Evercore Investment Banking Pitch Book

Financial Analysis

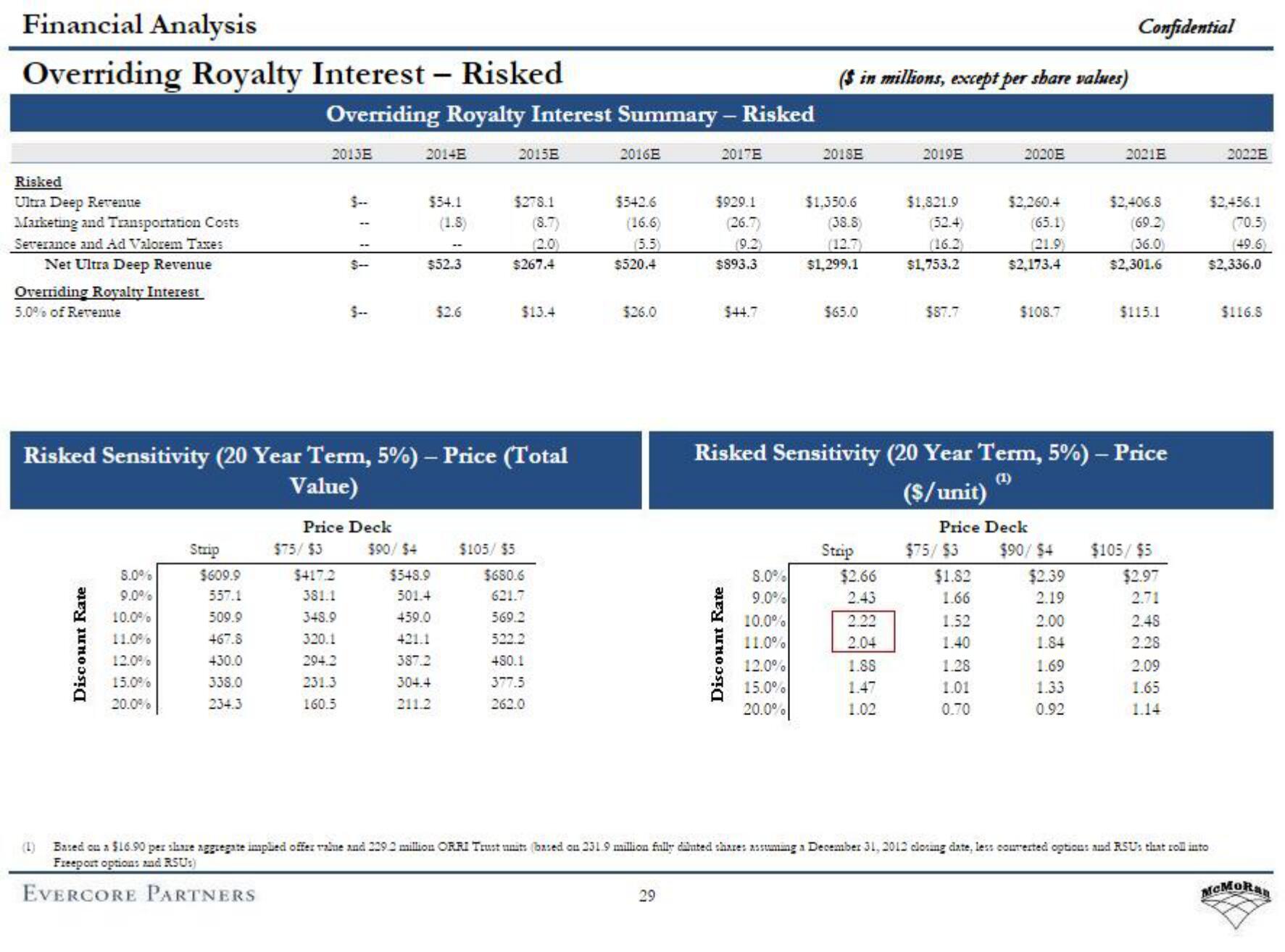

Overriding Royalty Interest - Risked

Risked

Ultra Deep Revenue

Marketing and Transportation Costs

Severance and Ad Valorem Taxes

Net Ultra Deep Revenue

Overriding Royalty Interest

5.0% of Revenue

Discount Rate

8.0%

9.0%

10.0%

11.0%

12.0%

15.0%

20.0%

Strip

$609.9

557.1

509.9

467.8

430.0

338.0

234.3

Overriding Royalty Interest Summary - Risked

2013E

$75/$3

$--

$-

Price Deck

$417.2

381.1

348.9

320.1

294.2

231.3

160.5

Risked Sensitivity (20 Year Term, 5%) - Price (Total

Value)

2014E

$90/54

$54.1

(1.8)

$52.3

$2.6

$548.9

501.4

459.0

421.1

387.2

304.4

211.2

2015E

$278.1

$105/ $5

$267.4

(8.7)

$13.4

$680.6

621.7

569.2

522.2

480.1

377.5

262.0

2016E

$542.6

(16.6)

(5.5)

$520.4

$26.0

2017E

29

$929.1

(26.7)

(9.2)

$893.3

$44.7

Discount Rate

8.0%

9.0%

10.0%

11.0%

($ in millions, except per share values)

12.0%

15.0%

20.0%

2018E

$1.350.6

(38.8)

(12.7)

$1,299.1

$65.0

Strip

$2.66

2.43

2.22

2.04

2019E

1.88

1.47

1.02

$1.821.9

(52.4)

(16.2)

$1,753.2

$87.7

Risked Sensitivity (20 Year Term, 5%) - Price

($/unit)

$75/ $3

2020E

$1.82

1.66

1.52

1.40

$2,260.4

(65.1)

(21.9)

$2,173.4

Price Deck

1.28

1.01

0.70

$108.7

$90/ $4

$2.39

2.19

2.00

1.84

Confidential

1.69

1.33

0.92

2021E

$2,406.8

(69.2)

(36.0)

$2,301.6

$115.1

$105/ $5

$2.97

2.71

2.48

2.28

2.09

1.65

1.14

Based on a $16.90 per share aggregate implied offer value and 229.2 million ORRI Trust units (based on 231.9 million fully diluted shares assuming a December 31, 2012 closing date, less couverted options and RSU that roll into

Freeport options and RSU:)

EVERCORE PARTNERS

2022E

$2,456.1

(70.5)

(49.6)

$2,336.0

$116.8

MCMoRanView entire presentation