Main Street Capital Fixed Income Presentation Deck

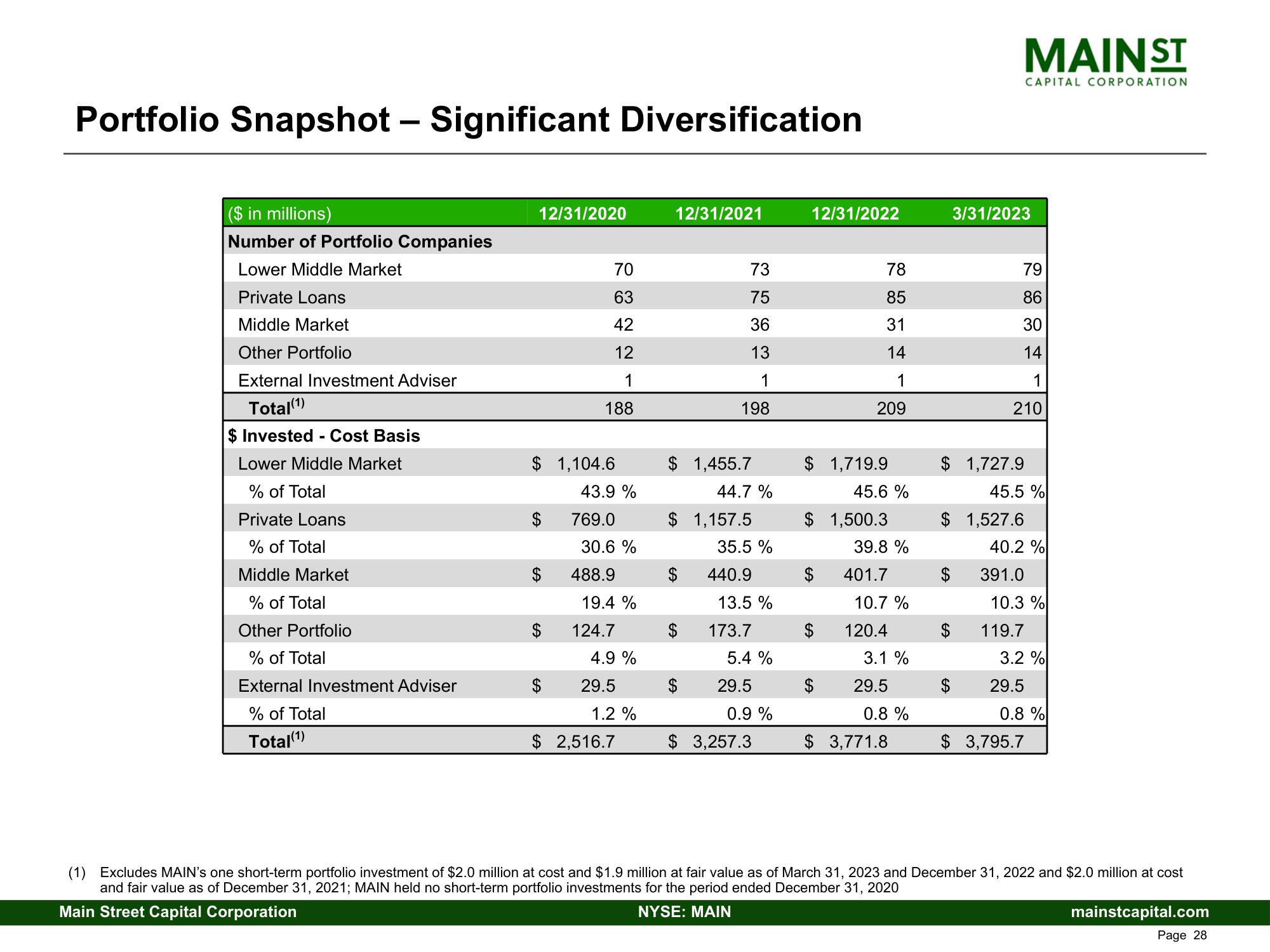

Portfolio Snapshot - Significant Diversification

($ in millions)

Number of Portfolio Companies

Lower Middle Market

Private Loans

Middle Market

Other Portfolio

External Investment Adviser

Total(¹)

$ Invested - Cost Basis

Lower Middle Market

% of Total

Private Loans

% of Total

Middle Market

% of Total

Other Portfolio

% of Total

External Investment Adviser

% of Total

Total(1)

12/31/2020

$ 1,104.6

$

$

$

70

63

42

12

1

188

$

43.9 %

769.0

30.6 %

488.9

19.4%

124.7

4.9 %

29.5

1.2 %

$ 2,516.7

12/31/2021

$ 1,455.7

73

75

36

13

1

198

$

$ 1,157.5

$

44.7%

35.5 %

440.9

13.5 %

173.7

5.4 %

29.5

0.9 %

$ 3,257.3

12/31/2022

$ 1,719.9

78

85

31

14

1

209

$

$ 1,500.3

$

45.6 %

39.8 %

401.7

10.7 %

120.4

3.1 %

29.5

0.8 %

3,771.8

3/31/2023

$ 1,727.9

79

86

30

14

1

210

MAIN ST

$ 1,527.6

CAPITAL CORPORATION

45.5%

119.7

40.2 %

391.0

10.3 %

3.2 %

$ 3,795.7

29.5

0.8 %

(1) Excludes MAIN's one short-term portfolio investment of $2.0 million at cost and $1.9 million at fair value as of March 31, 2023 and December 31, 2022 and $2.0 million at cost

and fair value as of December 31, 2021; MAIN held no short-term portfolio investments for the period ended December 31, 2020

Main Street Capital Corporation

NYSE: MAIN

mainstcapital.com

Page 28View entire presentation