Third Quarter 2022 Earnings Conference Call

Consumer Banking & Wealth

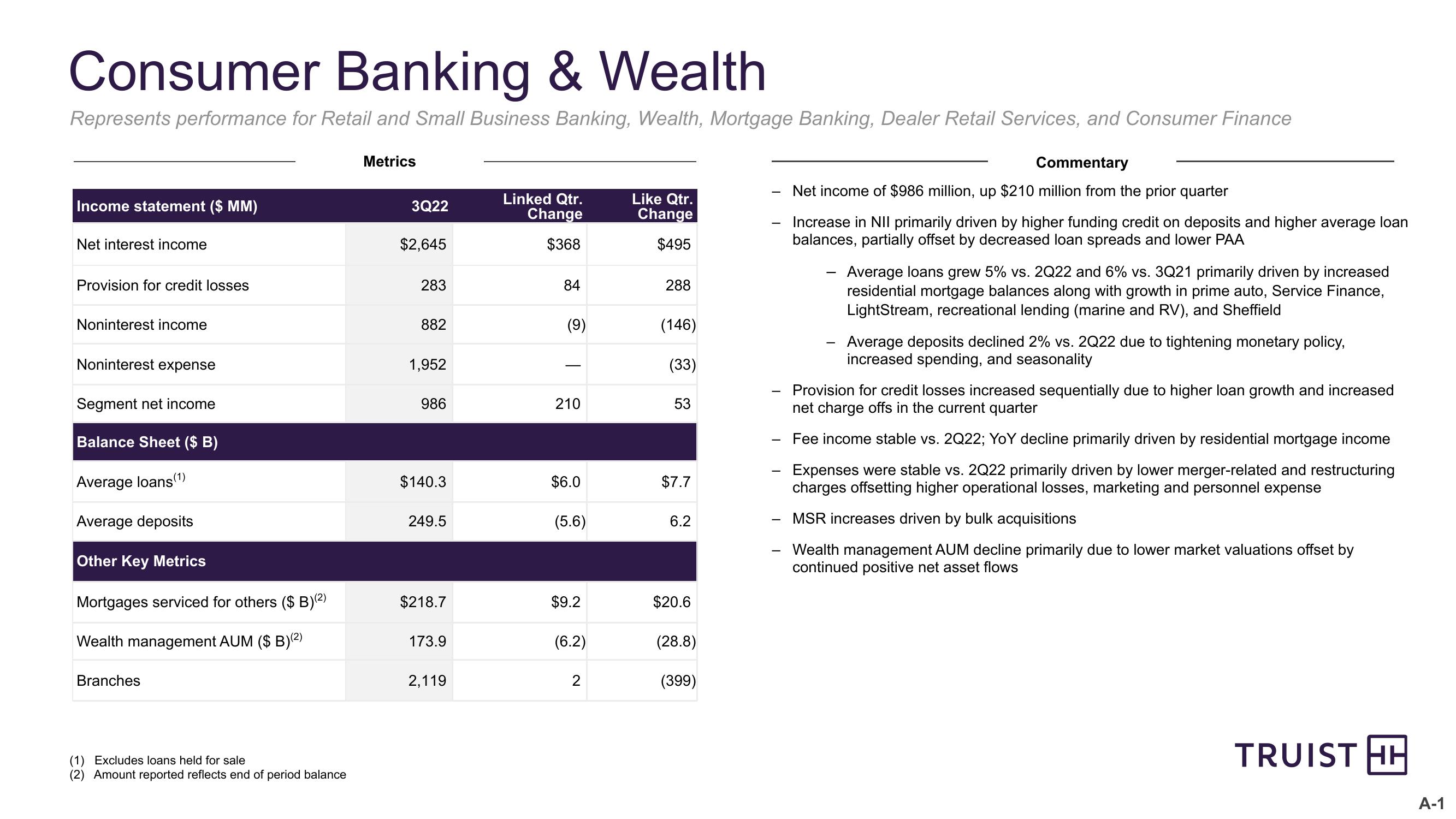

Represents performance for Retail and Small Business Banking, Wealth, Mortgage Banking, Dealer Retail Services, and Consumer Finance

Income statement ($ MM)

Metrics

$368

.....

$495

283

84

288

882

(9)

1,952

986

210

53

(146)

(33)

53

3Q22

Linked Qtr.

Change

Like Qtr.

Change

Net interest income

$2,645

Provision for credit losses

Noninterest income

Noninterest expense

Segment net income

Balance Sheet ($ B)

Average loans (1)

$140.3

$6.0

$7.7

Average deposits

249.5

(5.6)

6.2

Other Key Metrics

Mortgages serviced for others ($ B) (2)

$218.7

$9.2

$20.6

Wealth management AUM ($ B) (2)

173.9

(6.2)

(28.8)

Branches

2,119

2

(399)

-

-

-

Commentary

Net income of $986 million, up $210 million from the prior quarter

Increase in NII primarily driven by higher funding credit on deposits and higher average loan

balances, partially offset by decreased loan spreads and lower PAA

-

Average loans grew 5% vs. 2Q22 and 6% vs. 3Q21 primarily driven by increased

residential mortgage balances along with growth in prime auto, Service Finance,

LightStream, recreational lending (marine and RV), and Sheffield

Average deposits declined 2% vs. 2Q22 due to tightening monetary policy,

increased spending, and seasonality

Provision for credit losses increased sequentially due to higher loan growth and increased

net charge offs in the current quarter

Fee income stable vs. 2Q22; YoY decline primarily driven by residential mortgage income

Expenses were stable vs. 2Q22 primarily driven by lower merger-related and restructuring

charges offsetting higher operational losses, marketing and personnel expense

MSR increases driven by bulk acquisitions

Wealth management AUM decline primarily due to lower market valuations offset by

continued positive net asset flows

(1) Excludes loans held for sale

(2) Amount reported reflects end of period balance

TRUIST HH

A-1View entire presentation