Cheesecake Factory Investor Presentation Deck

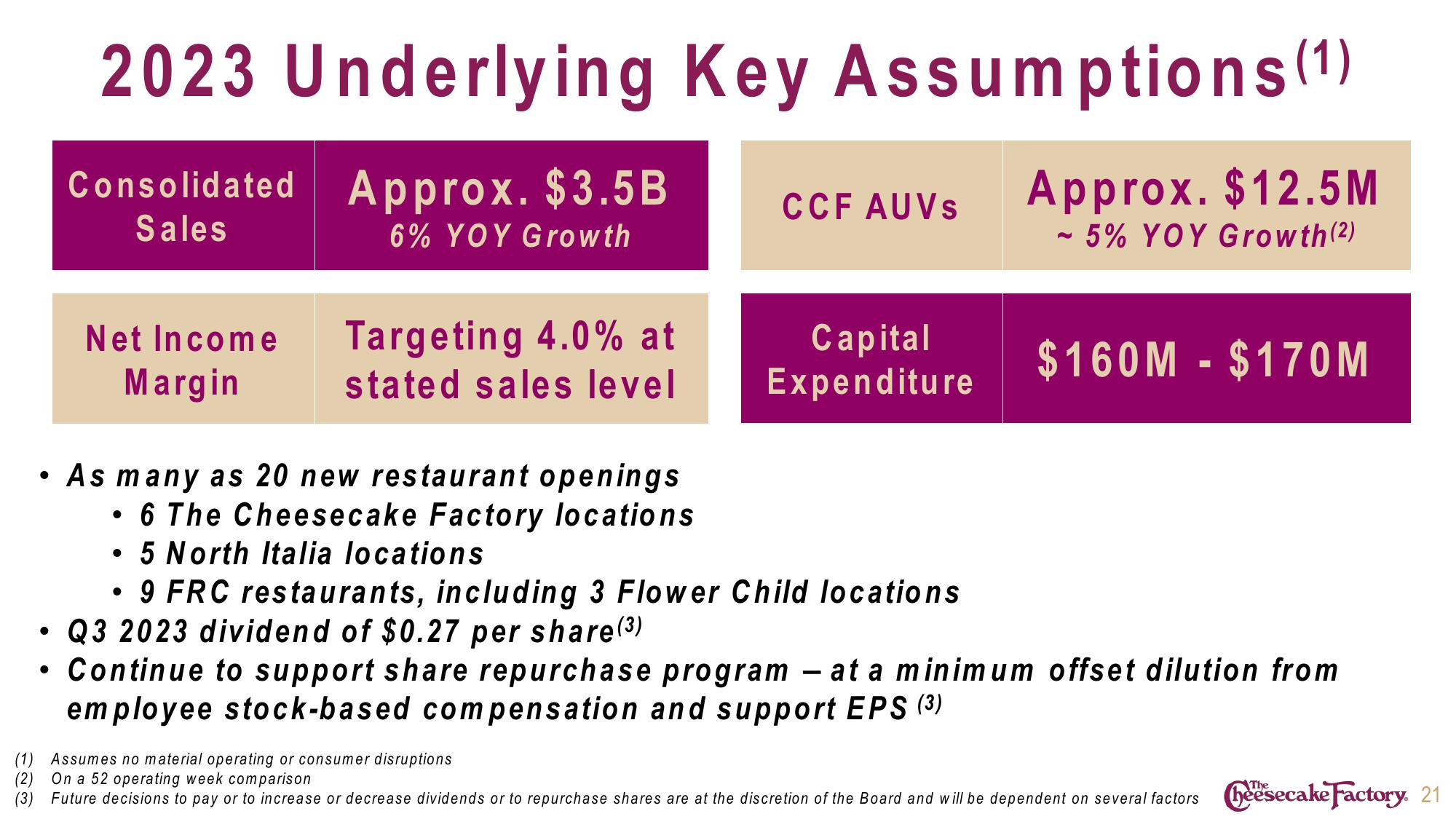

2023 Underlying Key Assumptions (1)

Consolidated Approx. $3.5B

Approx. $12.5M

Sales

6% YOY Growth

~ 5% YOY Growth (2)

Net Income

Margin

●

Targeting 4.0% at

stated sales level

• As many as 20 new restaurant openings

• 6 The Cheesecake Factory locations

• 5 North Italia locations

CCF AUVs

Capital

Expenditure

$160M - $170M

• 9 FRC restaurants, including 3 Flower Child locations

• Q3 2023 dividend of $0.27 per share(³)

Continue to support share repurchase program - at a minimum offset dilution from

employee stock-based compensation and support EPS (3)

(1) Assumes no material operating or consumer disruptions

(2) On a 52 operating week comparison

(3) Future decisions to pay or to increase or decrease dividends or to repurchase shares are at the discretion of the Board and will be dependent on several factors heesecake Factory. 21View entire presentation