Melrose Investor Day Presentation Deck

£m

700

600

500

400

300

200

100

0

1980

-100

Melrose

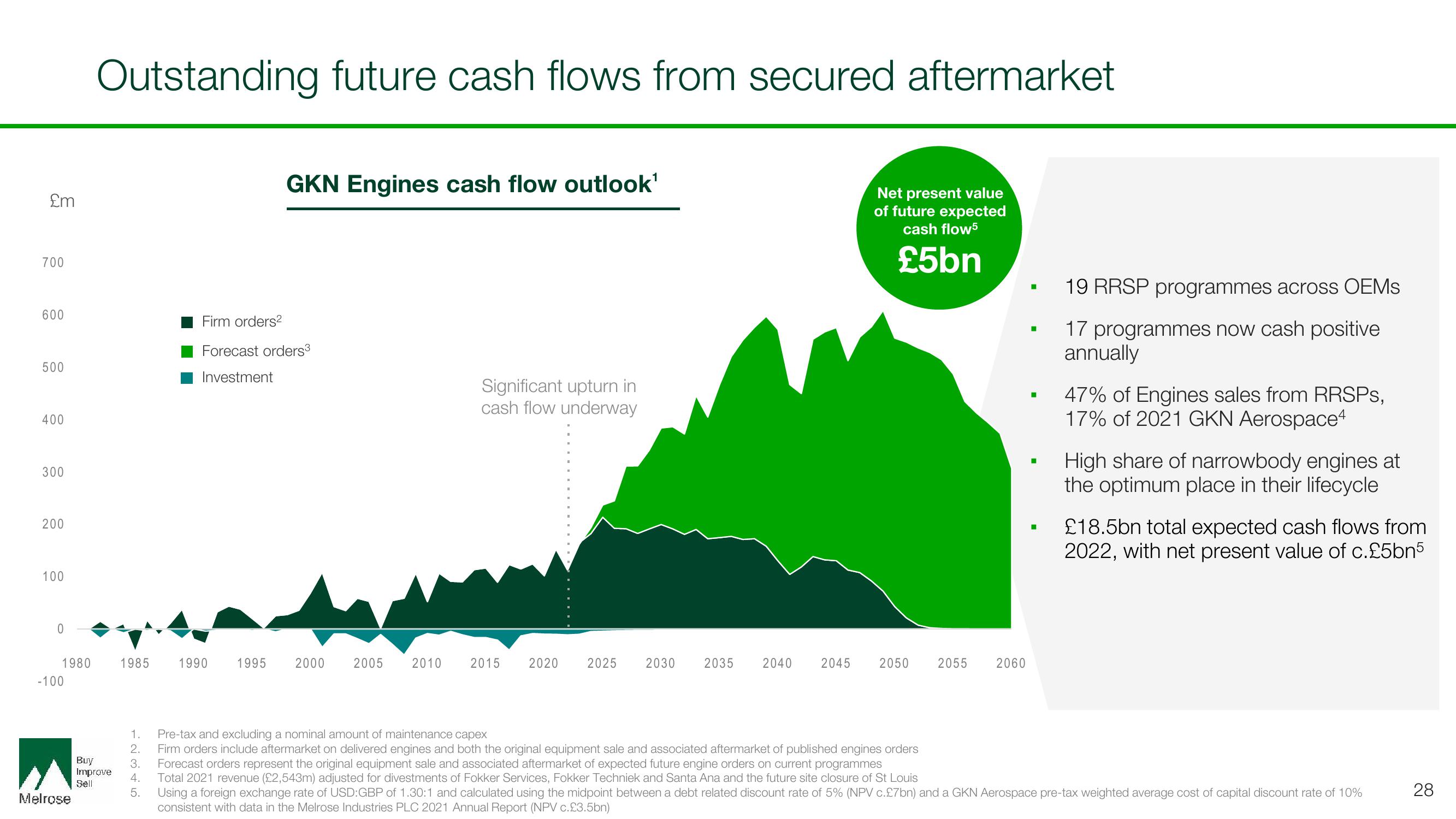

Outstanding future cash flows from secured aftermarket

Buy

Improve

Sell

1985

2.

3.

4.

5.

Firm orders²

Forecast orders³

Investment

1990

GKN Engines cash flow outlook¹

1995

2000

2005

2010

Significant upturn in

cash flow underway

2015

2020 2025 2030

Net present value

of future expected

cash flow5

£5bn

2035 2040 2045 2050

2055

2060

■

I

■

■

19 RRSP programmes across OEMs

17 programmes now cash positive

annually

47% of Engines sales from RRSPs,

17% of 2021 GKN Aerospace4

High share of narrowbody engines at

the optimum place in their lifecycle

£18.5bn total expected cash flows from

2022, with net present value of c.£5bn5

1. Pre-tax and excluding a nominal amount of maintenance capex

Firm orders include aftermarket on delivered engines and both the original equipment sale and associated aftermarket of published engines orders

Forecast orders represent the original equipment sale and associated aftermarket of expected future engine orders on current programmes

Total 2021 revenue (£2,543m) adjusted for divestments of Fokker Services, Fokker Techniek and Santa Ana and the future site closure of St Louis

Using a foreign exchange rate of USD:GBP of 1.30:1 and calculated using the midpoint between a debt related discount rate of 5% (NPV c.£7bn) and a GKN Aerospace pre-tax weighted average cost of capital discount rate of 10%

consistent with data in the Melrose Industries PLC 2021 Annual Report (NPV c.£3.5bn)

28View entire presentation