GMS Investor Presentation Deck

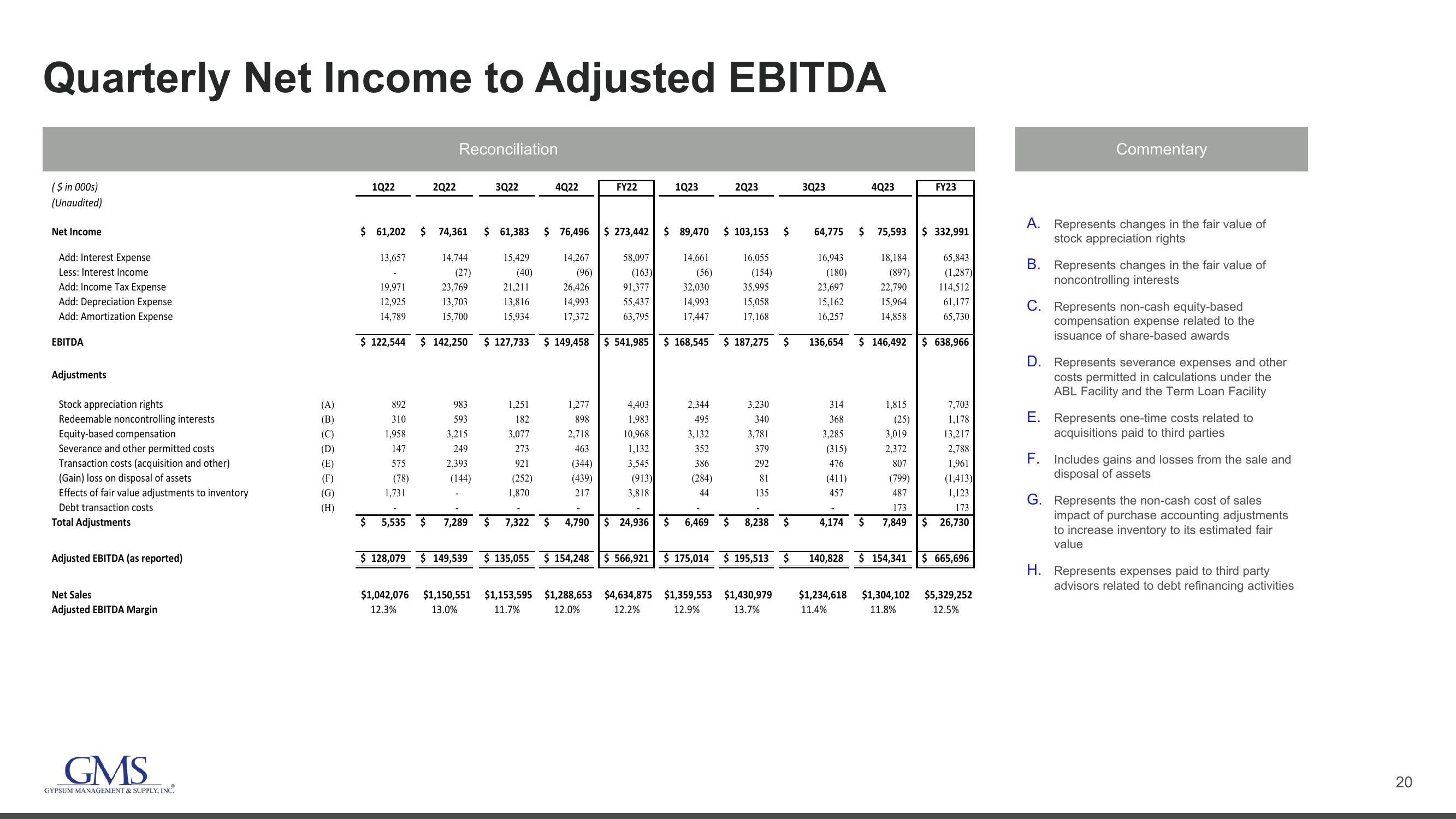

Quarterly Net Income to Adjusted EBITDA

($ in 000s)

(Unaudited)

Net Income

Add: Interest Expense

Less: Interest Income

Add: Income Tax Expense

Add: Depreciation Expense

Add: Amortization Expense

EBITDA

Adjustments

Stock appreciation rights

Redeemable noncontrolling interests

Equity-based compensation

Severance and other permitted costs

Transaction costs (acquisition and other)

(Gain) loss on disposal of assets

Effects of fair value adjustments to inventory

Debt transaction costs

Total Adjustments

Adjusted EBITDA (as reported)

Net Sales

Adjusted EBITDA Margin

GMS

GYPSUM MANAGEMENT & SUPPLY, INC.

(A)

(B)

(C)

(D)

(E)

(F)

(G)

(H)

1Q22

13,657

19,971

12,925

14,789

892

310

1,958

147

575

(78)

2Q22

$ 61,202 $ 74,361 $ 61,383 $ 76,496

15,429

14,744

(27)

23,769

(40)

21,211

13,703

13,816

15,700

15,934

$ 122,544 $ 142,250 $ 127,733

1,731

Reconciliation

983

593

3,215

249

2,393

(144)

$ 5,535 $ 7,289

$ 128,079 $ 149,539

3Q22

$

1,251

182

3,077

273

921

(252)

4Q22

1,870

14,267

(96)

26,426

14,993

17,372

$ 149,458

1,277

898

2,718

463

(344)

(439)

217

7,322 $ 4,790

$ 135,055 $ 154,248

FY22

$ 273,442

58,097

(163)

91,377

55,437

63,795

$ 541,985

4,403

1,983

10,968

1,132

3,545

(913)

3,818

$ 24,936

1Q23

$ 89,470 $ 103,153 $

14,661

(56)

32,030

14,993

17,447

2Q23

2,344

495

3,132

352

386

(284)

44

16,055

35,995

15,058

17,168

$ 168,545 $ 187,275 $

$ 566,921 $ 175,014

(154)

3,230

340

3,781

379

292

81

135

$ 6,469 $ 8,238 $

$ 195,513

$1,042,076 $1,150,551 $1,153,595 $1,288,653 $4,634,875 $1,359,553 $1,430,979

12.3%

13.0%

11.7%

12.0%

12.2%

12.9%

13.7%

$

3Q23

64,775

16,943

(180)

23,697

15,162

16,257

136,654

314

368

3,285

(315)

476

(411)

457

4Q23

$ 75,593

18,184

(897)

22,790

15,964

14,858

$ 146,492

1,815

(25)

3,019

2,372

807

(799)

487

173

4,174 $ 7,849

FY23

$ 332,991

65,843

(1,287)

114,512

61,177

65,730

$ 638,966

7,703

1,178

13,217

2,788

1,961

(1,413)

1,123

173

$ 26,730

140,828 $ 154,341 $ 665,696

$1,234,618 $1,304,102 $5,329,252

11.4%

11.8%

12.5%

Commentary

A. Represents changes in the fair value of

stock appreciation rights

B. Represents changes in the fair value of

noncontrolling interests

C. Represents non-cash equity-based

compensation expense related to the

issuance of share-based awards

D. Represents severance expenses and other

costs permitted in calculations under the

ABL Facility and the Term Loan Facility

E. Represents one-time costs related to

acquisitions paid to third parties

F.

Includes gains and losses from the sale and

disposal of assets

G. Represents the non-cash cost of sales

impact of purchase accounting adjustments

to increase inventory to its estimated fair

value

H. Represents expenses paid to third party

advisors related to debt refinancing activities

20View entire presentation