Pathward Financial Results Presentation Deck

FEE INCOME DRIVES PROFITABILITY

SECOND QUARTER ENDED MARCH 31, 2021

"

6

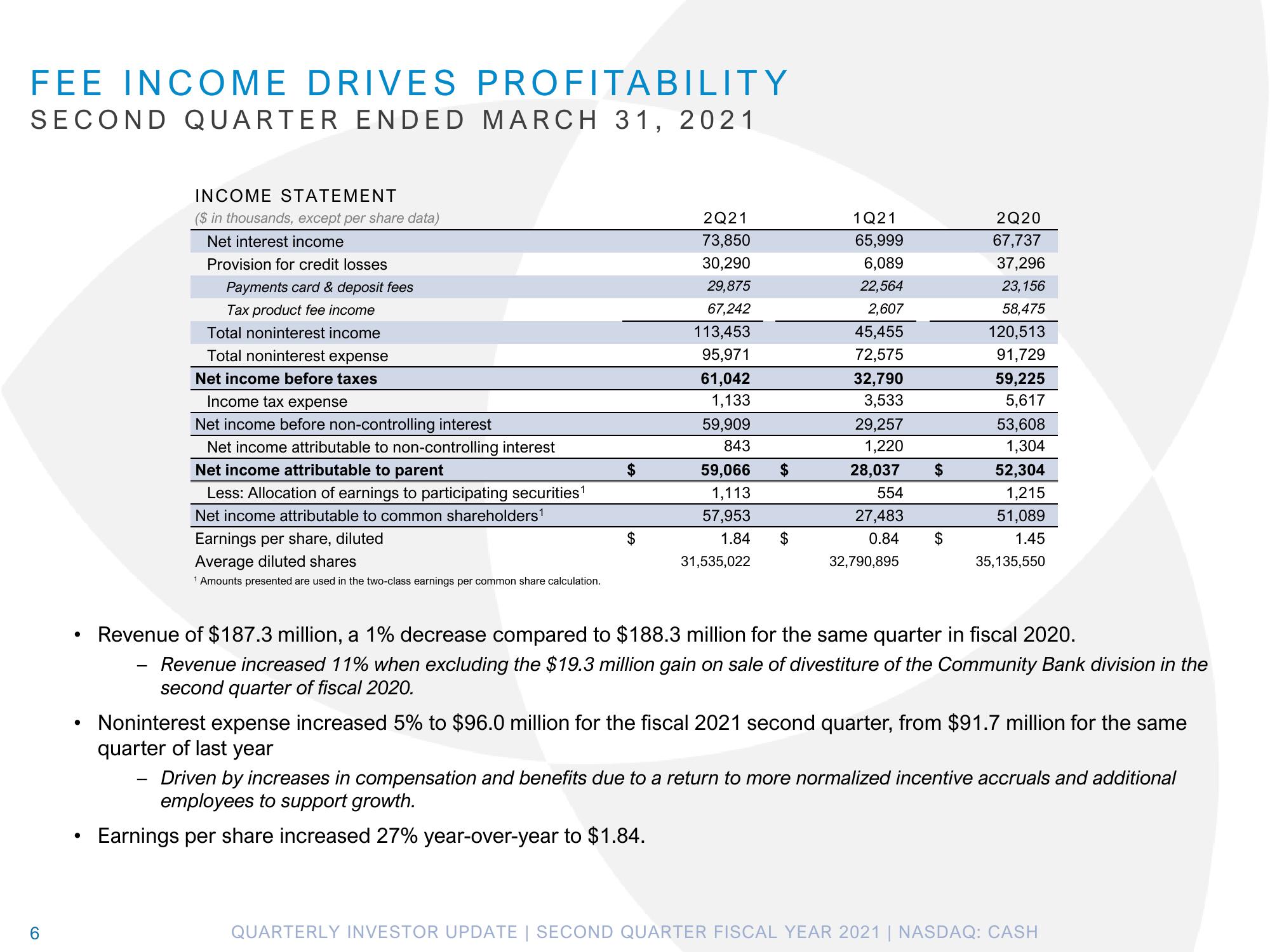

INCOME STATEMENT

($ in thousands, except per share data)

Net interest income

Provision for credit losses

Payments card & deposit fees

Tax product fee income

Total noninterest income

Total noninterest expense

Net income before taxes

Income tax expense

Net income before non-controlling interest

Net income attributable to non-controlling interest

Net income attributable to parent

Less: Allocation of earnings to participating securities¹

Net income attributable to common shareholders ¹

Earnings per share, diluted

Average diluted shares

1 Amounts presented are used in the two-class earnings per common share calculation.

$

2Q21

73,850

30,290

29,875

67,242

113,453

95,971

61,042

1,133

59,909

843

59,066 $

1,113

57,953

1.84 $

31,535,022

1Q21

65,999

6,089

22,564

2,607

45,455

72,575

32,790

3,533

29,257

1,220

28,037 $

554

27,483

0.84

32,790,895

$

2Q20

67,737

37,296

23,156

58,475

120,513

91,729

59,225

5,617

53,608

1,304

52,304

1,215

51,089

1.45

35,135,550

Revenue of $187.3 million, a 1% decrease compared to $188.3 million for the same quarter in fiscal 2020.

Revenue increased 11% when excluding the $19.3 million gain on sale of divestiture of the Community Bank division in the

second quarter of fiscal 2020.

Noninterest expense increased 5% to $96.0 million for the fiscal 2021 second quarter, from $91.7 million for the same

quarter of last year

Driven by increases in compensation and benefits due to a return to more normalized incentive accruals and additional

employees to support growth.

Earnings per share increased 27% year-over-year to $1.84.

QUARTERLY INVESTOR UPDATE | SECOND QUARTER FISCAL YEAR 2021 | NASDAQ: CASHView entire presentation