WeWork Results Presentation Deck

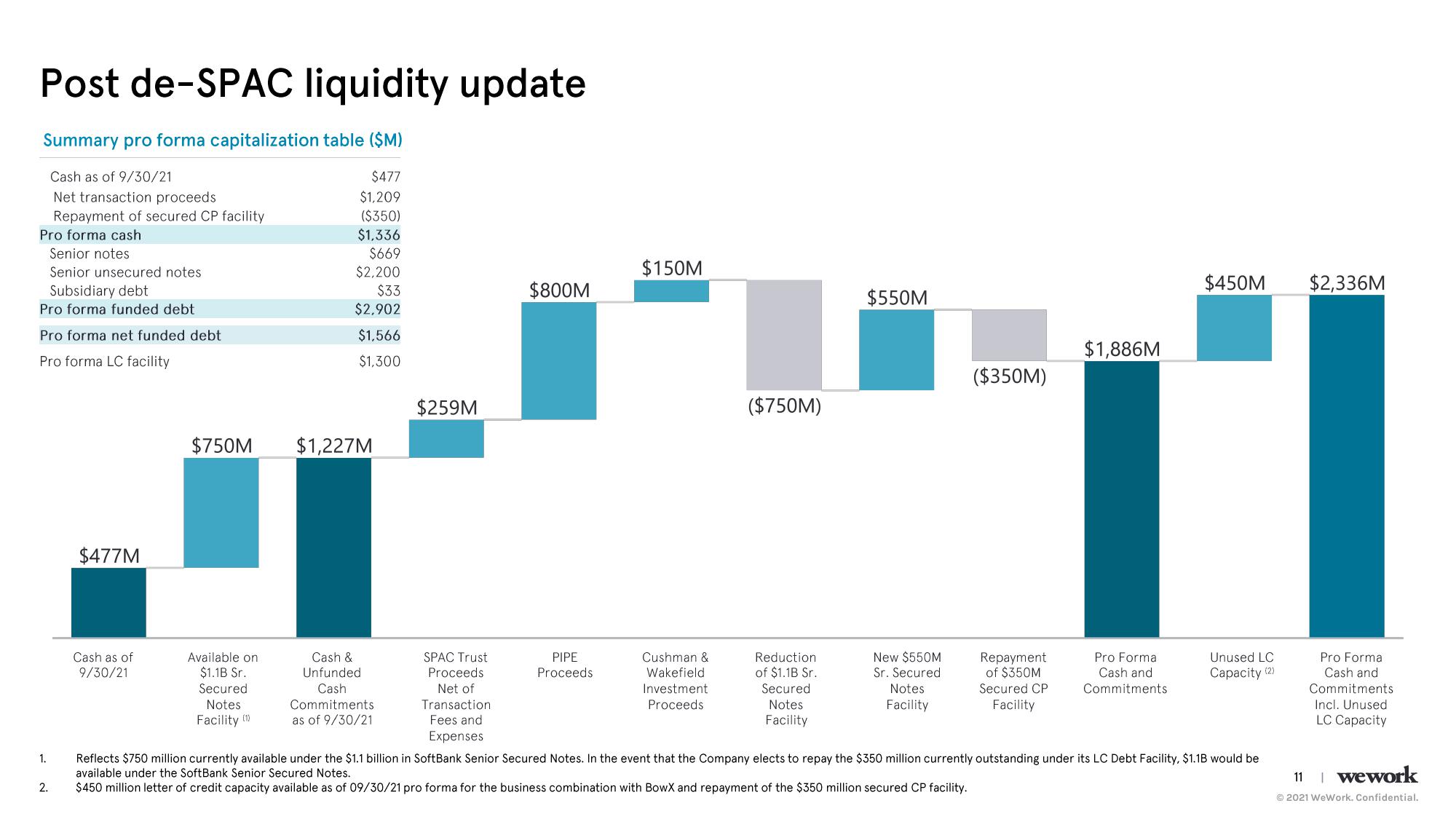

Post de-SPAC liquidity update

Summary pro forma capitalization table ($M)

Cash as of 9/30/21

$477

Net transaction proceeds

$1,209

($350)

$1,336

$669

$2,200

$33

$2,902

$1,566

$1,300

Repayment of secured CP facility

Pro forma cash

Senior notes

Senior unsecured notes

Subsidiary debt

Pro forma funded debt

Pro forma net funded debt

Pro forma LC facility

1.

2.

$477M

Cash as of

9/30/21

$750M

Available on

$1.1B Sr.

Secured

Notes

Facility (1)

$1,227M

Cash &

Unfunded

Cash

Commitments

as of 9/30/21

$259M

SPAC Trust

Proceeds

Net of

Transaction

Fees and

Expenses

$800M

PIPE

Proceeds

$150M

Cushman &

Wakefield

Investment

Proceeds

($750M)

Reduction

of $1.1B Sr.

Secured

Notes

Facility

$550M

New $550M

Sr. Secured

Notes

Facility

($350M)

Repayment

of $350M

Secured CP

Facility

$1,886M

$450M

$2,336M

1

Pro Forma

Cash and

Commitments

Unused LC

Capacity (2)

Reflects $750 million currently available under the $1.1 billion in SoftBank Senior Secured Notes. In the event that the Company elects to repay the $350 million currently outstanding under its LC Debt Facility, $1.1B would be

available under the SoftBank Senior Secured Notes.

$450 million letter of credit capacity available as of 09/30/21 pro forma for the business combination with BowX and repayment of the $350 million secured CP facility.

Pro Forma

Cash and

Commitments.

Incl. Unused

LC Capacity

11 1 wework

Ⓒ2021 WeWork. Confidential.View entire presentation