Bank of America Results Presentation Deck

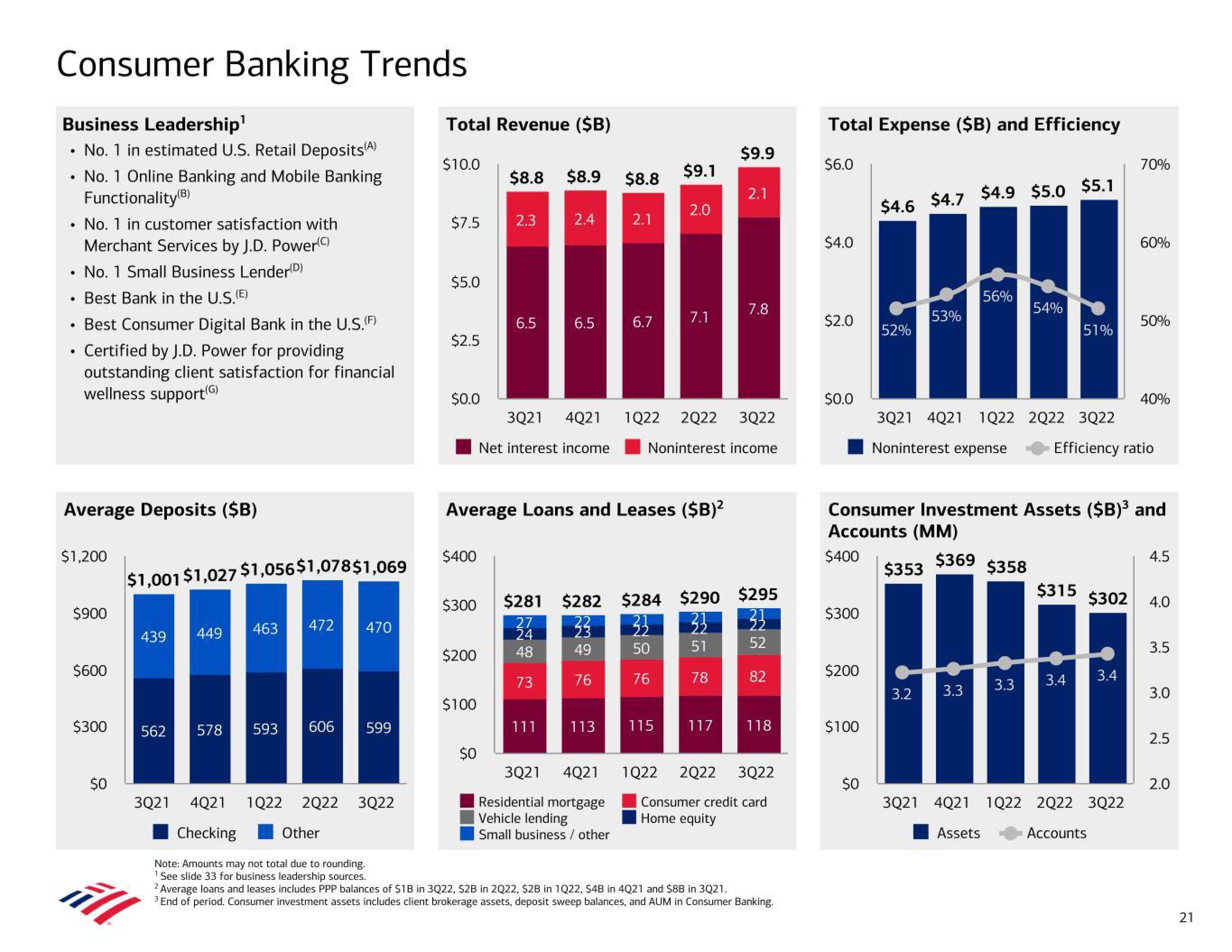

Consumer Banking Trends

Business Leadership¹

• No. 1 in estimated U.S. Retail Deposits(A)

.

• No. 1 Online Banking and Mobile Banking

.

Functionality (B)

.

.

Best Bank in the U.S. (E)

• Best Consumer Digital Bank in the U.S.(F)

Certified by J.D. Power for providing

outstanding client satisfaction for financial

wellness support(G)

No. 1 in customer satisfaction with

Merchant Services by J.D. Power(C)

No. 1 Small Business Lender (D)

.

Average Deposits ($B)

$1,200

$900

$600

$300

$0

$1,001 $1,027 $1,056$1,078$1,069

439

449

463

472

470

562 578 593 606 599

3Q21 4Q21 1Q22 2Q22 3Q22

Checking

Note: Amounts may not total due to rounding.

1 See slide 33 for business leadership sources.

Other

Total Revenue ($B)

$10.0

$7.5

$5.0

$2.5

$0.0

$400

$300

$200

$100

$8.8 $8.9

$0

2.3

6.5

2.4

6.5

Net interest income

111

Average Loans and Leases ($B)²

$8.8

33

49

76

2.1

113

6.7

3Q21 4Q21

Residential mortgage

Vehicle lending

Small business / other

3Q21 4Q21 1Q22 2Q22 3Q22

Noninterest income

$9.1

2.0

33

50

76

7.1

$281 $282 $284 $290 $295

27

33

24

52

48

73

115

$9.9

2.1

33

51

78

7.8

82

117 118

1Q22 2Q22 3Q22

Consumer credit card

Home equity

2 Average loans and leases includes PPP balances of $1B in 3Q22, $2B in 2022, $2B in 1Q22, $4B in 4Q21 and $8B in 3Q21.

3 End of period. Consumer investment assets includes client brokerage assets, deposit sweep balances, and AUM in Consumer Banking.

Total Expense ($B) and Efficiency

$6.0

$4.0

$2.0

$0.0

$300

$200

$100

$4.6 $4.7

$0

52%

53%

$353

3Q21 4021 1022

Noninterest expense

3.2

$4.9 $5.0 $5.1

56%

3.3

Consumer Investment Assets ($B)³ and

Accounts (MM)

$400

$369

54%

51%

$358

$315

|||

3.3

3.4

2022 3Q22

Efficiency ratio

$302

70%

3.4

60%

3Q21 4021 1022 2022 3Q22

Assets

Accounts

50%

40%

4.5

4.0

3.5

3.0

2.5

2.0

21View entire presentation