DraftKings Results Presentation Deck

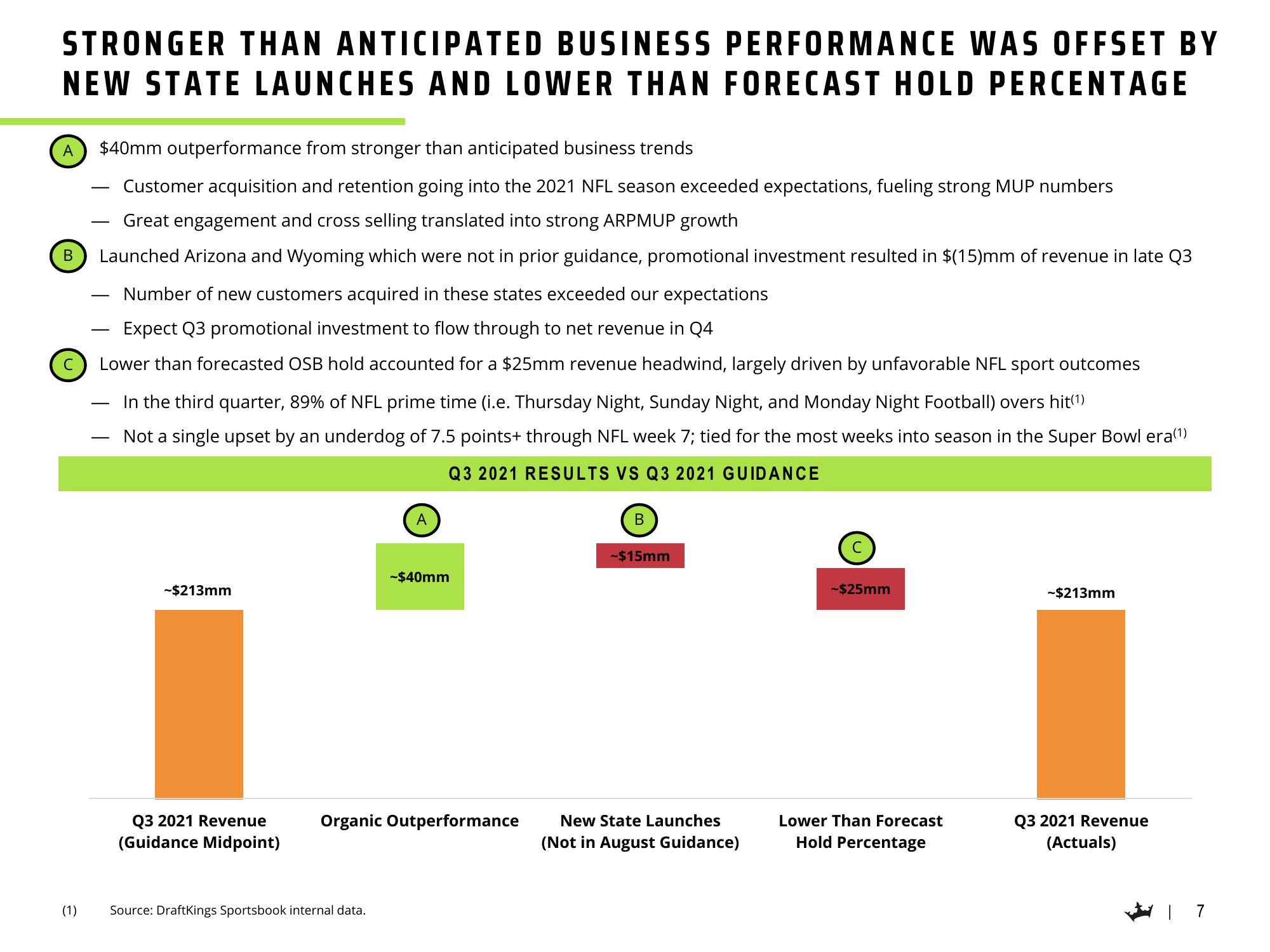

STRONGER THAN ANTICIPATED BUSINESS PERFORMANCE WAS OFFSET BY

NEW STATE LAUNCHES AND LOWER THAN FORECAST HOLD PERCENTAGE

A

B

(1)

$40mm outperformance from stronger than anticipated business trends

Customer acquisition and retention going into the 2021 NFL season exceeded expectations, fueling strong MUP numbers

Great engagement and cross selling translated into strong ARPMUP growth

Launched Arizona and Wyoming which were not in prior guidance, promotional investment resulted in $(15)mm of revenue in late Q3

Number of new customers acquired in these states exceeded our expectations

Expect Q3 promotional investment to flow through to net revenue in Q4

Lower than forecasted OSB hold accounted for a $25mm revenue headwind, largely driven by unfavorable NFL sport outcomes

In the third quarter, 89% of NFL prime time (i.e. Thursday Night, Sunday Night, and Monday Night Football) overs hit(¹)

Not a single upset by an underdog of 7.5 points+ through NFL week 7; tied for the most weeks into season in the Super Bowl era(¹)

Q3 2021 RESULTS VS Q3 2021 GUIDANCE

-

-$213mm

Q3 2021 Revenue

(Guidance Midpoint)

A

Source: DraftKings Sportsbook internal data.

-$40mm

Organic Outperformance

B

-$15mm

New State Launches

(Not in August Guidance)

-$25mm

Lower Than Forecast

Hold Percentage

-$213mm

Q3 2021 Revenue

(Actuals)View entire presentation