Spotify Results Presentation Deck

Executive Summary

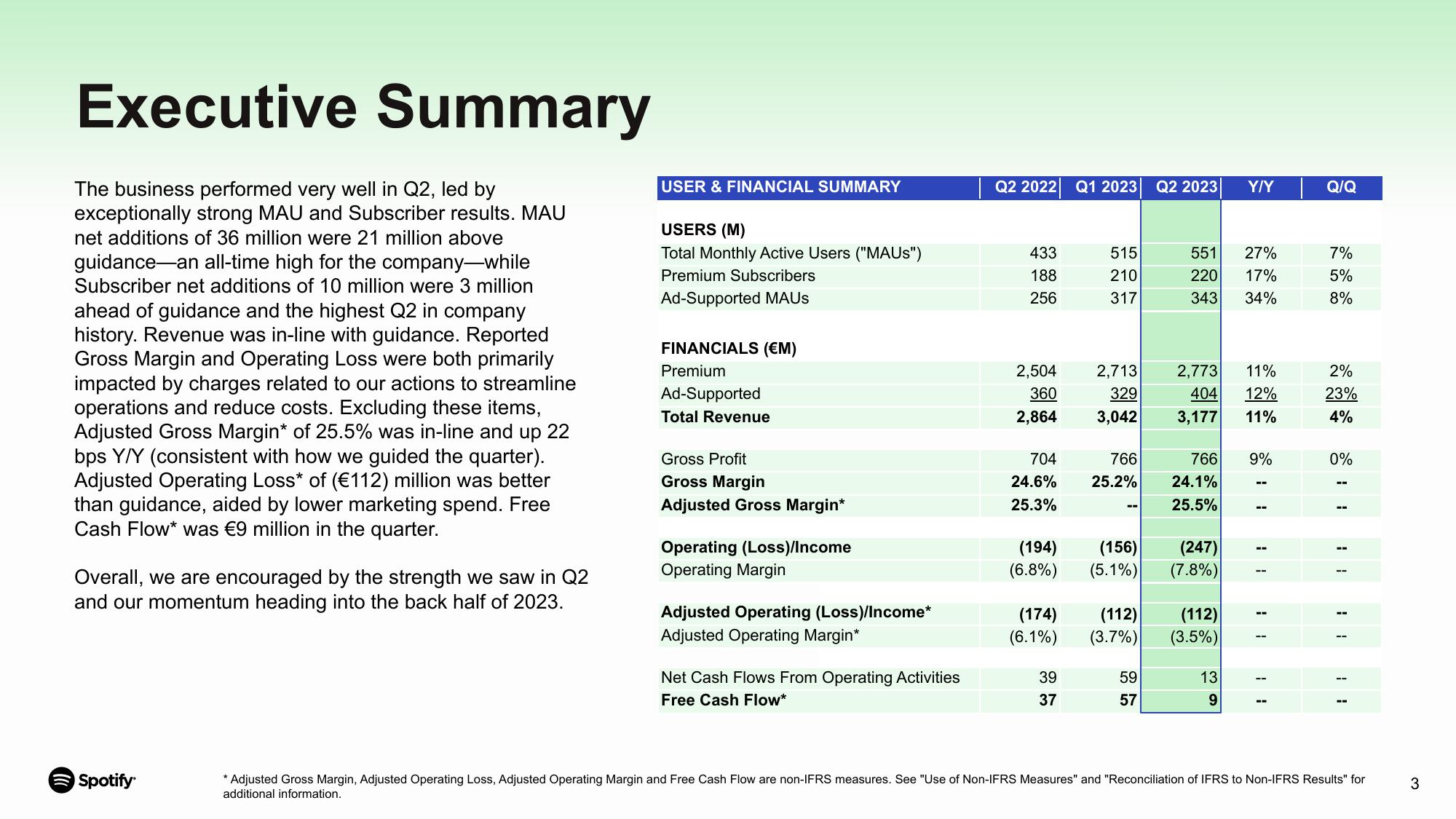

The business performed very well in Q2, led by

exceptionally strong MAU and Subscriber results. MAU

net additions of 36 million were 21 million above

guidance an all-time high for the company-while

Subscriber net additions of 10 million were 3 million

ahead of guidance and the highest Q2 in company

history. Revenue was in-line with guidance. Reported

Gross Margin and Operating Loss were both primarily

impacted by charges related to our actions to streamline

operations and reduce costs. Excluding these items,

Adjusted Gross Margin* of 25.5% was in-line and up 22

bps Y/Y (consistent with how we guided the quarter).

Adjusted Operating Loss* of (€112) million was better

than guidance, aided by lower marketing spend. Free

Cash Flow* was €9 million in the quarter.

Overall, we are encouraged by the strength we saw in Q2

and our momentum heading into the back half of 2023.

Spotify

USER & FINANCIAL SUMMARY

USERS (M)

Total Monthly Active Users ("MAUS")

Premium Subscribers

Ad-Supported MAUS

FINANCIALS (€M)

Premium

Ad-Supported

Total Revenue

Gross Profit

Gross Margin

Adjusted Gross Margin*

Operating (Loss)/Income

Operating Margin

Adjusted Operating (Loss)/Income*

Adjusted Operating Margin*

Net Cash Flows From Operating Activities

Free Cash Flow*

Q2 2022 Q1 2023

433

188

256

2,504

360

2,864

704

24.6%

25.3%

515

210

317

39

37

766

25.2%

--

(194) (156)

(6.8%) (5.1%)

2,713 2,773 11%

404 12%

329

3,042

3,177 11%

(174) (112)

(6.1%) (3.7%)

Q2 2023

59

57

551 27%

220

343

17%

34%

766 9%

24.1%

25.5%

Y/Y

(247)

(7.8%)

(112)

(3.5%)

13

9

--

11

Q/Q

7%

5%

8%

2%

23%

4%

0%

* Adjusted Gross Margin, Adjusted Operating Loss, Adjusted Operating Margin and Free Cash Flow are non-IFRS measures. See "Use of Non-IFRS Measures" and "Reconciliation of IFRS to Non-IFRS Results" for

additional information.

3View entire presentation