Orthofix SPAC Presentation Deck

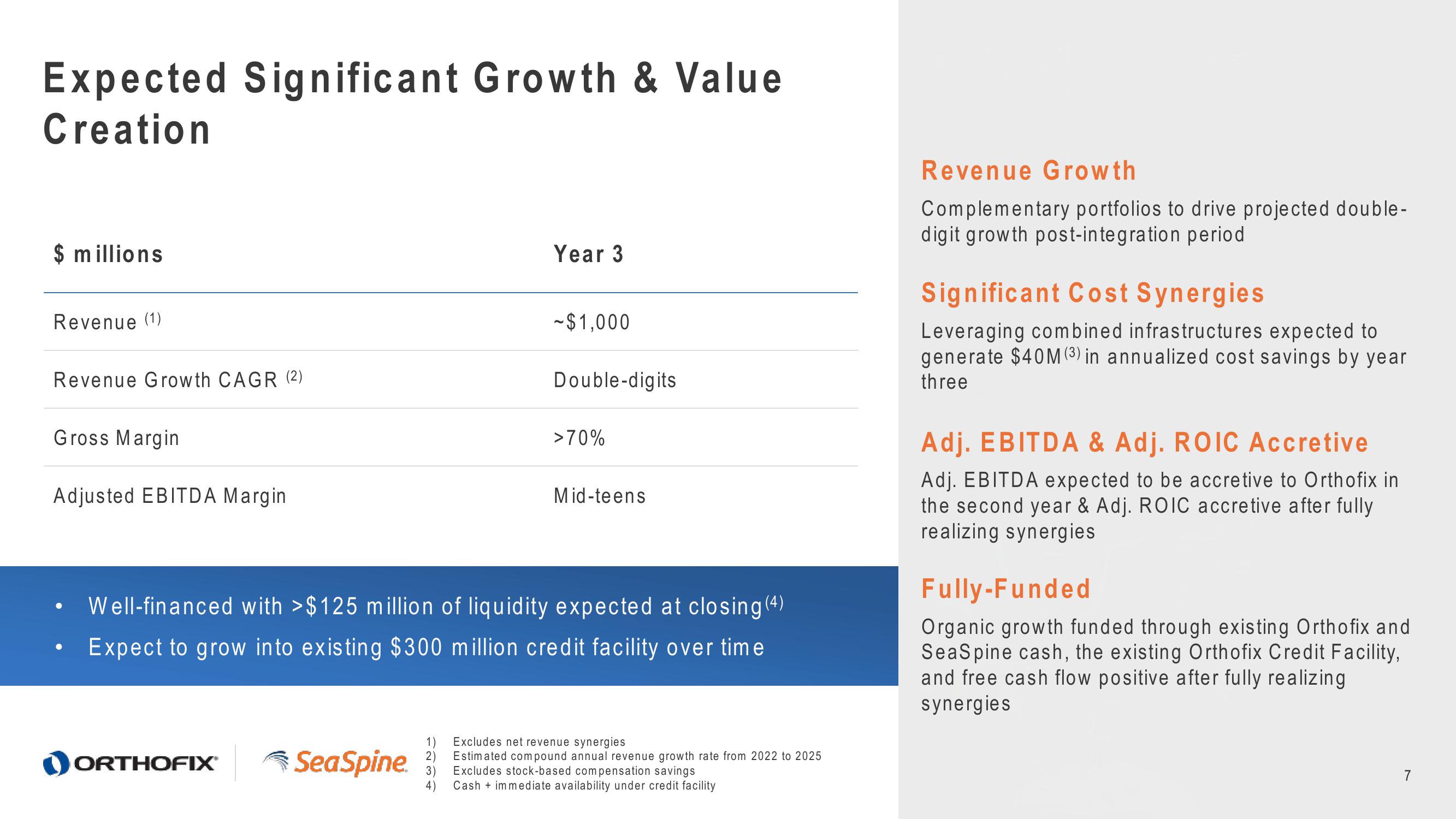

Expected Significant Growth & Value

Creation

$ millions

Revenue (1)

Revenue Growth CAGR (2)

Gross Margin

Adjusted EBITDA Margin

●

●

ORTHOFIX®

Sea Spine

1)

2)

Year 3

4)

-$1,000

Well-financed with >$125 million of liquidity expected at closing (4)

Expect to grow into existing $300 million credit facility over time

Double-digits

>70%

Mid-teens

Excludes net revenue synergies

Estimated compound annual revenue growth rate from 2022 to 2025

Excludes stock-based compensation savings

Cash + immediate availability under credit facility

Revenue Growth

Complementary portfolios to drive projected double-

digit growth post-integration period

Significant Cost Synergies

Leveraging combined infrastructures expected to

generate $40M (3) in annualized cost savings by year

three

Adj. EBITDA & Adj. ROIC Accretive

Adj. EBITDA expected to be accretive to Orthofix in

the second year & Adj. ROIC accretive after fully

realizing synergies

Fully-Funded

Organic growth funded through existing Orthofix and

SeaSpine cash, the existing Orthofix Credit Facility,

and free cash flow positive after fully realizing

synergies

7View entire presentation