Kinnevik Results Presentation Deck

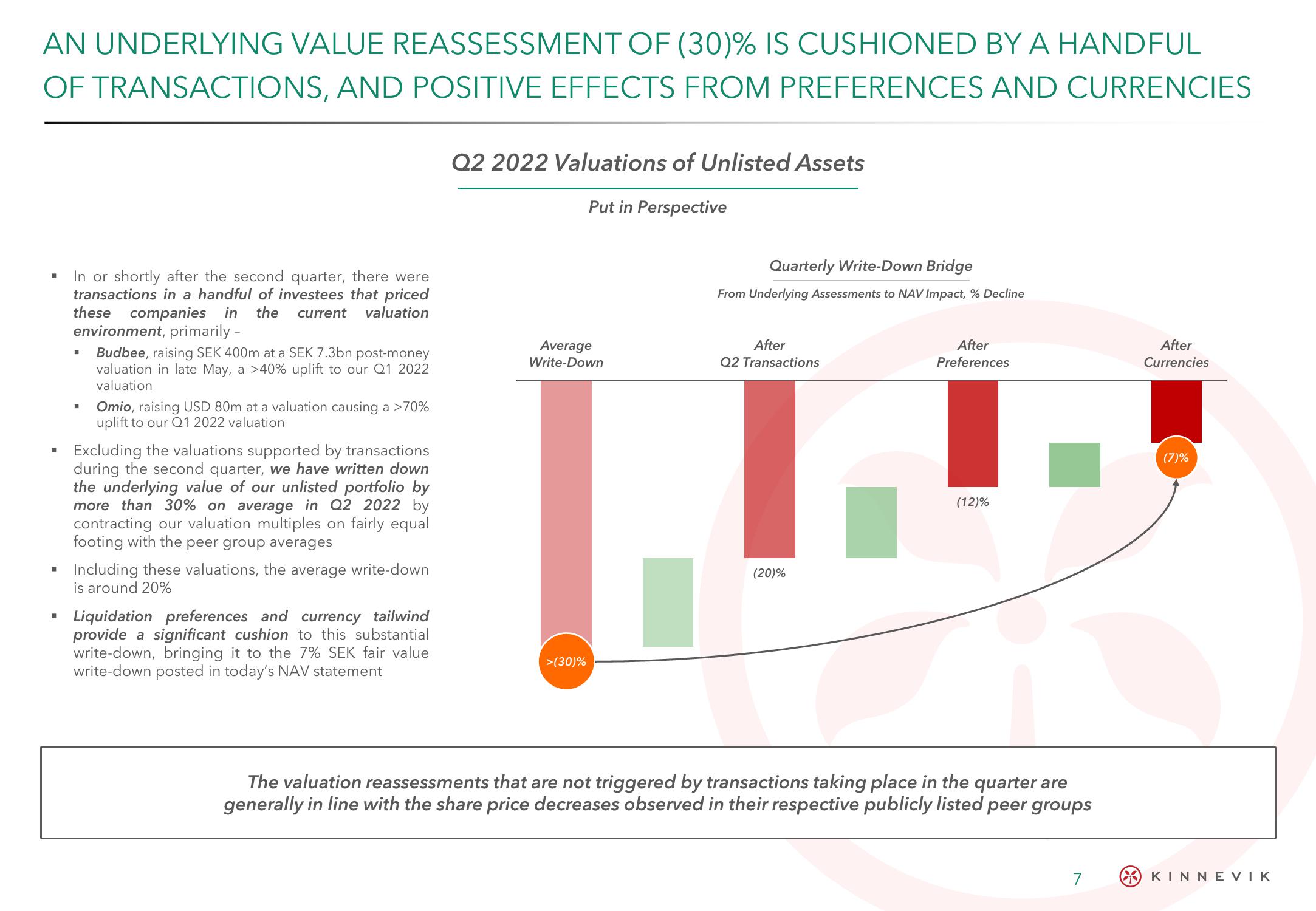

AN UNDERLYING VALUE REASSESSMENT OF (30)% IS CUSHIONED BY A HANDFUL

OF TRANSACTIONS, AND POSITIVE EFFECTS FROM PREFERENCES AND CURRENCIES

■

■

In or shortly after the second quarter, there were

transactions in a handful of investees that priced

these companies in the current valuation

environment, primarily -

Budbee, raising SEK 400m at a SEK 7.3bn post-money

valuation in late May, a >40% uplift to our Q1 2022

valuation

Omio, raising USD 80m at a valuation causing a >70%

uplift to our Q1 2022 valuation

Excluding the valuations supported by transactions

during the second quarter, we have written down

the underlying value of our unlisted portfolio by

more than 30% on average in Q2 2022 by

contracting our valuation multiples on fairly equal

footing with the peer group averages

Including these valuations, the average write-down

is around 20%

Liquidation preferences and currency tailwind

provide a significant cushion to this substantial

write-down, bringing it to the 7% SEK fair value

write-down posted in today's NAV statement

Q2 2022 Valuations of Unlisted Assets

Put in Perspective

Average

Write-Down

>(30)%

Quarterly Write-Down Bridge

From Underlying Assessments to NAV Impact, % Decline

After

Q2 Transactions

(20)%

After

Preferences

(12)%

The valuation reassessments that are not triggered by transactions taking place in the quarter are

generally in line with the share price decreases observed in their respective publicly listed peer groups

7

After

Currencies

(7)%

KINNEVIKView entire presentation