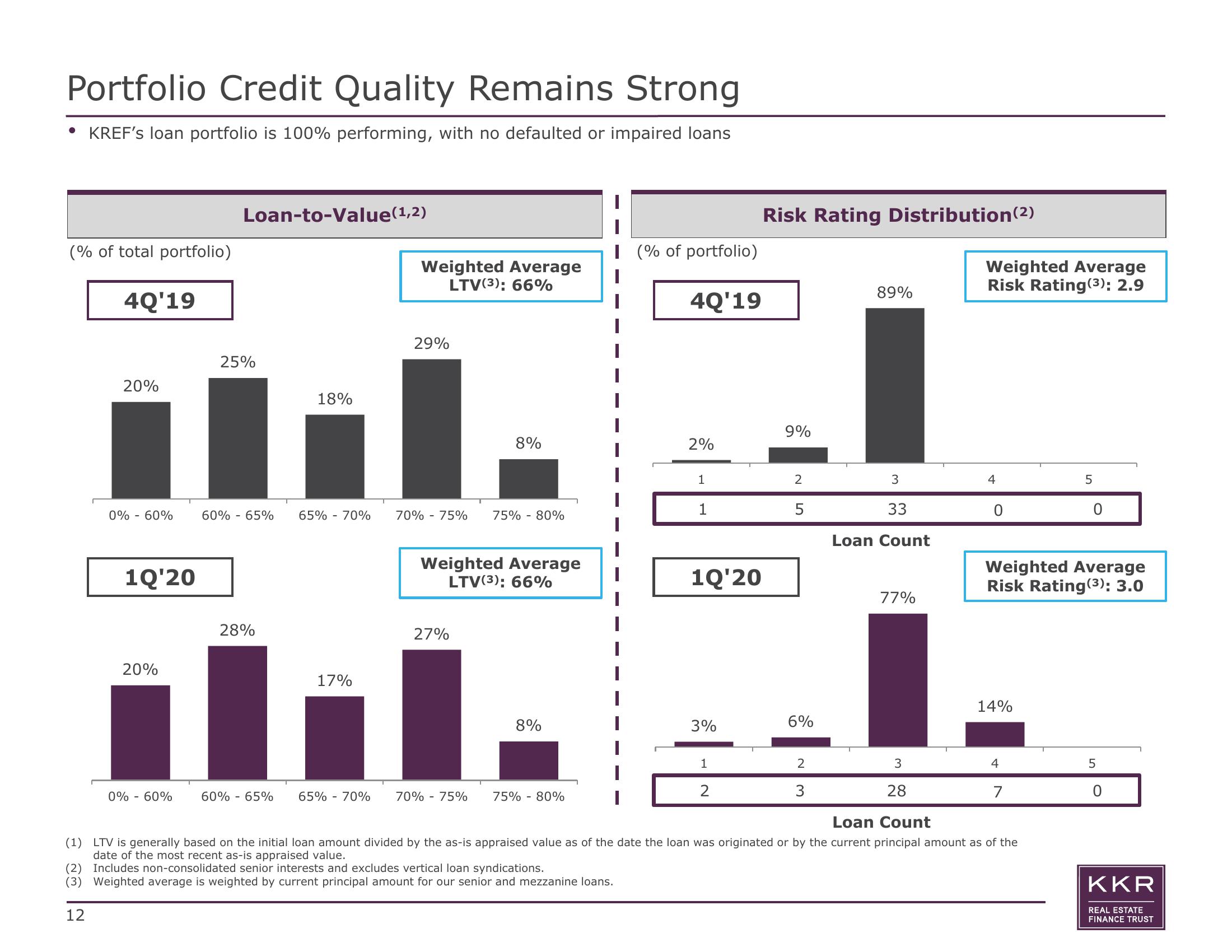

Portfolio Credit Quality Remains Strong

KREF's loan portfolio is 100% performing, with no defaulted or impaired loans

(% of total portfolio)

4Q'19

20%

0% - 60%

1Q'20

20%

0% - 60%

Loan-to-Value(1,2)

25%

18%

...

65% - 70%

60% - 65%

28%

Weighted Average

LTV(3): 66%

17%

29%

70% -75% 75% - 80%

8%

Weighted Average

LTV(3): 66%

27%

60% - 65% 65% - 70% 70% 75%

8%

75% - 80%

(% of portfolio)

(2) Includes non-consolidated senior interests and excludes vertical loan syndications.

(3) Weighted average is weighted by current principal amount for our senior and mezzanine loans.

12

4Q'19

2%

1

1

1Q'20

3%

1

2

Risk Rating Distribution (2)

9%

2

5

6%

2

89%

3

33

Loan Count

77%

3

28

Weighted Average

Risk Rating (³): 2.9

4

0

Weighted Average

Risk Rating (³): 3.0

14%

4

7

Loan Count

(1) LTV is generally based on the initial loan amount divided by the as-is appraised value as of the date the loan was originated or by the current principal amount as of the

date of the most recent as-is appraised value.

5

5

KKR

REAL ESTATE

FINANCE TRUSTView entire presentation