Baird Investment Banking Pitch Book

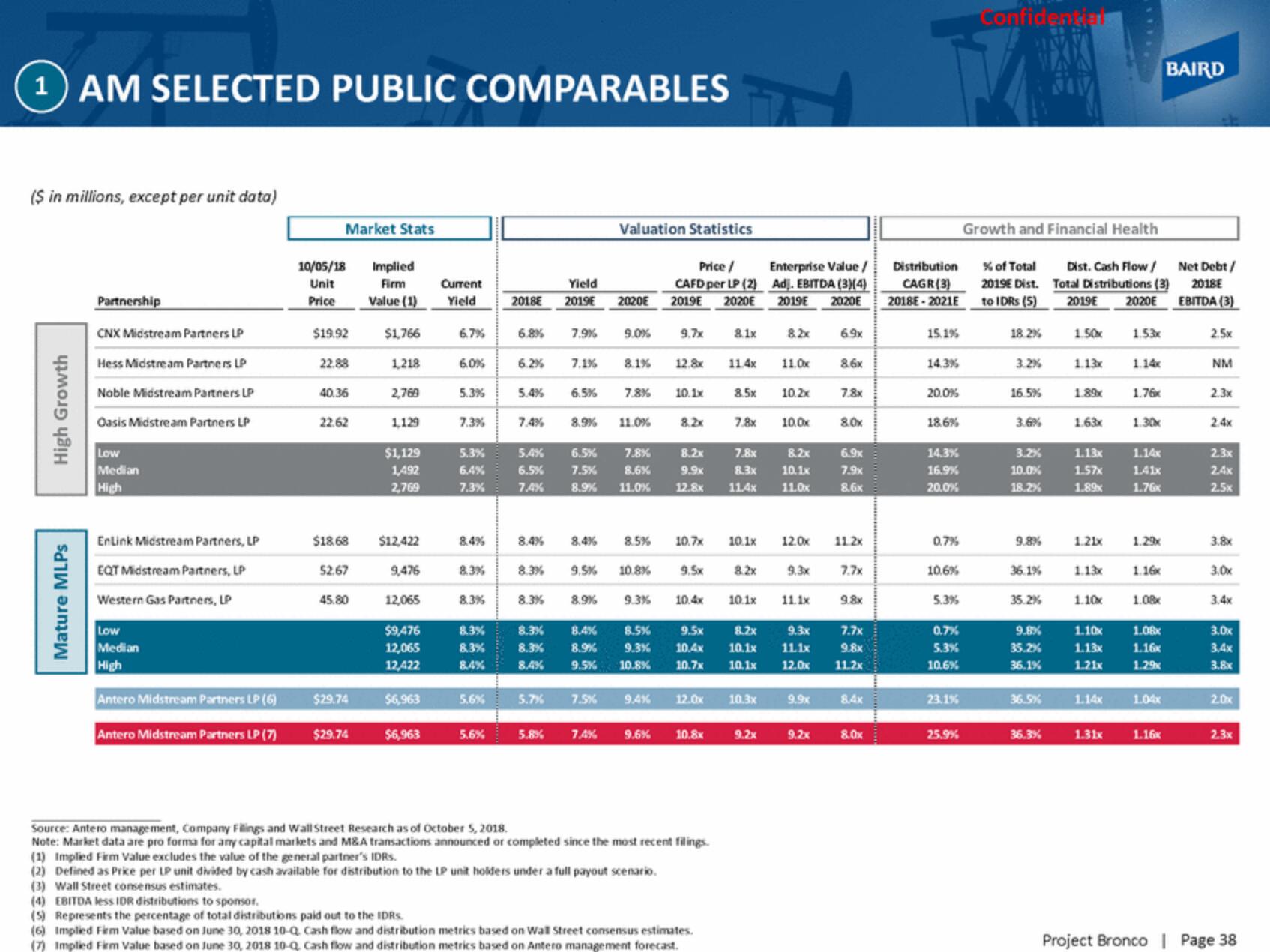

1) AM SELECTED PUBLIC COMPARABLES

($ in millions, except per unit data)

High Growth

Mature MLPs

Partnership

CNX Midstream Partners LP

Hess Midstream Partners LP

Noble Midstream Partners LP

Oasis Midstream Partners LP

Low

Median

High

EnLink Midstream Partners, LP

EQT Midstream Partners, LP

Western Gas Partners, LP

Low

Median

High

Antero Midstream Partners LP (6)

