Aston Martin Results Presentation Deck

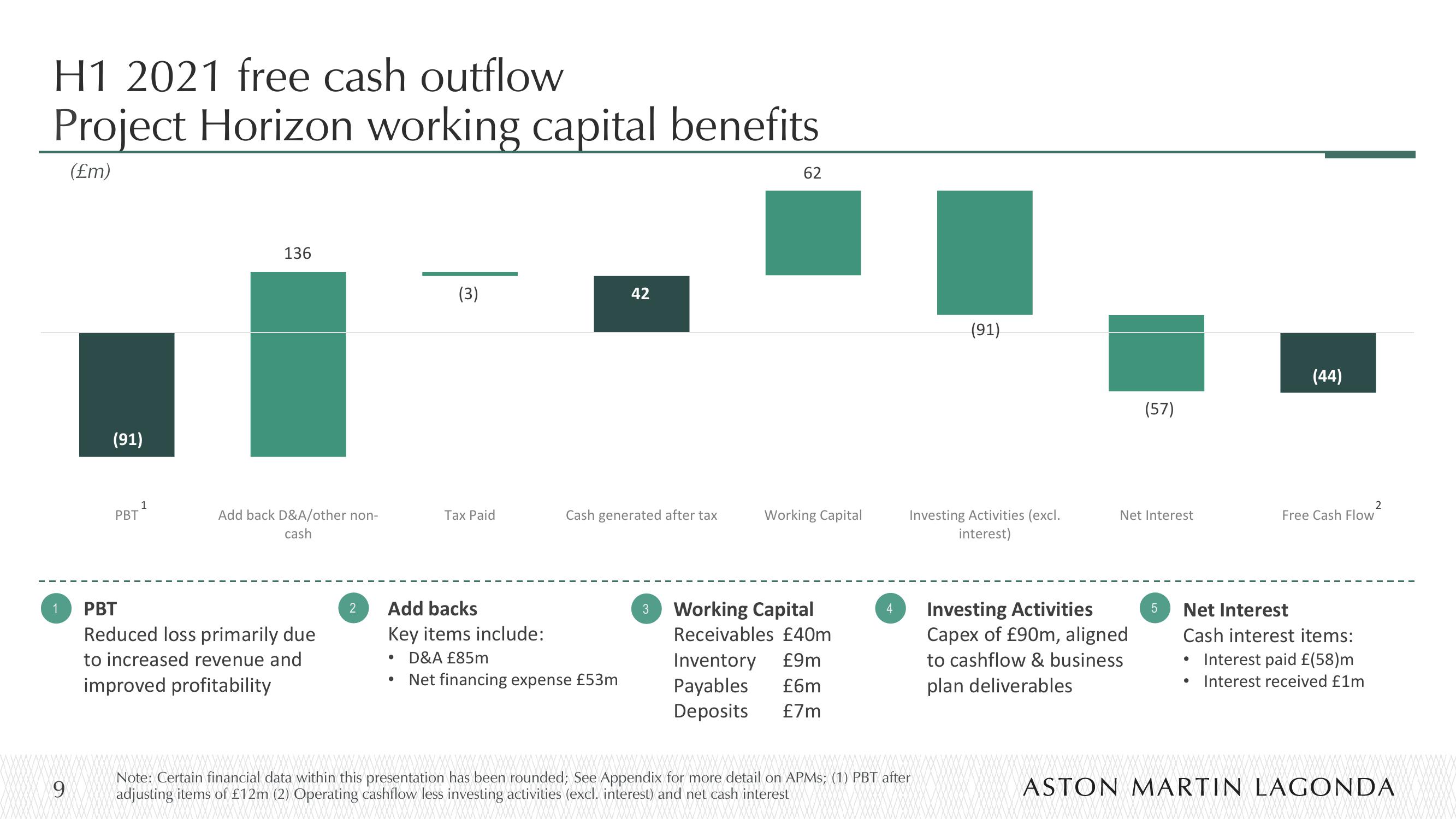

H1 2021 free cash outflow

Project Horizon working capital benefits

(£m)

1

9

(91)

PBT

1

136

Add back D&A/other non-

cash

PBT

Reduced loss primarily due

to increased revenue and

improved profitability

(3)

Tax Paid

2 Add backs

●

Key items include:

42

Cash generated after tax

D&A £85m

Net financing expense £53m

62

Working Capital

3 Working Capital

Receivables £40m

£9m

Inventory

Payables £6m

Deposits £7m

4

(91)

Investing Activities (excl.

interest)

Note: Certain financial data within this presentation has been rounded; See Appendix for more detail on APMs; (1) PBT after

adjusting items of £12m (2) Operating cashflow less investing activities (excl. interest) and net cash interest

(57)

Net Interest

Investing Activities

Capex of £90m, aligned

to cashflow & business

plan deliverables

5

(44)

●

2

Free Cash Flow

Net Interest

Cash interest items:

Interest paid £(58)m

Interest received £1m

ASTON MARTIN LAGONDAView entire presentation