Antero Midstream Partners LP (7)

Market Stats

10/05/18

Unit

Price

$19.92

22.88

40.36

22.62

$18.68

52.67

45.80

$29.74

$29.74

Implied

Firm

Value (1)

$1,766

1,218

2,769

1,129

$1,129

1,492

2,769

$12,422

9,476

12,065

$9,476

12,065

12,422

$6,963

$6,963

Current

Yield

6.7%

6.0%

5.3%

7.3%

5.3%

6.4%

7.3%

8.4%

8.3%

8.3%

8.3%

8.3%

8.4%

5.6%

5.6%

2018E

6.8% 7.9%

6.2%

5.4%

8.4%

Yield

2019€

7.4% 8.9%

8.3%

8.3%

7.1%

6.5%

5.8%

Valuation Statistics

Price /

CAFD per LP (2)

2019E 2020E

8.3% 8.4%

8.3%

8.9%

9.5%

8.4%

2020E

5.7% 7.5%

9.0%

7.4%

8.1% 12.8x 11.4x

7.8% 10.1x

11.0%

9.5% 10.8%

9.7x

5.4%

6.5%

7.8%

8.2x

7.8x

8.2x

8.6%

9.9x

8.3x

10.1x

6.5% 7.5%

7.4% 8.9% 11.0% 12.8x 11.4x 11.0x

8.2x

8.5%

9.3%

10.8%

9.4%

9.5x

8.1x

12.0x

8.5x

9.6% 10.8x

8.4% 8.5% 10.7x 10.1x 12.0x 11.2x

8.9% 9.3% 10.4x 10.1x 11.1x

Source: Antero management, Company Fillings and Wall Street Research as of October 5, 2018.

Note: Market data are pro forma for any capital markets and M&A transactions announced or completed since the most recent filings.

(1) Implied Firm Value excludes the value of the general partner's IDRS.

(2) Defined as Price per LP unit divided by cash available for distribution to the LP unit holders under a full payout scenario.

(3) Wall Street consensus estimates.

9.5x 8.2x

10.4x 10.1x

10.7x 10.1x

(4) EBITDA less IDR distributions to sponsor.

(5) Represents the percentage of total distributions paid out to the IDRS.

(6) Implied Firm Value based on June 30, 2018 10-Q Cash flow and distribution metrics based on Wall Street consensus estimates.

(7) Implied Firm Value based on June 30, 2018 10-Q, Cash flow and distribution metrics based on Antero management forecast.

8.2x

Enterprise Value /

Ad. EBITDA (3)(4)

2019E 2020E

7.8x 10.0x

8.2x

11.0x

10.3x

10.2x

9.2x

9.3x

6.9x

9.9x

8.6x

9.2x

7.8x

8.0x

6.9x

7.9x

8.6x

7.7x

7.7x

9.3x

11.1x

12.0x 11.2x

9.8x

9.8x

8.4x

8.0x

Distribution

CAGR(3)

2018E-2021E

15.1%

14.3%

20.0%

18.6%

14.3%

16.9%

20.0%

0.7%

10.6%

5.3%

0.7%

5.3%

10.6%

23.1%

25.9%

Confidential

Growth and Financial Health

% of Total

2019€ Dist.

to IDRS (5)

Dist. Cash Flow/

Total Distributions (3)

2019E 2020E

18.2%

3.2%

16.5%

3.6%

3.2%

10.0%

18.2%

9.8%

36.1%

35.2%

9.8%

35.2%

36.1%

36.5%

36.3%

1.50x

1.13x

1.89x

1.63x

1.13x

1.57x

1.30x

1.14x

1.41x

1.89x 1.76x

1.21x

1.13x

1.10x

1.13x

1.21x

1.53x

1.14x

1.14x

1.31x

1.76x

1.10k 1.08

1.29x

1.16x

1.08x

1.16x

1.29x

1.04x

BAIRD

1.16x

Net Debt /

2018E

EBITDA (3)

2.5x

NM

2.3x

2.4x

2.3x

2.4x

2.5x

3.8x

3.0x

3.4x

3.0x

3.4x

3.8x

2.0x

2.3x

Project Bronco | Page 38View entire presentation